Industrials products and automation company Regal Rexnord (NYSE: RRX). fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 10.4% year on year to $1.48 billion. Its non-GAAP profit of $2.49 per share was in line with analysts’ consensus estimates.

Is now the time to buy Regal Rexnord? Find out by accessing our full research report, it’s free.

Regal Rexnord (RRX) Q3 CY2024 Highlights:

- Revenue: $1.48 billion vs analyst estimates of $1.52 billion (2.9% miss)

- Adjusted EPS: $2.49 vs analyst expectations of $2.48 (in line)

- EBITDA: $337 million vs analyst estimates of $352.6 million (4.4% miss)

- Management lowered its full-year Adjusted EPS guidance to $9.30 at the midpoint, a 3.1% decrease

- Gross Margin (GAAP): 37.7%, up from 33.6% in the same quarter last year

- Operating Margin: 11.8%, up from -1.2% in the same quarter last year

- EBITDA Margin: 22.8%, up from 20.6% in the same quarter last year

- Free Cash Flow Margin: 8.5%, down from 9.8% in the same quarter last year

- Organic Revenue fell 2.7% year on year (-10.8% in the same quarter last year)

- Market Capitalization: $11.25 billion

CEO Louis Pinkham commented, "Our team's controllable execution was strong in the third quarter, most evident in healthy adjusted gross and EBITDA margin gains, and clear signs of market outgrowth in our largest and highest-margin segment, Industrial Powertrain Solutions. As a Company, we delivered record adjusted gross margins of 38.4%, providing clear line of sight to our goal of 40% exiting 2025. A record high adjusted EBITDA margin of 22.8% was up 110 basis points versus prior year and aligned with our goal of 25% exiting 2025. And finally, adjusted EPS was up 18.6% versus prior year, a clear inflection point for Regal Rexnord."

Company Overview

Headquartered in Milwaukee, Regal Rexnord (NYSE: RRX) provides power transmission and industrial automation products.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

