While the dust of the 2024 election cycle has barely settled, the financial world is already placing its bets on the next battle for the White House. As of February 2026, prediction markets—the once-niche platforms that successfully forecasted the 2024 outcome with surgical precision—are signaling a clear trajectory for the 2028 U.S. Presidential Election. Vice President JD Vance has solidified his position as the GOP frontrunner, while California Governor Gavin Newsom has emerged as the clear favorite to lead the Democratic ticket.

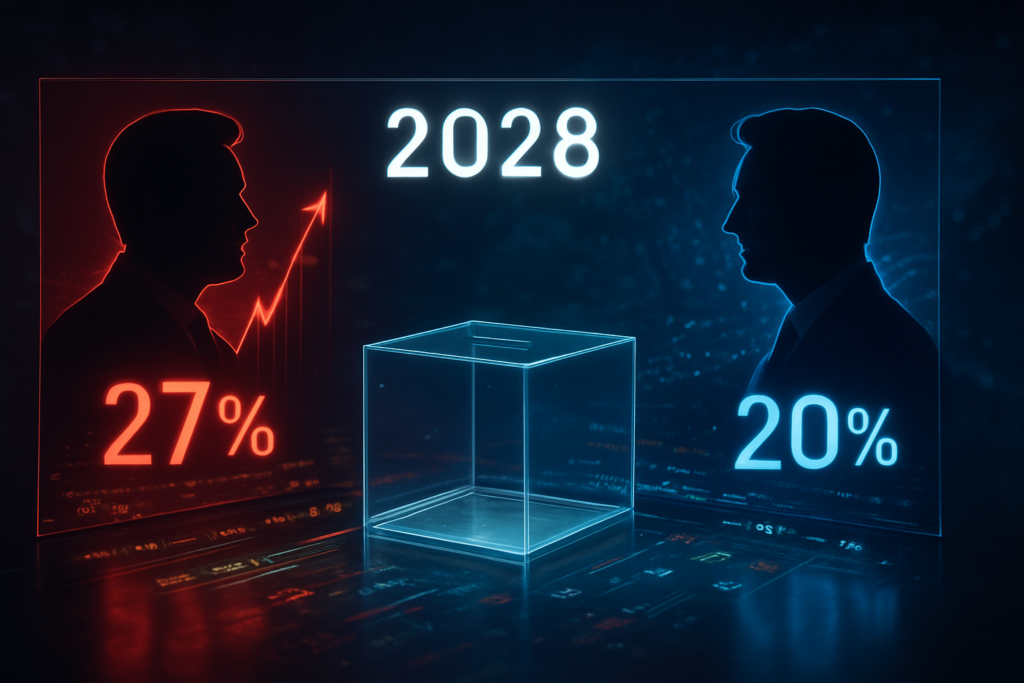

Traders on Kalshi and Polymarket are currently pricing a Vance presidency at a 27% probability, a striking figure for a race still nearly three years away. Newsom follows closely at approximately 20%, reflecting a market that is increasingly viewing the 2028 cycle as a high-stakes clash between the incumbent "America First" successor and the West Coast’s most prominent Democratic "fighter." This early activity is not merely speculative; it is the cornerstone of what analysts are calling "Information Finance," where these markets serve as long-term sentiment indicators that influence everything from corporate hedging to legislative strategy.

The Market: What’s Being Predicted

The 2028 Presidential election is no longer just a political conversation; it is a high-liquidity financial market. On Polymarket, the world’s largest decentralized prediction platform, the "2028 Presidential Winner" contract has already surpassed $250 million in total trading volume. Meanwhile, Kalshi—the first federally regulated exchange to offer such contracts—has seen over $12.5 million in its GOP nomination market alone. These platforms allow participants to buy and sell "shares" in a candidate, with prices fluctuating between $0.01 and $0.99 based on the perceived probability of the outcome.

The current odds reflect a significant consolidation within both parties. JD Vance’s nomination odds are currently trading at nearly 50%, a level of dominance that suggests traders view him as the undisputed heir to the MAGA movement. His primary competition, according to the markets, remains at a distance: Florida’s political heavyweights and other GOP rising stars are trading in the low double digits. On the Democratic side, Gavin Newsom has pulled away from a crowded field that includes figures like Representative Alexandria Ocasio-Cortez (7%) and Pennsylvania Governor Josh Shapiro (8%), with Newsom’s nomination odds hovering around 32%.

This surge in liquidity has been bolstered by the entry of mainstream financial institutions. Robinhood Markets, Inc. (NASDAQ: HOOD) and Interactive Brokers Group, Inc. (NASDAQ: IBKR) have integrated event contracts into their retail platforms, bringing millions of new participants into the ecosystem. The resolution of these markets is straightforward: a "yes" contract pays out $1.00 if the candidate is inaugurated as President in January 2029, while all other contracts expire at zero.

