Beverage company Zevia (NYSE: ZVIA) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 15.6% year on year to $36.37 million. Next quarter’s revenue guidance of $39 million underwhelmed, coming in 4.1% below analysts’ estimates. Its GAAP loss of $0.04 per share was 50% above analysts’ consensus estimates.

Is now the time to buy Zevia PBC? Find out by accessing our full research report, it’s free.

Zevia PBC (ZVIA) Q3 CY2024 Highlights:

- Revenue: $36.37 million vs analyst estimates of $39.04 million (6.8% miss)

- EPS: -$0.04 vs analyst estimates of -$0.08 (50% beat)

- EBITDA: -$1.51 million vs analyst estimates of -$1.98 million (23.6% beat)

- Revenue Guidance for Q4 CY2024 is $39 million at the midpoint, below analyst estimates of $40.65 million

- EBITDA guidance for Q4 CY2024 is $2 million at the midpoint, above analyst estimates of -$1.02 million

- Gross Margin (GAAP): 49.1%, up from 45.4% in the same quarter last year

- Operating Margin: -8.2%, up from -26.5% in the same quarter last year

- EBITDA Margin: -4.1%, up from -21.2% in the same quarter last year

- Sales Volumes fell 12.2% year on year (-8.2% in the same quarter last year)

- Market Capitalization: $64.38 million

“We are very pleased to have delivered vast improvements in net loss and adjusted EBITDA, despite coming in slightly below our net sales expectations,” said Amy Taylor, President and Chief Executive Officer.

Company Overview

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE: ZVIA) is a better-for-you beverage company.

Beverages, Alcohol and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Zevia PBC is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale.