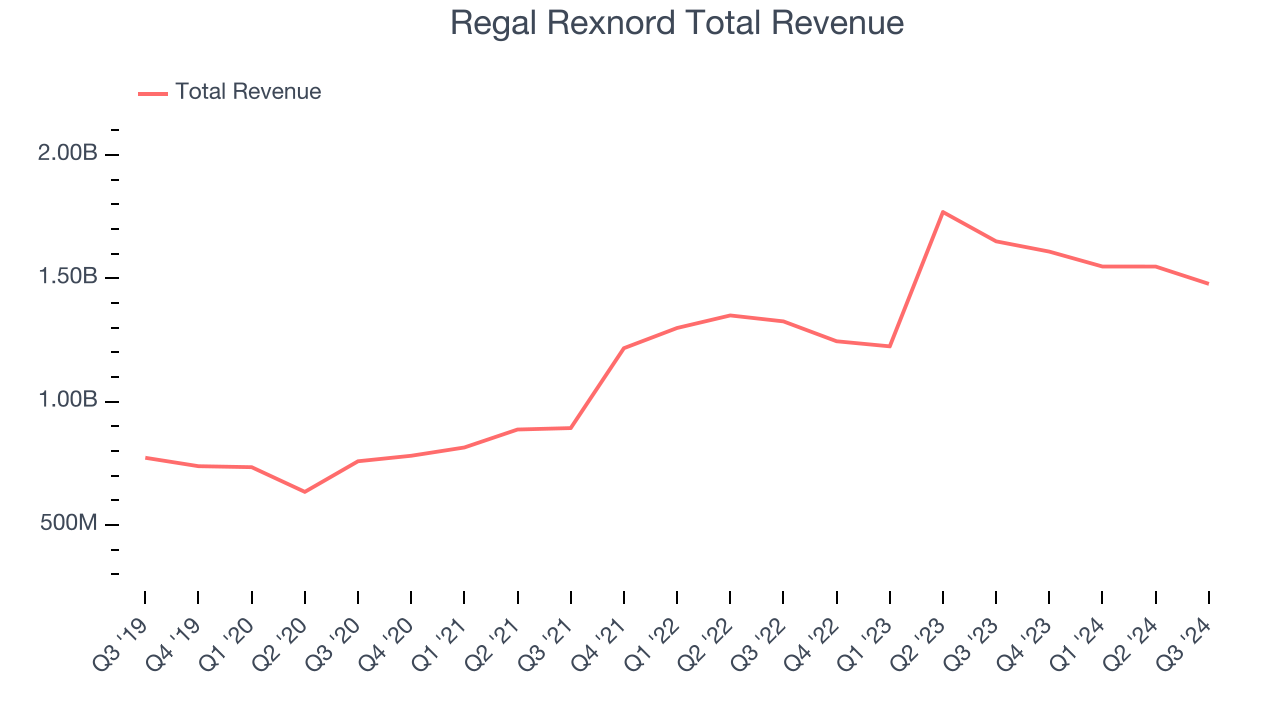

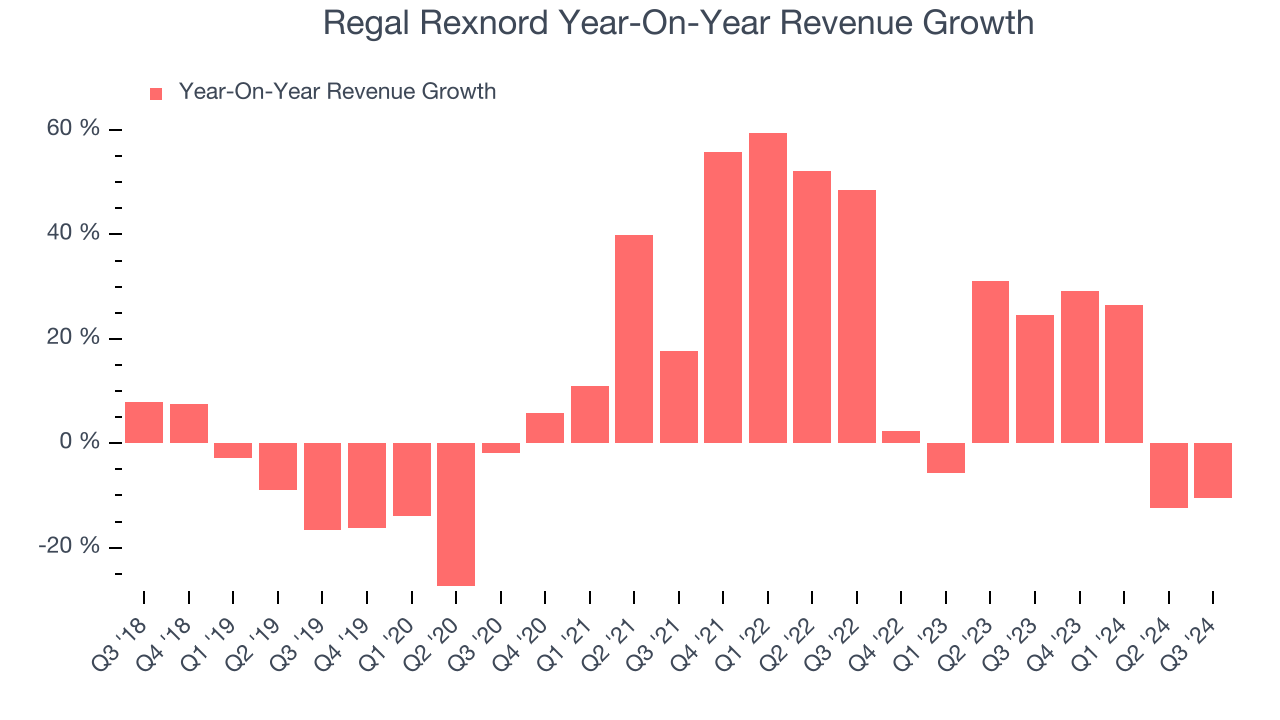

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, Regal Rexnord grew its sales at an excellent 12.8% compounded annual growth rate. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Regal Rexnord’s annualized revenue growth of 9.1% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

