Over the past six months, Landstar’s stock price fell to $121.67. Shareholders have lost 19.9% of their capital, which is disappointing considering the S&P 500 has climbed by 18.4%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Landstar, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Landstar Will Underperform?

Despite the more favorable entry price, we're swiping left on Landstar for now. Here are three reasons there are better opportunities than LSTR and a stock we'd rather own.

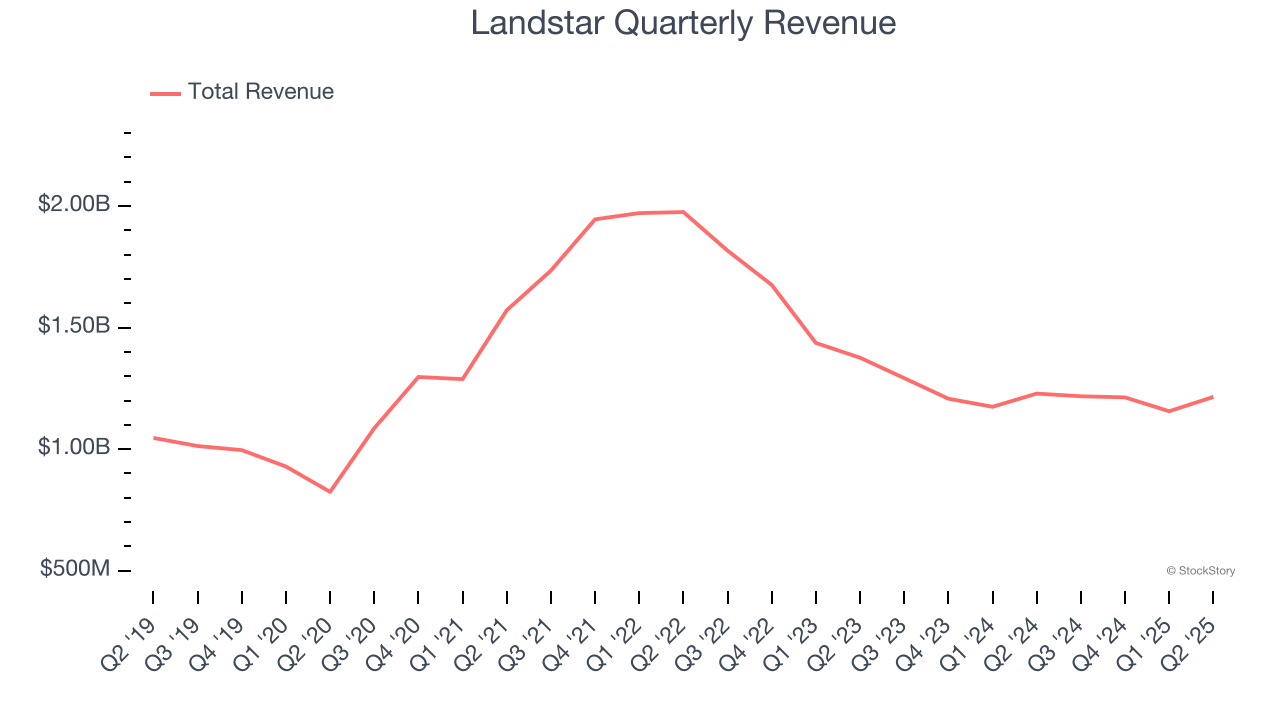

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Landstar’s 5% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the industrials sector.