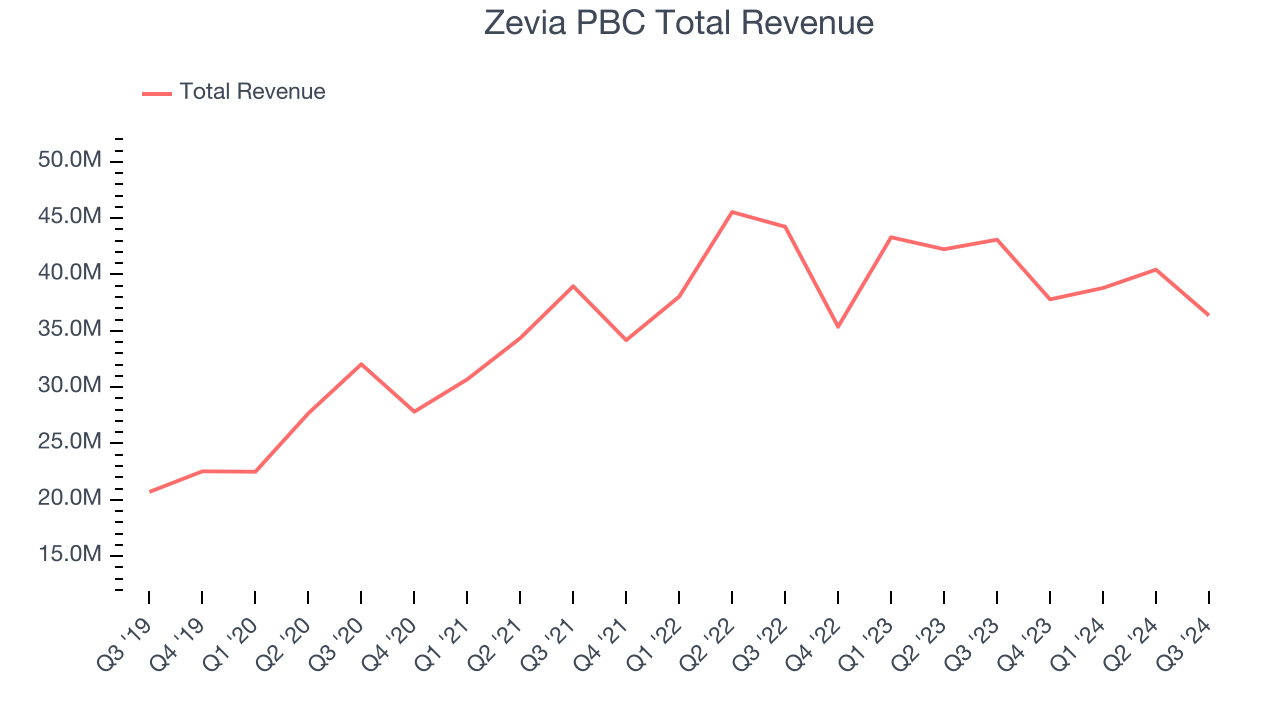

As you can see below, Zevia PBC’s 5.2% annualized revenue growth over the last three years was tepid as consumers bought less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Zevia PBC missed Wall Street’s estimates and reported a rather uninspiring 15.6% year-on-year revenue decline, generating $36.37 million of revenue. Management is currently guiding for a 3.2% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.1% over the next 12 months, an acceleration versus the last three years. This projection is healthy and shows the market thinks its newer products will spur faster growth.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

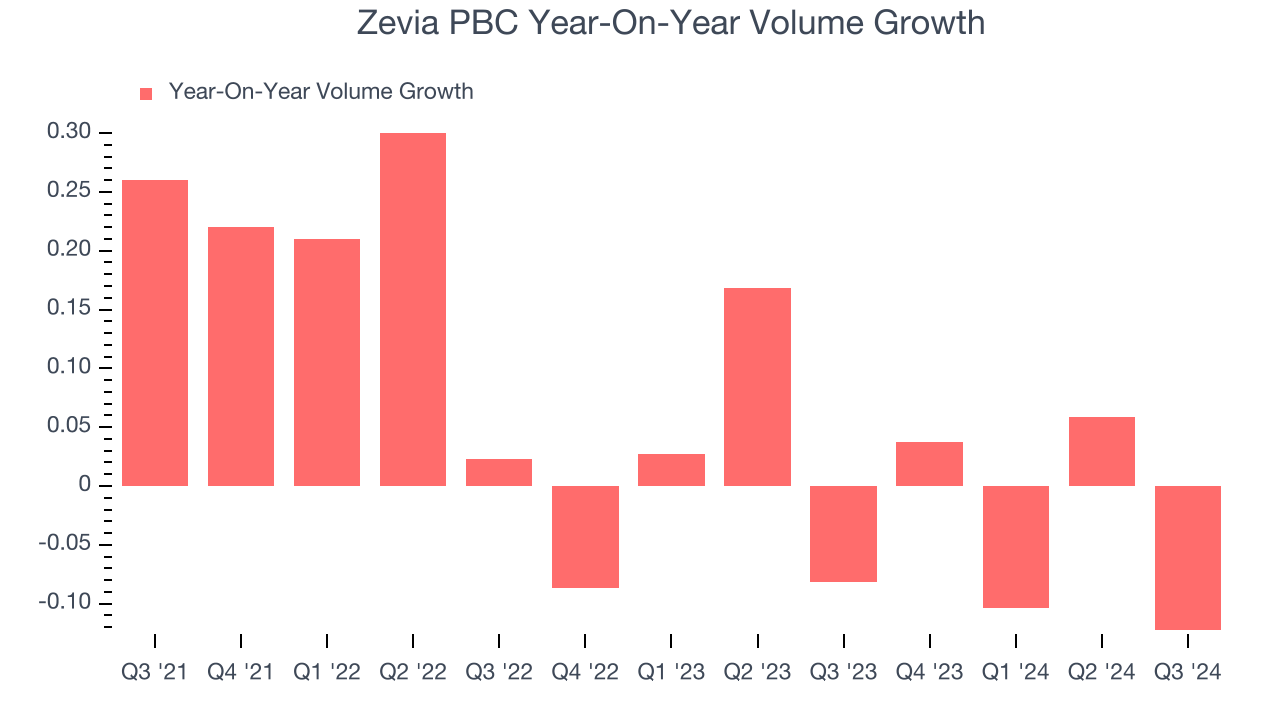

Zevia PBC’s average quarterly sales volumes have shrunk by 1.3% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Zevia PBC’s Q3 2024, sales volumes dropped 12.2% year on year. This result was a further deceleration from the 8.2% year-on-year decline it posted 12 months ago, showing the business is struggling to push its products.

Key Takeaways from Zevia PBC’s Q3 Results

We were impressed by Zevia PBC’s optimistic EBITDA forecast for next quarter, which blew past analysts’ expectations. We were also excited its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed analysts’ expectations and its full-year revenue guidance missed Wall Street’s estimates. Overall, this quarter was mixed. The stock remained flat at $1.08 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.