Why Traders Are Betting

The market’s favoritism toward JD Vance is largely driven by his performance during the first year of his vice presidency. Traders point to his role as the administration’s "legislative enforcer" and his deep ties to the domestic manufacturing and trade policy sectors as evidence of his entrenched power within the party. Unlike traditional polling, which often measures "favorability," prediction markets measure "electability" and "institutional momentum." The markets are effectively "pricing in" the consolidation of the Republican base behind Vance.

For Gavin Newsom, the momentum is tied to his aggressive stance against federal policies in late 2025. Specifically, his successful push for California’s "Prop 50"—a measure that allowed the state to redraw its congressional maps mid-decade—is viewed by traders as a signal that he is willing to engage in the "bare-knuckle" politics required for a national campaign. When the federal courts upheld these maps in January 2026, Newsom’s odds of winning the Democratic nomination saw a 15% jump in a single week.

Traders are also heavily influenced by the "Nate Silver Effect"—the retrospective realization that prediction markets were far more accurate than traditional polls in 2024. While many pollsters described the 2024 race as a 50/50 toss-up until Election Night, markets on Polymarket and Kalshi consistently priced a 60% probability for the eventual winner weeks in advance. This track record has transformed "liquid truth" into a preferred metric for hedge funds and institutional investors looking to mitigate political risk.

Broader Context and Implications

The 2028 markets are the primary evidence for the rise of "Information Finance" (InfoFi), a term increasingly used to describe the transition of truth into a tradable asset. The Intercontinental Exchange, Inc. (NYSE: ICE), the parent company of the New York Stock Exchange, recently finalized a strategic investment in prediction infrastructure, recognizing that political futures are now critical utilities for the global economy. Major firms like Susquehanna International Group (SIG) have become primary market makers, ensuring that these markets have the depth and liquidity required for institutional participation.

This shift has been aided by a dramatic change in the regulatory climate. In January 2026, under new leadership, the Commodity Futures Trading Commission (CFTC) withdrew several long-standing proposals that sought to ban political event contracts. The agency's new "pro-innovation" stance treats these markets as vital tools for price discovery, allowing platforms like Kalshi to operate with greater legal certainty and partner with media giants like Warner Bros. Discovery, Inc. (NASDAQ: WBD) and Comcast Corporation (NASDAQ: CMCSA) to provide real-time probability data.

Historically, early-cycle markets have been criticized for their volatility, but the 2028 cycle is different. The sheer volume of capital involved has compressed bid-ask spreads and reduced the impact of "noise" traders. These markets are now acting as early-warning systems for corporations, which use the JD Vance or Gavin Newsom odds to hedge against future tax reforms, environmental regulations, or changes in international trade agreements.

What to Watch Next

As we move through the remainder of 2026, several key milestones are expected to shift the 2028 odds. The first major hurdle will be the 2026 Midterm Elections. If the GOP maintains or expands its control of Congress, Vance’s odds are expected to climb further, potentially breaking the 30% mark for the presidency. Conversely, a Democratic "Blue Wave" would likely see Newsom’s odds surge as he would be credited as the party’s most effective surrogate and strategist.

Legislative battles in the summer of 2026 regarding the renewal of major tax provisions will also be a catalyst for market movement. Traders will be watching how Vance navigates these negotiations as the tie-breaking vote in the Senate. On the Democratic side, the upcoming primary debates for various governorships and Senate seats will provide a platform for Newsom to further consolidate his "leader of the opposition" status.

Additionally, the integration of prediction market data into mainstream financial terminals like Bloomberg and Refinitiv is expected to bring a second wave of institutional liquidity. As more quantitative trading firms—such as DRW and Jane Street—establish dedicated InfoFi desks, we expect the 2028 Presidential market to become one of the most stable and scrutinized assets in the world.

Bottom Line

The early 2028 presidential markets represent more than just a bet on a candidate; they are a sophisticated real-time analysis of the American political landscape. The current lead held by JD Vance reflects a market that sees his incumbency and party consolidation as a formidable barrier to any challenger. At the same time, Gavin Newsom’s steady rise illustrates a Democratic base—and a donor class—that is increasingly rallying behind a candidate perceived as a media-savvy fighter.

These markets have successfully moved from the fringes of the internet to the core of Wall Street. By treating political outcomes as financial risks that can be hedged, the prediction market ecosystem has created a more accurate, or at least more responsive, indicator of public sentiment than traditional methods.

As the 2028 cycle progresses, the "liquid truth" provided by these exchanges will likely become the primary lens through which the world views the future of American leadership. While 2028 remains far on the horizon, the markets are already telling us that the battle for the next decade has already begun.

This article is for informational purposes only and does not constitute financial or betting advice. Prediction market participation may be subject to legal restrictions in your jurisdiction.

PredictStreet focuses on covering the latest developments in prediction markets.

Visit the PredictStreet website at https://www.predictstreet.ai/.