New York-based Fox Corporation (FOXA) produces and distributes news, sports, and entertainment through FOX News Media, FOX Sports, FOX Entertainment, FOX Television Stations, and Tubi, an ad-supported streaming platform.

Commanding a market capitalization of approximately $32.7 billion, the company operates 29 full-power broadcast stations, including 11 duopolies, and reaches audiences via cable, satellite, and digital channels.

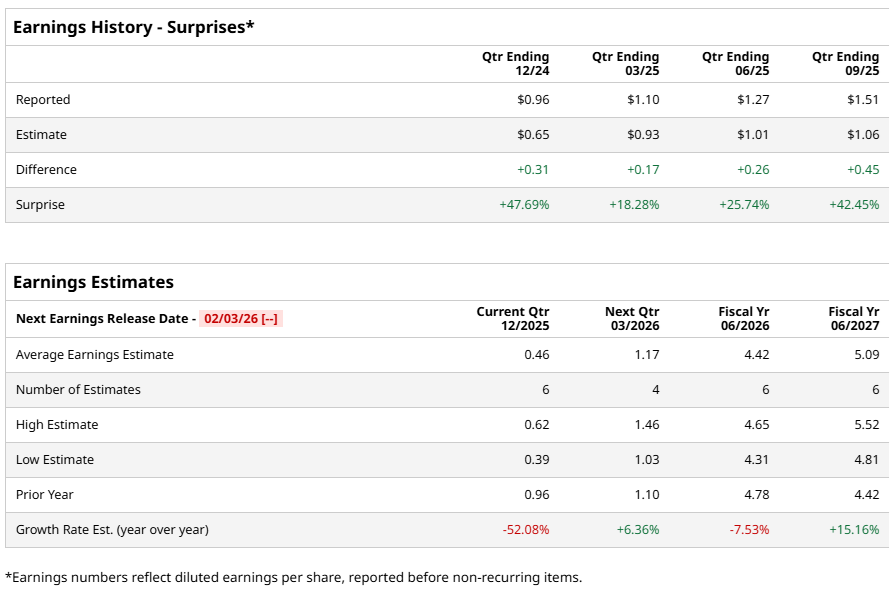

Fox is preparing to release its fiscal 2026 Q2 earnings on Tuesday, Feb. 3, before the market opens. Analysts forecast diluted EPS of $0.46, down 52.1% from $0.96 in last year’s quarter. Yet, the company’s track record of beating EPS estimates in each of the past four quarters suggests resilience.

Looking ahead, Wall Street models fiscal 2026 diluted EPS of $4.42, a 7.5% year-over-year decline, before projecting a fiscal 2027 rebound with EPS growth of 15.2% from the prior year to $5.09.

Coming to share-price performance, FOXA stock has surged 53.4% over the past 52 weeks, adding 4.2% year-to-date (YTD), outperforming the broader market. By contrast, the S&P 500 Index ($SPX) rose 16.2% over the same period, gaining just 1.5% YTD.

Within the communications sector, Fox’s gains stand out against the State Street Communication Services Select Sector SPDR ETF (XLC), which climbed 18.6% in 52 weeks but declined slightly YTD.

Momentum strengthened significantly on Thursday, Oct. 30, 2025, as the stock rose 7.7% intraday on the back of strong fiscal 2026 first-quarter results that significantly beat Wall Street's expectations. Revenue climbed 4.9% year-over-year to $3.74 billion, surpassing analyst estimates of $3.57 billion. Adjusted EPS jumped 4.1% from the year-ago value to $1.51, topping analyst estimates of $1.08.

The strong performance was driven by Tubi, which delivered its first profitable quarter, with ad revenue soaring roughly 27% and average viewing time rising 18%. NFL ratings also strengthened, up nearly 12% year-over-year, highlighting Fox’s continued dominance in live sports content.

Additionally, Fox announced a $1.5 billion share buyback, signaling management’s confidence in the company’s growth trajectory and commitment to returning capital to shareholders.

Reflecting this momentum, Wall Street has assigned FOXA stock an overall “Moderate Buy” rating, unchanged from three months prior. Among 20 analysts covering the stock, nine recommend “Strong Buy,” one suggests “Moderate Buy,” and 10 maintain a “Hold” stance.

FOXA stock is already trading above its mean price target of $72.35. Meanwhile, the Street-high target of $97 suggests potential upside of 27.4% from current levels, underscoring investor optimism in Fox’s strategic positioning and ability to deliver consistent growth across its diverse platforms.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 'Project Catalyst' Is Coming for This High-Yield Dividend Star. Should You Buy Shares in 2026 to Profit?

- Precious Metals Remain Strong: Why That’s a Red Flag for Stocks Amid Venezuela Tumult

- Will Roku Dominate Streaming Stocks in 2026?

- What's Driving the Parabolic Rise in Silver Futures, and How Long Can the Rally Last?