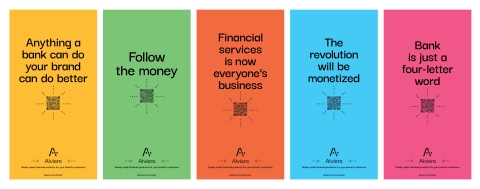

“Bank Is Just a Four Letter Word”

Alviere, the leading global embedded finance platform enabling any brand to deliver financial products and services to its customers and employees, today unveiled full page newspaper ads that officially announce a new era of financial services that will result in leading consumer brands offering all the same financial services traditionally only accessible at banking institutions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211122005889/en/

(Graphic: Business Wire)

The series of four ads appear in “The Wall Street Journal.” The ads carry bold titles and include a URL that directs readers to a landing page with more details about how brands can bring financial services to their large customer base to establish deeper, meaningful relationships with their existing customers.

“As a company on the front lines of this momentous shift in financial services, we wanted to use this ad campaign to make a bold statement,” said Yuval Brisker, CEO and Co-Founder of Alviere. “We feel like this campaign is kind of a sounding of the starting gun in the race to help brands build deeper, meaningful relationships with customers that have known them for years. There is immense demand for embedded finance services and as such, we are looking for the best partners to jointly launch branded banking experiences.”

The full spread of ads in the campaign carry the messages in the above image. The ads appeared in issues of the Journal in October and November.

Brands are ready to make the shift to offering financial services, according to a survey Alviere conducted last year that asked senior leaders responsible for technology innovation at major U.S. brands. In the survey, 75 percent of respondents said they would offer financial services in the next six months if there was a quick and easy way to do so. And 51 percent of those surveyed said they plan to take the leap to offering financial services in the next year.

And more than half of the technology innovators at the largest brands surveyed said their preferred method for increasing revenue is through programs that improve customer loyalty, retention and lifetime value. Of the tech innovators surveyed that already offer financial services, 95 percent said they have seen a positive impact on customer retention. And 54 percent of those surveyed that offer financial services say these services have had a positive impact on customer retention.

Alviere is already helping two major U.S. brands complete the technology transformation necessary to offer a full suite of financial services to their customer bases of almost 10 million consumers. These brands are expected to roll out their financial service offering in early 2022.

Alviere has raised more than $90 million in funding since its founding in 2017. In April, Alviere closed a $20 million Series A led by Viola Ventures and Viola Fintech, with the participation of CommerzVentures, Mitsubishi Capital Corporation, Wix.com Capital, Draper Triangle Ventures, Cross River Bank Capital, CERCA Partners and others. Last month, the company announced an additional $50 million in Series B investment.

About Alviere

Alviere provides the most complete embedded finance platform available today, empowering the world’s most visible, trusted and beloved brands to offer financial services to their customers for the first time. Alviere’s easy, powerful and future-proof platform and associated services allows any business to launch a new financial services line of business to dramatically increase profits, deepen customer relationships and insights, and increase satisfaction and retention. To find out how embedded financial products can take you into the next generation of profitable business visit us at www.alviere.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211122005889/en/

Contacts

JP Cavender

SutherlandGold for Alviere

alviere@sutherlandgold.com