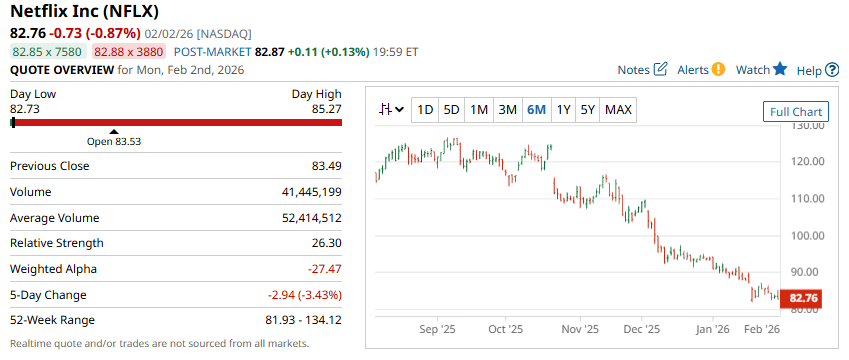

Netflix (NFLX) has been under severe pressure recently, currently sitting 38% below the 52-week high.

However, the options market is hinting that a higher stock price might be just around the corner.

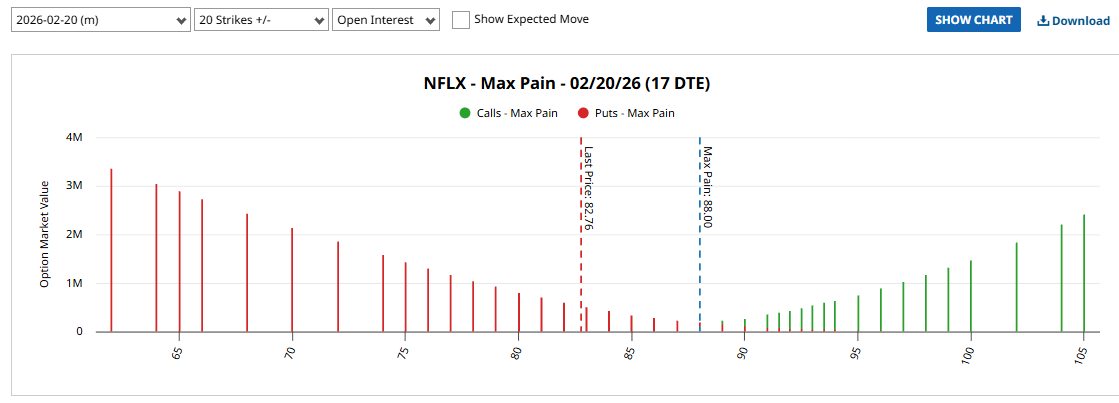

The options market could be indicating that the stock might settle around the 88 mark by February 20th.

This is due to a theory called Max Pain and is something I talked about in a video for Barchart.

The Max Pain Theory claims that as option expiration approaches, stock prices will get pushed toward the price at which the greatest number of options in terms of dollar value will expire worthless.

Large institutions are generally net sellers of options, so they will benefit the most from options expiring worthless, or with the lowest net value.

We can use Barchart to find the Max Pain level quickly and easily for any stock and expiration.

Here we can see that the Max Pain level for NFLX on February 20th is right around $88.

What can we do with this information?

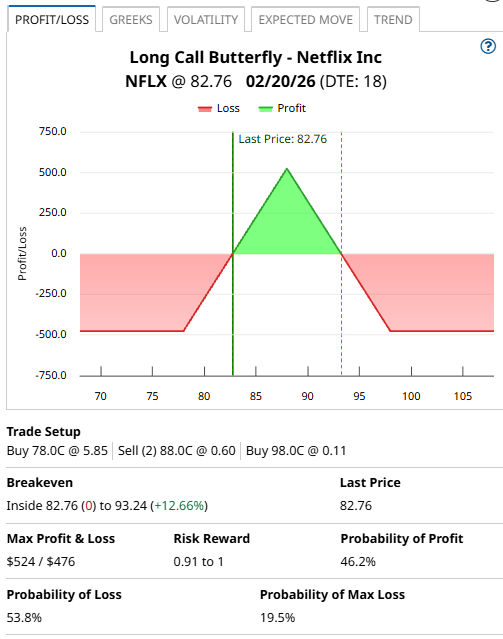

Well, if we think that the Max Pain theory might play out this month, we could look to trade a butterfly spread centred at the 88 strike.

Let’s take a look at how that trade idea might be structured.

NFLX MAX PAIN BUTTERFLY SPREAD

A butterfly spread is constructed by buying a lower strike put, selling two middle strike puts and buying one upper strike put. The trade is entered for a net debit meaning the trader pays to enter the trade. This debit is also the maximum possible loss.

The maximum profit is calculated as the difference between the short and long puts less the premium that you paid for the spread.

Using the February 20 expiry, the trade would involve buying the $78 strike put, selling two of the $88 strike puts and buying one $98 strike put.

The cost for the trade would be around $476 which is the most the trade could lose. The maximum potential gain is around $524.

NFLX COMPANY DETAILS

The Barchart Technical Opinion rating is a 100% Sell with a Strongest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Relative Strength is below 30%. The market is in oversold territory. Watch for a potential trend reversal.

NFLX rates as a Strong Buy according to 26 analysts with 4 Moderate Buy, 13 Hold and 1 Strong Sell ratings.

Implied volatility is 31.45% which gives NFLX an IV Percentile of 46% and an IV Rank of 15.31%

Netflix is considered a pioneer in the streaming space. The company evolved from a small DVD-rental provider to a dominant streaming service provider, courtesy of its wide-ranging content portfolio and a fortified international footprint.

Netflix has been spending aggressively on building its original show portfolio.

This is helping it sustain its leading position despite the launch of new services like Disney and Apple TV as well as the existing services like Amazon prime video.

Netflix streams movies, television shows and documentaries across a wide variety of genres and languages.

Subscribers, both domestic and international, can watch them on a host of internet-connected devices, including television sets, computers and mobile devices.

Conclusion And Risk Management

The Max Pain theory suggests Netflix stock could gravitate toward $88 by February 20th expiration, creating a potential opportunity for butterfly spread traders.

The butterfly spread outlined offers a defined-risk approach to capitalize on this theory, with maximum loss limited to the $476 premium paid.

The strategy profits if Netflix trades near $88 at expiration but loses money if the stock moves significantly in either direction.

Key risk considerations include:

- The strategy requires precise timing and price prediction

- Max Pain levels can shift as new options positions change

For traders considering this approach, position sizing is crucial. The butterfly spread should represent only a small portion of your overall portfolio given its speculative nature.

The Max Pain level offers one perspective but shouldn't be the sole basis for trading decisions.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart