In a repeat of the 2020 experience, after a very strong third quarter, home prices across the United States continued to climb in October albeit at a slower pace than in September. Radian HPI rose at an annualized rate of 17.3 percent in the month of October, slightly below the 17.6 percent recorded in the prior month, according to Radian Home Price Index (HPI) data released today by Red Bell Real Estate, LLC, a Radian Group Inc. company (NYSE: RDN). The company believes the Radian HPI is the most comprehensive and timely measure of U.S. housing market prices and conditions available in the market today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211118006245/en/

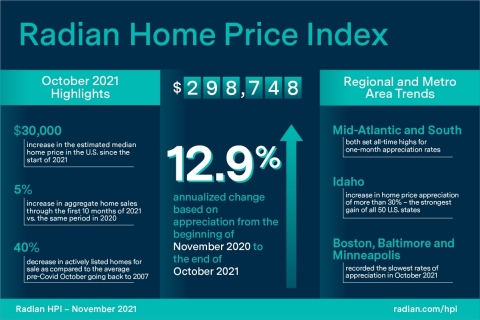

Radian Home Price Index (HPI) Infographic November 2021 (Graphic: Business Wire)

While the one-month trend was slightly lower, in the twelve months since November 2020, the Radian HPI increased nationally by 12.9 percent. This pace represented yet another month that this metric delivered an all-time year-over-year record and was the second-best month-over-month appreciation rate of 2021. The Radian HPI is calculated based on the estimated values of more than 70 million unique addresses each month, covering all single-family property types and geographies.

“The slowdown in the national appreciation rate in October marks the first month-over-month decline in three quarters. However, the U.S. winter buying season typically means lower activity, so this slowdown may simply represent seasonal impacts,” noted Steve Gaenzler, SVP of Data and Analytics. Gaenzler added that, “Seeing slowdowns in the historic rates of appreciation may be helpful as affordability continues to be impacted by the rapid pace of appreciation in many metro areas. Existing homeowners have been material benefactors of this appreciation, but at the potential expense of many looking to enter the market for the first time.”

NATIONAL DATA AND TRENDS

- Median estimated home price in the U.S. rose to $298,748

- October records lowest count of active listings for any October, on continued inventory slump

Nationally, the median estimated price for single-family and condominium homes rose to $298,748. Since the start of 2021, the median estimated home price in the U.S. has increased more than $30,000, nearly double the absolute increase recorded nationally in the first 10 months of the prior year. By region, median home estimates are more than $60,000 higher in the West region than they were at the end of 2020; the highest regional dollar gain so far this year. Prices in the Midwest region are higher by $17,000 over the same period, representing the smallest absolute gain by a region.

Nationally, supply and demand remain substantially imbalanced relative to long-term trends. Counts of residential homes listed for sale were significantly lower in October compared to any previous October. In total, the number of actively listed homes for sale was 40 percent lower than the average pre-COVID October going back to 2007, and more than 15 percent lower than October of 2020, the prior low for October listings. On the demand side, closed sales of previously listed properties were down in October marking the fourth consecutive month of falling sales. However, October’s sales counts were the second highest ever for an October month, and absorbed a record 33 percent of the prior month’s aggregate listing counts.

For a calendar year, last year set a record for homes sales volume. Through the first 10 months of 2021, aggregate home sales were 5 percent higher than the same period in 2020, making it likely that 2021 will establish a new record for sales volume in the United States. The combination of all-time record sales volume with significant supply challenges continues to be the driving force behind increasing home values throughout 2021.

REGIONAL DATA AND TRENDS

- Most Regions reported lower appreciation rates for house prices in October

- West region records largest decline, while South continues to be strongest

The national experience of slightly slower price appreciation played out similarly across most of the six Regional indices. In October, the annualized price gains from the month prior were lower in four of the six tracked regions. The exceptions to slower rates of appreciation were in the MidAtlantic and South regions which both set all-time highs for one-month appreciation rates. For the remaining four regions, October represented the second strongest appreciation month of the year. Whereas the Midwest region possessed the largest annual increase a year ago, this year the South region holds the title. The South region is the only region to have ever recorded a one-month (annualized) rate of appreciation in excess of 20 percent, and October was the second consecutive month this was achieved.

At the state level, in the last 12 months (October 2020 through October 2021), home price appreciation rose in all 50 states, ranging from an increase of 4 percent to the strongest gain of more than 30 percent in the state of Idaho. After Idaho, Montana, Maine and Arizona recorded the highest appreciation rates over the last year. In total, 41 states have recorded double digit increases in median home prices.

METROPOLITAN AREA DATA AND TRENDS

- Less than half of top cities record faster appreciation in most recent month

- Three of top five cities located in the South region

In October, six of the top 20 metropolitan areas (CBSAs) reported faster appreciation rates than the prior month, with Miami recording the fastest monthly appreciation rate of 2021. The South region was the best performing region in October. In fact, three of the top 4 performing CBSAs last month were in the South. Boston, St. Louis and Detroit recorded the most significant slowdowns in appreciation rate, and Boston, Baltimore and Minneapolis recorded the slowest rates of appreciation in October.

Looking at the 50 largest cities across the country, 18 of them reported faster appreciation rates in October as compared to a month earlier. Over the past 12 months, Boise, ID, Bridgeport, CT, Austin, TX, Phoenix, AZ and Charlotte, NC recorded the fastest rates of appreciation within the top 50 cities. So far in 2021, Boise has the largest dollar gain of the top 50 cities with median estimated values more than $70,000 higher than the end of 2020. Changes in composition of homes, including many new construction units larger and more expensive than pre-COVID housing stock, is helping to increase the median estimated home value.

ABOUT THE RADIAN HPI

Red Bell Real Estate, LLC, a subsidiary of Radian Group Inc., provides national and regional indices for download at radian.com/hpi, along with information on how to access the full library of indices.

Additional content on the housing market can also be found on the Radian Insights page located at https://radian.com/news-and-knowledge/insights.

Red Bell offers the Radian HPI data set along with a client access portal for content visualization and data extraction. The engine behind the Radian HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The Radian HPI Portal is a self-service data and visualization platform that contains a library of thousands of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the Radian HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

In addition to the services offered by its Red Bell subsidiary, Radian is ensuring the American dream of homeownership responsibly and sustainably through products and services that include industry-leading mortgage insurance and a comprehensive suite of mortgage, risk, title, valuation, asset management and other real estate services. The company is powered by technology, informed by data and driven to deliver new and better ways to transact and manage risk.

Visit http://www.radian.com to see how Radian is shaping the future of mortgage and real estate services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211118006245/en/

Contacts

For Investors

John Damian – 215.231.1383

john.damian@radian.com

For the Media

Rashi Iyer – 215.231.1167

rashi.iyer@radian.com