As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the processors and graphics chips industry, including Nvidia (NASDAQ: NVDA) and its peers.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 8 processors and graphics chips stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.1% since the latest earnings results.

Best Q3: Nvidia (NASDAQ: NVDA)

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ: NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

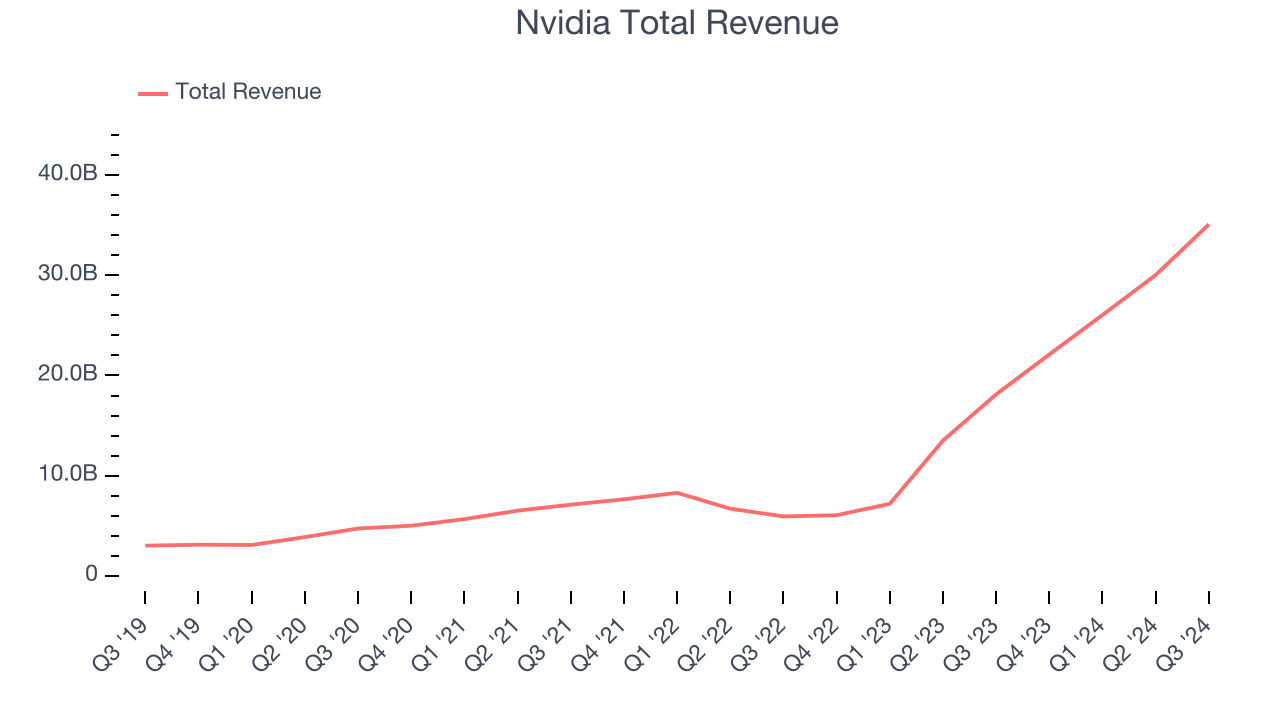

Nvidia reported revenues of $35.08 billion, up 93.6% year on year. This print exceeded analysts’ expectations by 5.9%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

“The age of AI is in full steam, propelling a global shift to NVIDIA computing,” said Jensen Huang, founder and CEO of NVIDIA.

Nvidia pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 1% since reporting and currently trades at $144.42.

Qualcomm (NASDAQ: QCOM)

Having been at the forefront of developing the standards for cellular connectivity for over four decades, Qualcomm (NASDAQ: QCOM) is a leading innovator and a fabless manufacturer of wireless technology chips used in smartphones, autos and internet of things appliances.