2. EPS Growth Has Stalled

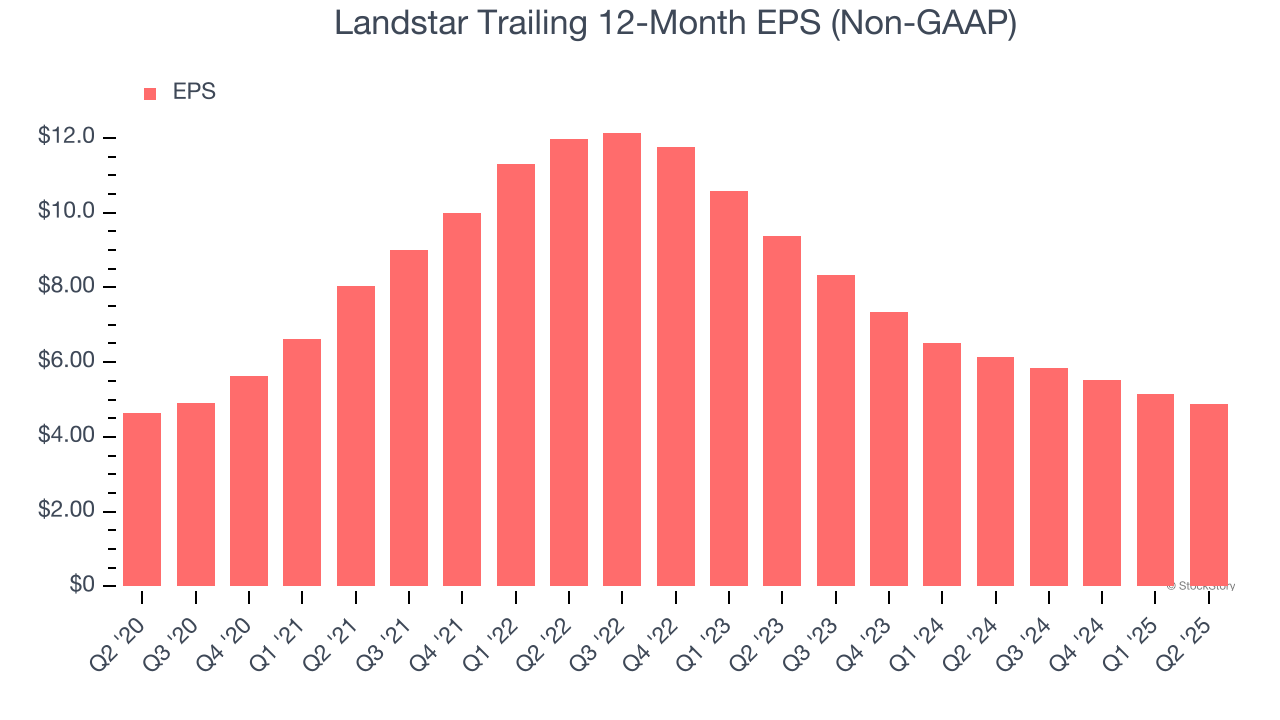

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Landstar’s flat EPS over the last five years was below its 5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

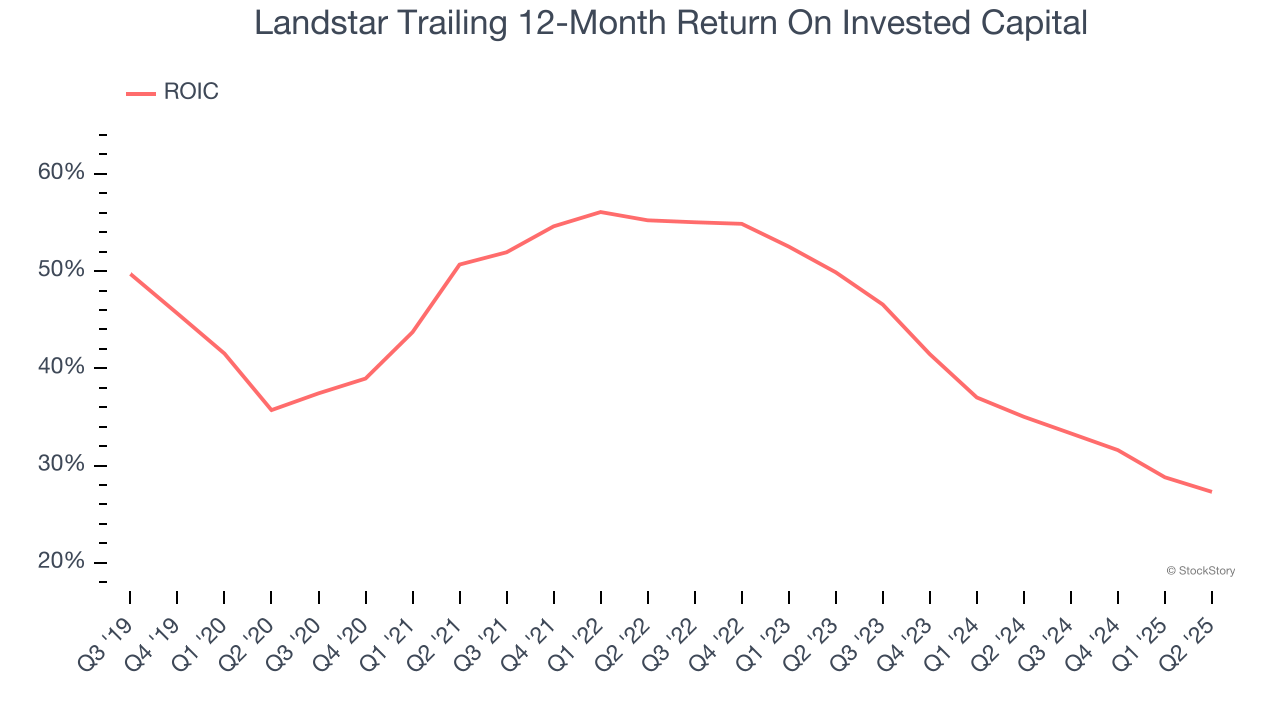

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Landstar’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Landstar, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 21.9× forward P/E (or $121.67 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Landstar

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.