EV Owners Less Satisfied with Auto Insurance Shopping Experience

The average cost of auto insurance in the United States is up 22.2% year over year through the end of February, more than any other category of household expenses measured in the U.S. Department of Labor Statistics Consumer Price Index.1 According to the J.D. Power 2024 U.S. Insurance Shopping Study,SM released today, that notable increase in premium—combined with lackluster customer satisfaction scores this year—is putting more insurance customers into the market for a new policy than ever before. Nearly half (49%) of U.S. auto insurance customers say they are actively shopping for a new plan.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240430489927/en/

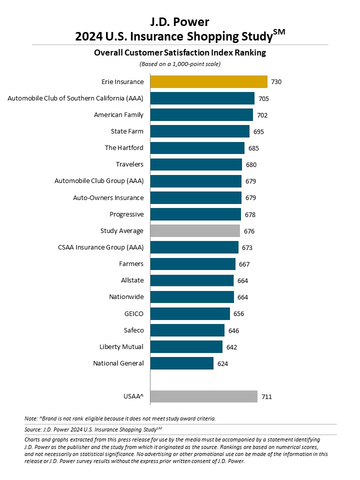

J.D. Power 2024 U.S. Insurance Shopping Study (Graphic: Business Wire)

“After the past few years of steady auto insurance premium increases, customers are no longer passively keeping an eye out for a better deal,” said Stephen Crewdson, senior director, insurance business intelligence at J.D. Power. “Instead, they are actively seeking new carriers to offset these rising costs. However, with rising premiums across the country and fewer insurers explicitly offering usage-based insurance—or UBI plans—during the quoting process, insurance shoppers are not finding many alternatives.”

Following are some key findings of the 2024 study:

- Auto insurance shopping and switch rates increase: Nearly half (49%) of auto insurance customers have actively shopped for a new policy in the past year. Of those, 29% have switched carriers. Switch rates are highest among members of Generation Z.2 Average overall satisfaction among auto insurance shoppers is 676 (on a 1,000-point scale).

- EV owners confront insurance sticker shock: Electric vehicle (EV) owners are less satisfied with the auto insurance purchase experience than are customers insuring gasoline-powered vehicles. The average purchase experience satisfaction score among EV owners is 663, which is 16 points lower than the average score among owners of gas-powered vehicles. This gap is attributable to lower satisfaction with the quote process and price of the policy because EVs are typically more expensive to insure than comparable gas-powered vehicles.

- Insurers pull back on offering UBI when quoting: UBI programs, which use telematics software to monitor an insured’s driving style and assign rates based on safety and mileage metrics, were only offered to 15% of insurance shoppers this year, down from 22% a year ago and 20% in 2022. Customers enrolling in UBI programs show just a 6-point increase in price satisfaction in 2024, which is down considerably from a 32-point difference in 2023.

- Growing interest in dealer- and manufacturer-provided insurance: More than one-third (35%) of auto insurance customers say they are interested in embedded insurance, a form of auto insurance that is provided directly through the automobile dealer or manufacturer.

- Customer acquisition funnels play key role in market share: State Farm and Progressive show increases in customer yield through the customer acquisition funnel while GEICO’s acquisition funnel narrowed this year. Accordingly, State Farm and Progressive show gains in market share in this year’s study, while GEICO’s share is down.

Study Ranking

Erie Insurance ranks highest among large auto insurers in providing a satisfying purchase experience, with a score of 730. Automobile Club of Southern California (AAA) (705) ranks second and American Family (702) ranks third.

The J.D. Power U.S. Insurance Shopping Study was redesigned for 2024. Now in its 18th year, the study captures advanced insight into each stage of the shopping funnel and is based on responses from 10,003 insurance customers who requested an auto insurance price quote from at least one competitive insurer in the previous six months. The study was fielded from March 2023 through January 2024.

For more information about the U.S. Insurance Shopping Study, visit https://www.jdpower.com/business/resource/jd-power-us-insurance-shopping-study.

See the online press release at http://www.jdpower.com/pr-id/2024033.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe, and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

______________________

1 U.S. Department of Labor Statistics Consumer Price Index, March 2024 https://www.bls.gov/news.release/cpi.nr0.htm#:~:text=Indexes%20which%20increased%20in%20March%20include%20shelter%2C,insurance%2C%20medical%20care%2C%20apparel%2C%20and%20personal%20care.

2 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2006). Millennials (1982-1994) are a subset of Gen Y.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240430489927/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com