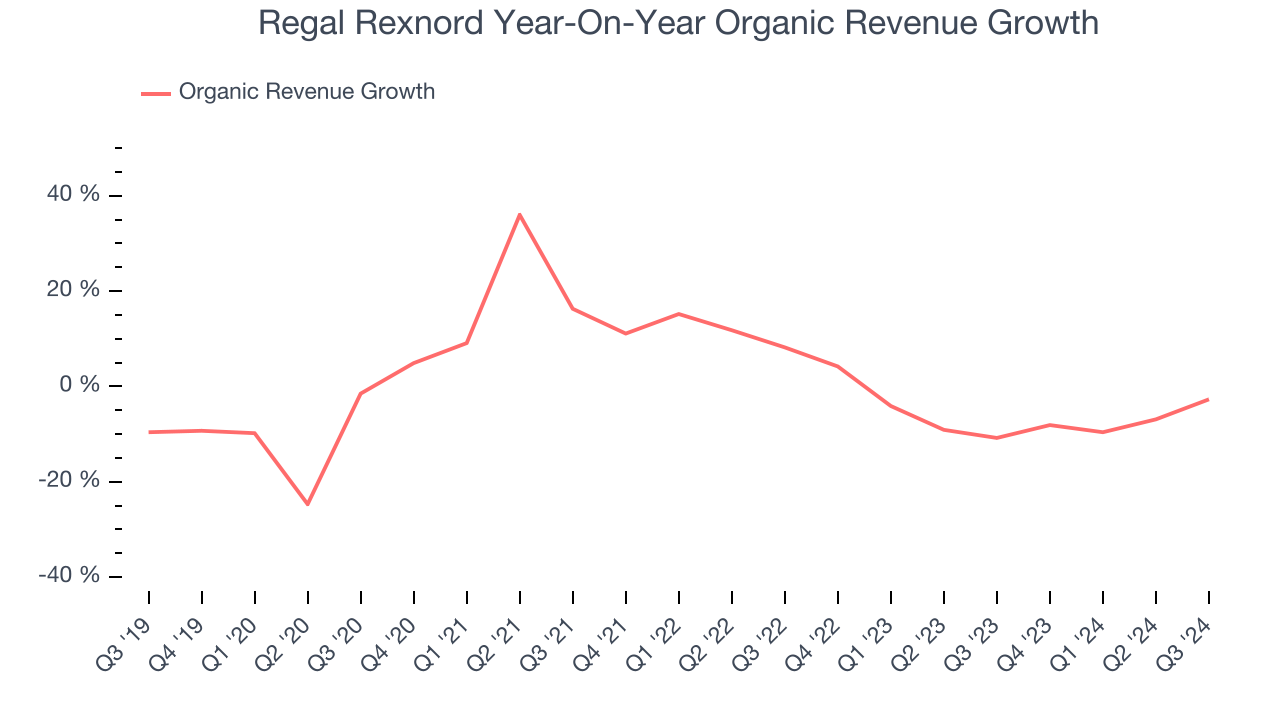

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Regal Rexnord’s organic revenue averaged 5.9% year-on-year declines. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline performance.

This quarter, Regal Rexnord missed Wall Street’s estimates and reported a rather uninspiring 10.4% year-on-year revenue decline, generating $1.48 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates the market believes its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

