Technology giant Microsoft (NASDAQ: MSFT) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 18.4% year on year to $77.67 billion. Its GAAP profit of $3.72 per share was 1.6% above analysts’ consensus estimates.

Is now the time to buy Microsoft? Find out by accessing our full research report, it’s free for active Edge members.

Microsoft (MSFT) Q3 CY2025 Highlights:

- Revenue: $77.67 billion vs analyst estimates of $75.49 billion (2.9% beat)

- Operating Profit (GAAP): $37.96 billion vs analyst estimates of $35.16 billion (8% beat)

- EPS (GAAP): $3.72 vs analyst estimates of $3.66 (1.6% beat)

- Intelligent Cloud Revenue: $0.02 vs analyst estimates of $30.29 billion (2% beat)

- Business Software Revenue: $33.02 billion vs analyst estimates of $32.36 billion (2.1% beat)

- Personal Computing Revenue: $13.76 billion vs analyst estimates of $12.85 billion (7% beat)

- Gross Margin: 69%, in line with the same quarter last year

- Operating Margin: 48.9%, up from 46.6% in the same quarter last year

- Free Cash Flow Margin: 33%, up from 29.4% in the same quarter last year

- Market Capitalization: $4.03 trillion

"Our planet-scale cloud and AI factory, together with Copilots across high value domains, is driving broad diffusion and real-world impact," said Satya Nadella, chairman and chief executive officer of Microsoft.

Revenue Growth

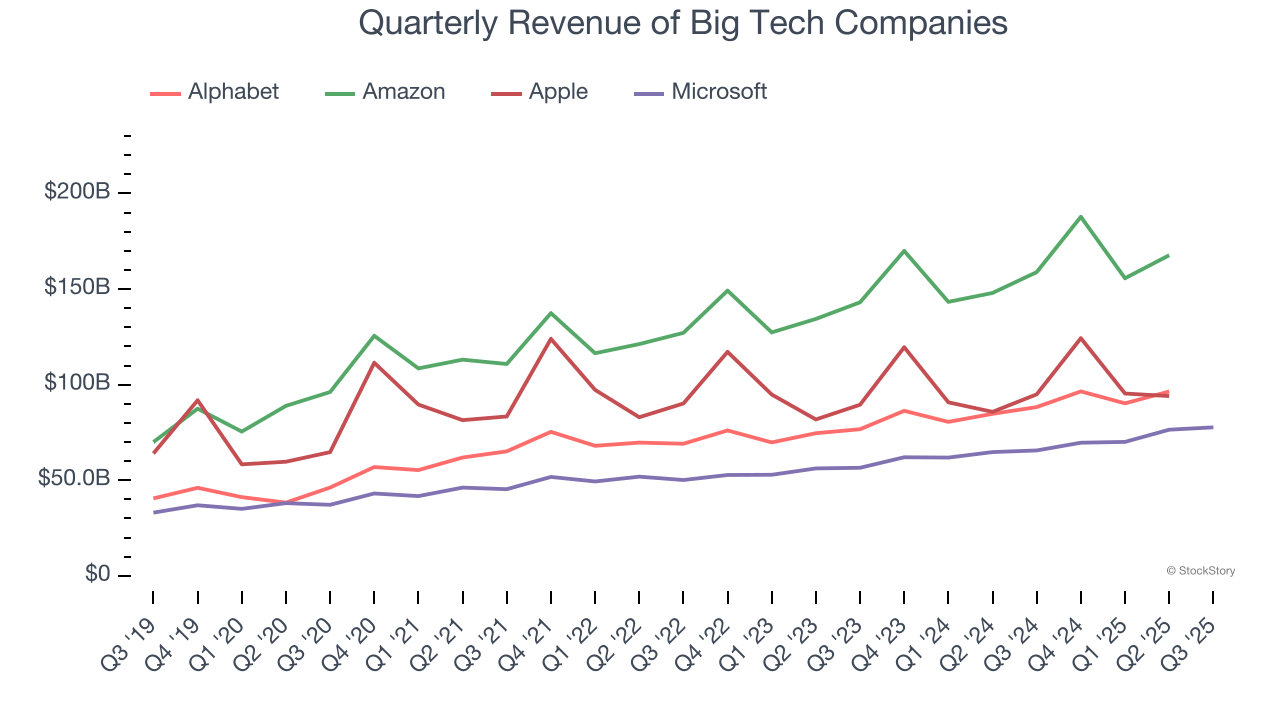

Microsoft proves that huge, scaled companies can still grow quickly. The company’s revenue base of $147.1 billion five years ago has nearly doubled to $293.8 billion in the last year, translating into an exceptional 14.8% annualized growth rate.