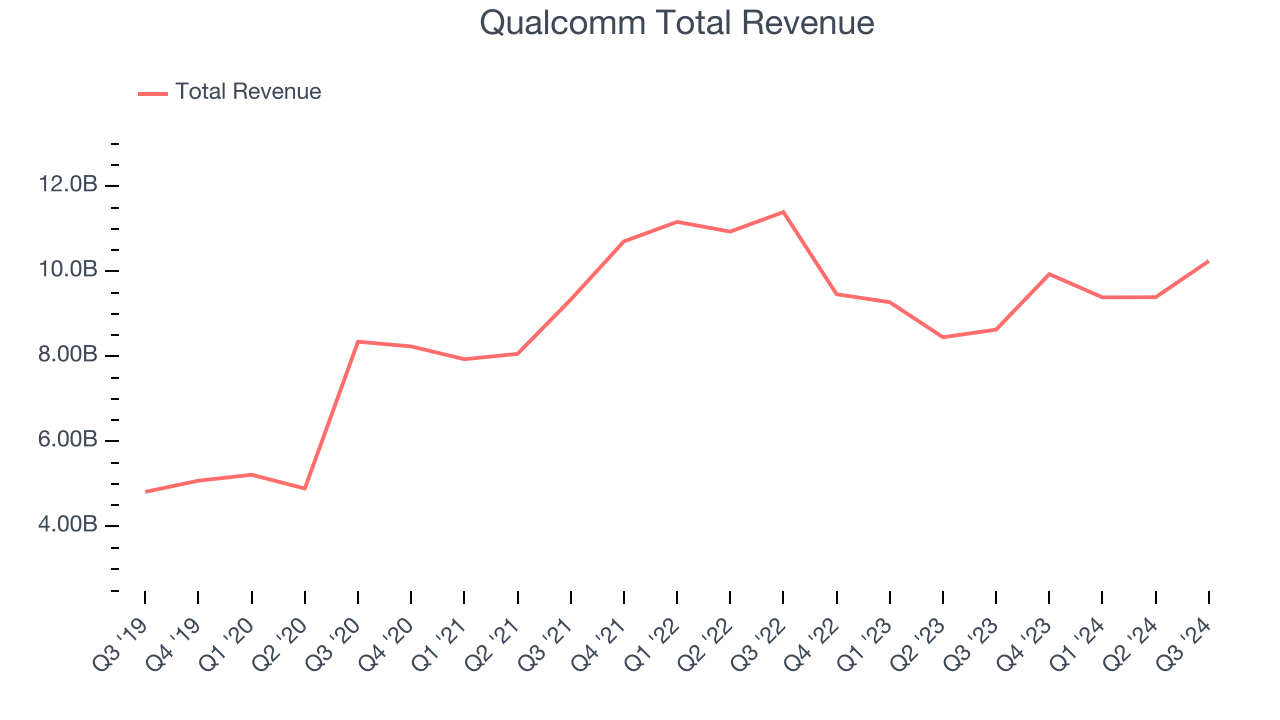

Qualcomm reported revenues of $10.24 billion, up 18.7% year on year, outperforming analysts’ expectations by 3.1%. The business had a very strong quarter with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.3% since reporting. It currently trades at $160.60.

Is now the time to buy Qualcomm? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: SMART (NASDAQ: SGH)

Based in the US, SMART Global Holdings (NASDAQ: SGH) is a diversified semiconductor company offering memory, digital, and LED products.

SMART reported revenues of $311.1 million, down 1.7% year on year, falling short of analysts’ expectations by 4.3%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

SMART delivered the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $21.

Read our full analysis of SMART’s results here.

AMD (NASDAQ: AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ: AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD reported revenues of $6.82 billion, up 17.6% year on year. This number surpassed analysts’ expectations by 1.6%. Taking a step back, it was a mixed quarter as it also produced a significant improvement in its inventory levels but revenue guidance for next quarter slightly missing analysts’ expectations.

The stock is down 15% since reporting and currently trades at $141.28.

Read our full, actionable report on AMD here, it’s free.

Allegro MicroSystems (NASDAQ: ALGM)

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ: ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

Allegro MicroSystems reported revenues of $187.4 million, down 32% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a slower quarter as it recorded revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

The stock is down 3.7% since reporting and currently trades at $21.39.

Read our full, actionable report on Allegro MicroSystems here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.