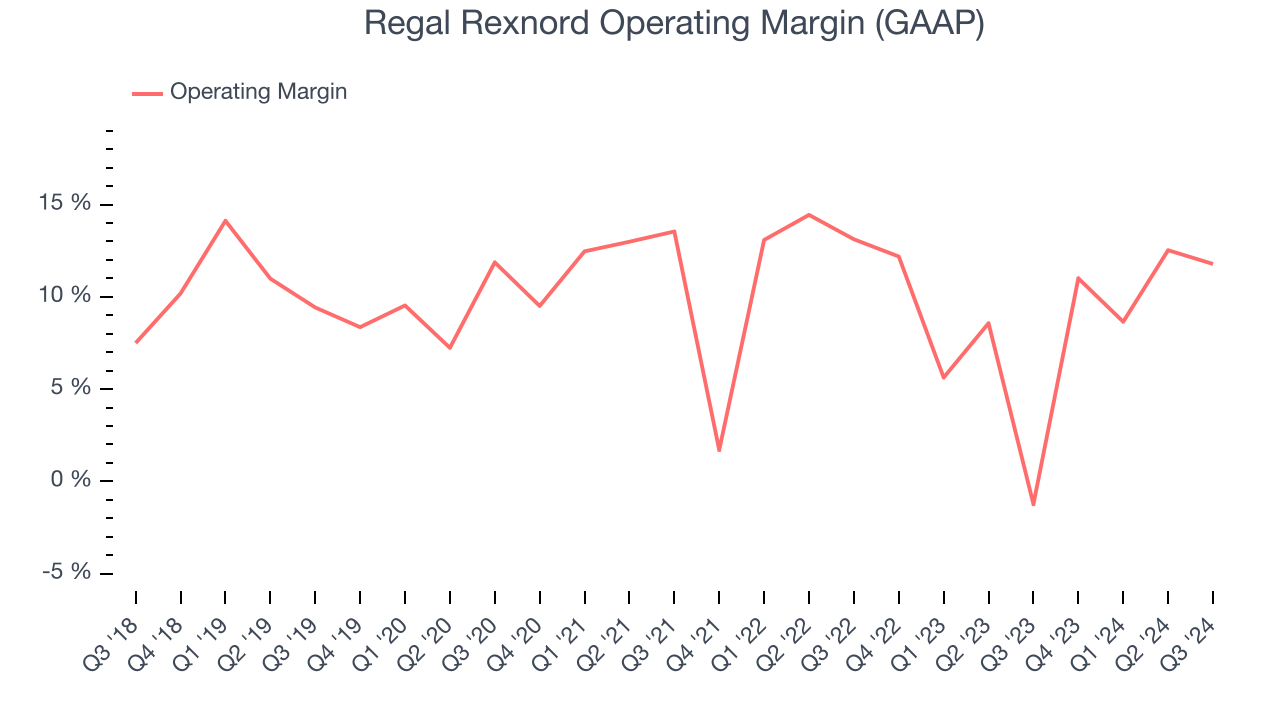

Regal Rexnord has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.7%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Regal Rexnord’s annual operating margin rose by 1.6 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Regal Rexnord generated an operating profit margin of 11.8%, up 13 percentage points year on year. The increase was solid, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