Over the same period, Microsoft’s big tech peers Amazon, Alphabet, and Apple put up annualized growth rates of 15.2%, 17.7%, and 8.4%, respectively. Comparing the four is relevant because investors often pit them against each other to derive their valuations. With these benchmarks in mind, we think Microsoft’s price is fair.

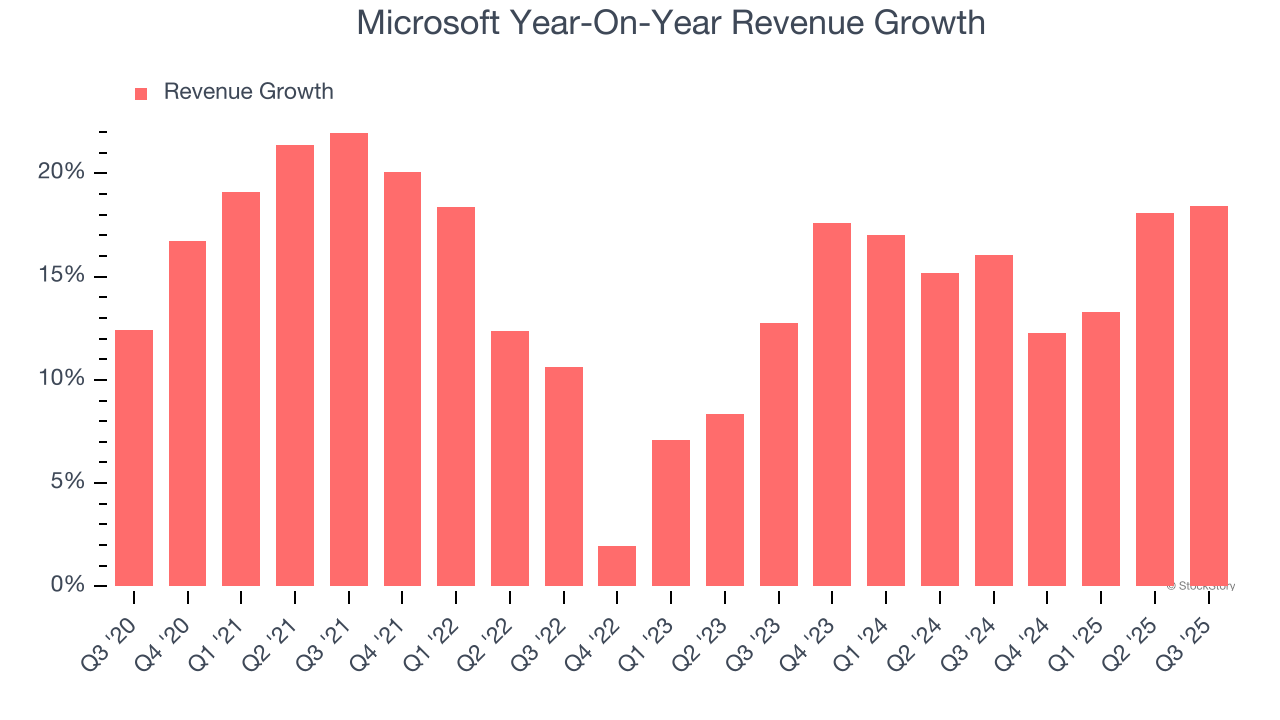

We at StockStory emphasize long-term growth, but for big tech companies, a half-decade historical view may miss emerging trends in AI. Microsoft’s annualized revenue growth of 16% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Microsoft reported year-on-year revenue growth of 18.4%, and its $77.67 billion of revenue exceeded Wall Street’s estimates by 2.9%. Looking ahead, sell-side This projection is still healthy and illustrates the market sees some success for its newer products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Key Takeaways from Microsoft’s Q3 Results

It was encouraging to see Microsoft narrowly top analysts’ revenue expectations this quarter, as Personal Computing, Business Services, and Intelligent Cloud all beat. We were also glad its consolidated revenue and EPS both outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 2.5% to $529.15 immediately following the results.

Big picture, is Microsoft a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.