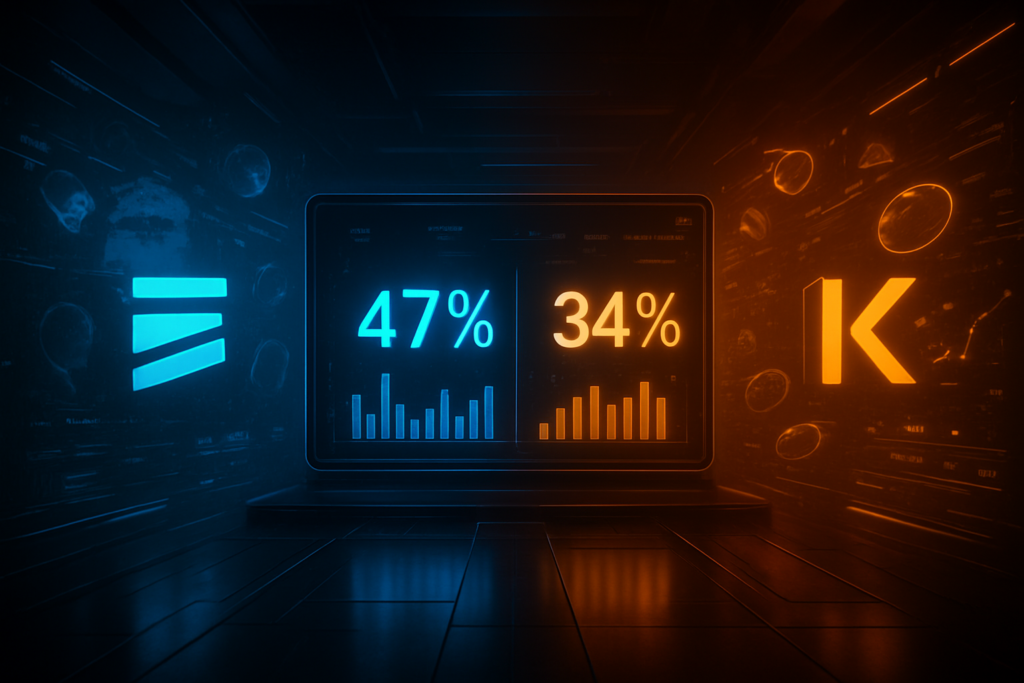

As of early February 2026, the prediction market landscape has transformed from a niche hobby for "superforecasters" into a multi-billion dollar pillar of the global financial system. At the heart of this explosion is a titanic struggle for dominance between the two undisputed heavyweights: Polymarket and Kalshi. The stakes are nothing less than the title of the world’s primary "truth engine." Currently, a high-traffic contract on Manifold Markets, which serves as a meta-layer for industry sentiment, gives Polymarket a 47% chance of claiming the 2026 volume crown, while Kalshi trails at 34%.

This rivalry has divided the trading community into two distinct camps. While Kalshi has leveraged its regulatory compliance to become the "Robinhood of events," Polymarket has maintained its status as the "Bloomberg of the blockchain," dominating the high-stakes world of geopolitical and macroeconomic forecasting. The current betting activity on Manifold reflects a growing debate: will the raw mass-market appeal of sports propel Kalshi to the top, or will Polymarket’s dominance in "high-signal" global events prove more lucrative?

The Market: What's Being Predicted

The central point of contention is the definition of "volume leadership." The Manifold Markets contract, which has seen heavy participation from industry insiders and "whales," specifically tracks which platform will handle the most notional volume for the calendar year 2026. However, there is a critical caveat in the resolution criteria: the contract excludes "pure sports betting" volume to focus on "event-based information finance." This distinction is vital because, in 2025, Kalshi cleared a staggering $43.1 billion in total volume, but over 90% of that was tied to sports contracts through its integration with Robinhood Markets, Inc. (NASDAQ: HOOD).

Polymarket, which ended 2025 with $33.4 billion in volume, is currently the favorite on Manifold because of its perceived monopoly on "pure" prediction markets. Traders are pricing in the fact that while Kalshi attracts millions of small-dollar sports bettors, Polymarket attracts massive institutional liquidity on "high-alpha" events. The odds have shifted significantly since January 1st, when the two were nearly neck-and-neck. Polymarket’s recent surge to 47% follows a series of high-volume geopolitical events in January that saw over $5 billion in monthly activity on the platform.