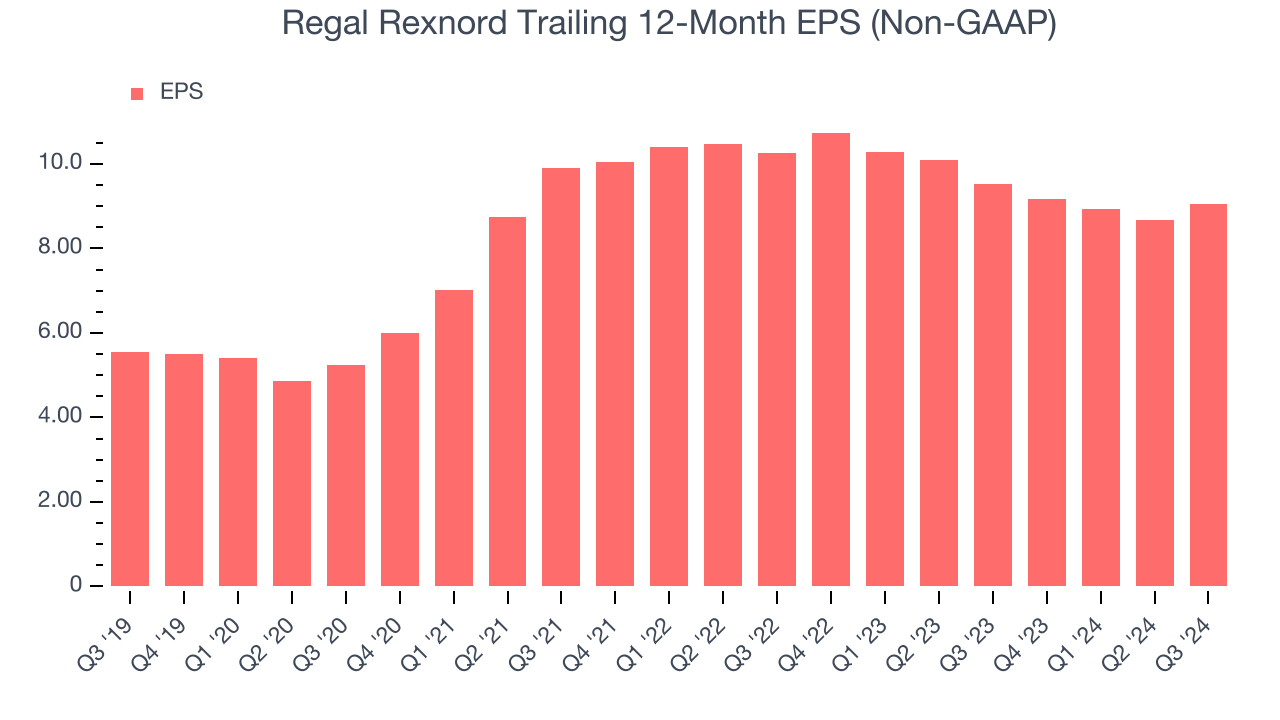

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

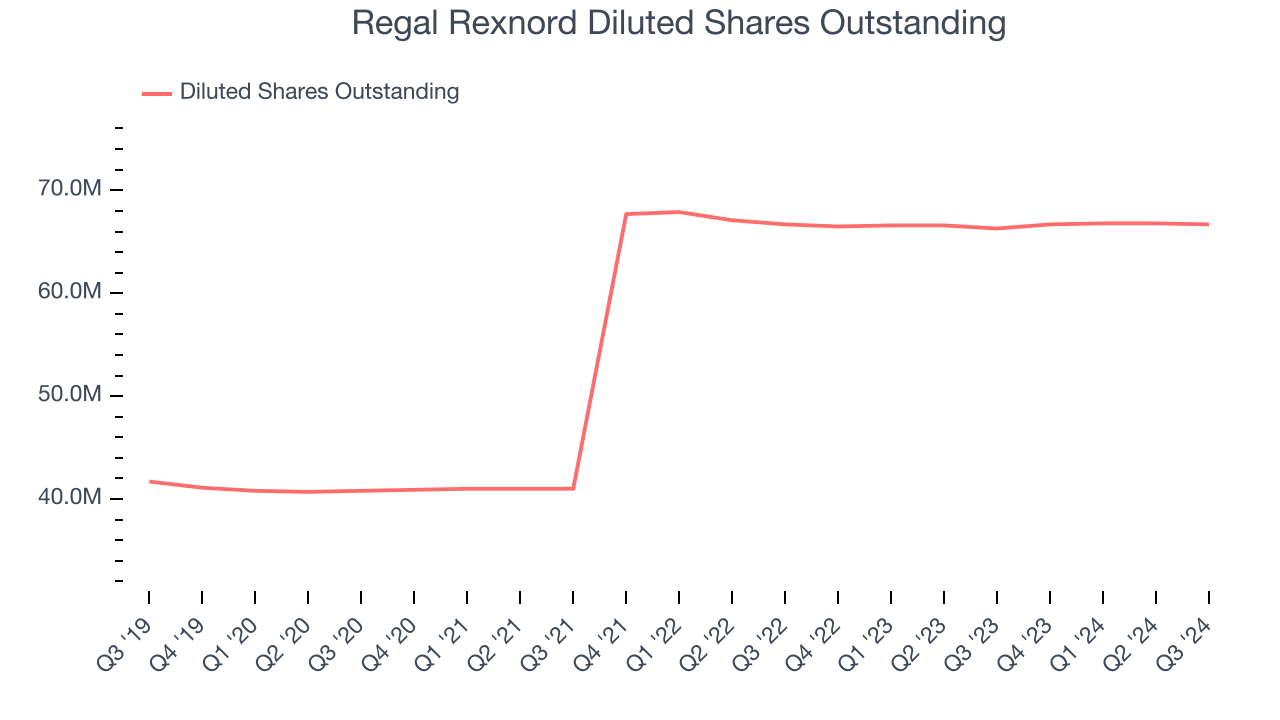

Regal Rexnord’s EPS grew at a solid 10.3% compounded annual growth rate over the last five years. Despite its operating margin expansion during that time, this performance was lower than its 12.8% annualized revenue growth. This tells us that non-fundamental factors affected its ultimate earnings.

We can take a deeper look into Regal Rexnord’s earnings to better understand the drivers of its performance. A five-year view shows Regal Rexnord has diluted its shareholders, growing its share count by 60%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Regal Rexnord, its two-year annual EPS declines of 6% mark a reversal from its (seemingly) healthy five-year trend. We hope Regal Rexnord can return to earnings growth in the future.In Q3, Regal Rexnord reported EPS at $2.49, up from $2.10 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Regal Rexnord’s full-year EPS of $9.06 to grow by 22.2%.

Key Takeaways from Regal Rexnord’s Q3 Results

We struggled to find many strong positives in these results. Its revenue missed and its organic revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.3% to $163 immediately following the results.

Regal Rexnord may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.