After a strong finish to the first half of 2021, home prices across the United States rose at an even faster pace in July as compared to June. According to Radian Home Price Index (HPI) data released today by Red Bell Real Estate, LLC, a Radian Group Inc. company (NYSE: RDN), home prices nationally rose month-over-month from June 2021 to July 2021 at an annualized rate of 14.7 percent. The company believes the Radian HPI is the most comprehensive and timely measure of U.S. housing market prices and conditions available in the market today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210826005669/en/

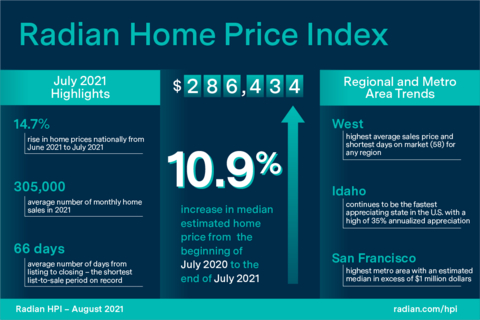

Radian Home Price Index (HPI) Infographic August 2021 (Graphic: Business Wire)

The Radian HPI also rose 10.9 percent year-over-year (July 2020 to July 2021), which was slightly higher than the year-over-year increase recorded last month. Through the first seven months of 2021, the average monthly annualized increase was 10.7 percent with each of the last three months reporting above average appreciation. The Radian HPI is calculated based on the estimated values of more than 70 million unique addresses each month, covering all single-family property types and geographies.

“The addition of more active home listings into the market inventory has not slowed the path of home price gains. Nationally and in most local markets, homes sales volume remains at all-time highs while supply is far below historic norms,” noted Steve Gaenzler, SVP of Data and Analytics. “Home prices are not showing any signs of softening or slowing their impressive gains of 2021. However, while appreciation rates have continued to rise, price affordability has declined. Even with recent reductions in mortgage rates, consumers are buying into a less affordable market which may impact future activity and price growth,” added Gaenzler.

NATIONAL DATA AND TRENDS

- Median home price in the U.S. rose to $286,434

- Home prices rose an annualized 13.1 percent over the last three months

Nationally, the median estimated price for single-family and condominium homes rose to $286,434. Across the U.S., home prices nationally rose 13.1 percent over the prior three months, an increase over the second quarter’s 11.7 percent increase. Homes continue to sell briskly across the U.S. In July, the average number of days a home was on the market prior to contracting for sale dropped to 66 days, the shortest list-to-sale period on record. In fact, homes that are listed but have not yet contracted for sale have also set a record last month for the shortest number of days on market. At only 85 days on market for actively listed properties, the rate of turnover of homes continues to be buoyed by lack of supply.

With the exceptions of only 2015 and 2020, in every year since before the Great Recession, June has been the most active sales contract month and July was the second most active. The same pattern has emerged in 2021.

The average number of monthly home sales thus far in 2021 has reached 305,000 per month. That is more than 10 percent higher per month than the average 275,000 homes sold in each of the first seven months of 2020.

And while listing volume has increased in each of the last eight months, the number of listings remains significantly below prior years.

REGIONAL DATA AND TRENDS

- July gains were solid across all regions

- Regional sales and listing activity sets records

Similar to our national reporting, all six U.S. regions reported positive price appreciation in residential housing markets in July 2021. Year-over-year increases in home prices ranged across the regional landscape from 12.9 percent (West) to 9.2 percent (MidAtlantic). Appreciation rates are higher over the most recent months. The July appreciation rates annualized ranged from 12.7 percent (MidAtlantic) to 16.5 percent (South). In July, all regions appreciated at annualized rates greater than 12 percent.

Demand was consistently strong across all regions as all six regions notched record low days on market for sold properties. The West region which carries the highest average sales price and the highest estimated median sales price also recorded the shortest days on market at 58. The MidAtlantic region took the longest to sell, but still logged a record at 85 days.

Among the 51 states and territories the Radian HPI tracks, Idaho continues to be the fastest appreciating state in the nation. Nationally, states displayed a wide range of annualized appreciation rates in July 2021 from the low of 5.4 percent in Iowa to the high of more than 35 percent in Idaho.

METROPOLITAN AREA DATA AND TRENDS

- Pace of metro area gains eased in July

Across the 20-largest metro areas of the U.S, seven reported slower price appreciation compared to the prior month. And, the other four recorded rates were unchanged from the prior months. Only nine of the largest metro areas recorded an increase in the rate of home price appreciation from June. The Atlanta metro area has the lowest estimated median price of the 20-largest metros while San Francisco, the only metro with an estimated median of more than $1 million dollars, has the highest.

ABOUT THE RADIAN HPI

Red Bell Real Estate, LLC, a subsidiary of Radian Group Inc., provides national and regional indices for download at radian.com/hpi, along with information on how to access the full library of indices.

Additional content on the housing market can also be found on the Radian Insights page located at https://radian.com/news-and-knowledge/insights.

Red Bell offers the Radian HPI data set along with a client access portal for content visualization and data extraction. The engine behind the Radian HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The Radian HPI Portal is a self-service data and visualization platform that contains a library of thousands of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the Radian HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

In addition to the services offered by its Red Bell subsidiary, Radian is ensuring the American dream of homeownership responsibly and sustainably through products and services that include industry-leading mortgage insurance and a comprehensive suite of mortgage, risk, title, valuation, asset management and other real estate services. The company is powered by technology, informed by data and driven to deliver new and better ways to transact and manage risk.

Visit http://www.radian.com to see how Radian is shaping the future of mortgage and real estate services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210826005669/en/

Contacts

For Investors

John Damian – Phone: 215.231.1383

Email: john.damian@radian.com

For the Media

Rashi Iyer – Phone: 215.231.1167

Email: rashi.iyer@radian.com