Why Traders Are Betting

The divergence in odds is driven by the vastly different "moats" each platform has built. Kalshi’s strength lies in its "sports flywheel." By partnering with the NHL and other major leagues, Kalshi has turned prediction markets into a regulated alternative to traditional sportsbooks. This has created a massive influx of retail traders, but it also makes the platform vulnerable to regional regulatory shifts. For example, a recent preliminary injunction in Massachusetts has barred Kalshi from offering sports contracts in the state, a move that traders fear could be replicated in other high-volume states like New York or Nevada.

Conversely, Polymarket’s 47% lead is fueled by its "Geopolitical/Macro" dominance. In January 2026, the platform famously outperformed every major news outlet during "Operation Absolute Resolve" in Venezuela. While traditional media struggled to verify reports on the ground, the "Maduro Trade" on Polymarket saw $56.6 million in volume, accurately pricing the regime's collapse hours before official confirmation. Similarly, markets regarding the nomination of Kevin Warsh as the next Federal Reserve Chair saw over $368 million in volume, with the "Yes" side hitting 94% probability just before the official announcement from the White House.

Traders are also closely watching the "whale" activity. Large institutional firms like Susquehanna and DRW have reportedly been shifting more liquidity into Polymarket’s macro markets, viewing them as a superior hedging tool compared to traditional derivatives. This "institutionalization" of the truth is a major factor driving the Manifold odds in Polymarket's favor.

Broader Context and Implications

This rivalry represents a pivotal moment for "Information Finance" (InfoFi). The 2024 US Election was the "Big Bang" for this industry, proving that prediction markets could act as a more accurate barometer of reality than traditional polling. Now, in 2026, the question is no longer if these markets work, but how they will be regulated and integrated into the broader economy.

The regulatory environment has shifted dramatically under the new CFTC Chairman, Michael Selig. His "pro-market" stance has been a boon for both platforms, but a new conflict has emerged: the war between federal pre-emption and state-level gaming commissions. While Selig has expressed support for a federal framework for prediction markets, states like New Jersey and Nevada are fighting to classify these platforms as "gambling," which would subject them to high taxes and restrictive licensing.

Furthermore, Polymarket’s successful re-entry into the US market—via its $112 million acquisition of QCEX, a CFTC-licensed exchange—has leveled the playing field. This move stripped Kalshi of its "only legal US option" advantage, forcing the competition to be fought purely on the quality of the markets and the depth of liquidity.

What to Watch Next

The coming months will provide several "stress tests" for these platforms. The first major milestone is the resolution of the Massachusetts legal challenge against Kalshi. If the court upholds the ban on sports contracts, Kalshi’s volume could take a significant hit, likely causing its Manifold odds to plummet further. On the other hand, if Kalshi successfully defends its model as "economic hedging" rather than gambling, it could reclaim its momentum.

For Polymarket, the key will be maintaining its edge in "breaking news" markets. Watch for the upcoming "Global Climate Accord" negotiations in March; if Polymarket can once again provide a faster, more accurate signal than traditional diplomacy observers, it will cement its status as the world’s premier information source. Additionally, the potential for a "super-app" launch from Polymarket later this year could further bridge the gap with Kalshi’s retail-friendly interface.

Bottom Line

The battle for the 2026 volume crown is more than just a competition between two apps; it is a fight to define the future of how humanity consumes information. Kalshi is betting on the ubiquity of sports and the power of mainstream financial integrations. Polymarket is betting on the value of "pure" truth and the global demand for geopolitical clarity.

The Manifold Markets odds—47% for Polymarket and 34% for Kalshi—suggest that while sports volume is impressive, traders believe the real future of prediction markets lies in the "Macro" niche. As we move deeper into 2026, the platform that can best navigate the regulatory minefield while maintaining deep liquidity on world-changing events will likely emerge victorious. For now, the "Truth Engine" of Polymarket holds the lead, but in a market where everything is a bet, nothing is guaranteed.

This article is for informational purposes only and does not constitute financial or betting advice. Prediction market participation may be subject to legal restrictions in your jurisdiction.

PredictStreet focuses on covering the latest developments in prediction markets.

Visit the PredictStreet website at https://www.predictstreet.ai/.