Snack food company Utz Brands (NYSE: UTZ) announced better-than-expected revenue in Q3 CY2025, with sales up 3.4% year on year to $377.8 million. Its non-GAAP profit of $0.23 per share was in line with analysts’ consensus estimates.

Is now the time to buy Utz? Find out by accessing our full research report, it’s free for active Edge members.

Utz (UTZ) Q3 CY2025 Highlights:

- Revenue: $377.8 million vs analyst estimates of $375 million (3.4% year-on-year growth, 0.7% beat)

- Adjusted EPS: $0.23 vs analyst estimates of $0.23 (in line)

- Operating Margin: 0.9%, down from 5.3% in the same quarter last year

- Free Cash Flow Margin: 18.4%, up from 7.9% in the same quarter last year

- Organic Revenue rose 3.4% year on year vs analyst estimates of 2.6% growth (78.2 basis point beat)

- Sales Volumes rose 4.5% year on year (2.4% in the same quarter last year)

- Market Capitalization: $1.03 billion

“Utz delivered another quarter of strong performance, demonstrating both top-line and adjusted earnings growth,” said Howard Friedman, Chief Executive Officer of Utz.

Company Overview

Tracing its roots back to 1921 when Bill and Salie Utz began making potato chips in their kitchen, Utz Brands (NYSE: UTZ) offers salty snacks such as potato chips, tortilla chips, pretzels, cheese snacks, and ready-to-eat popcorn, among others.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.44 billion in revenue over the past 12 months, Utz is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

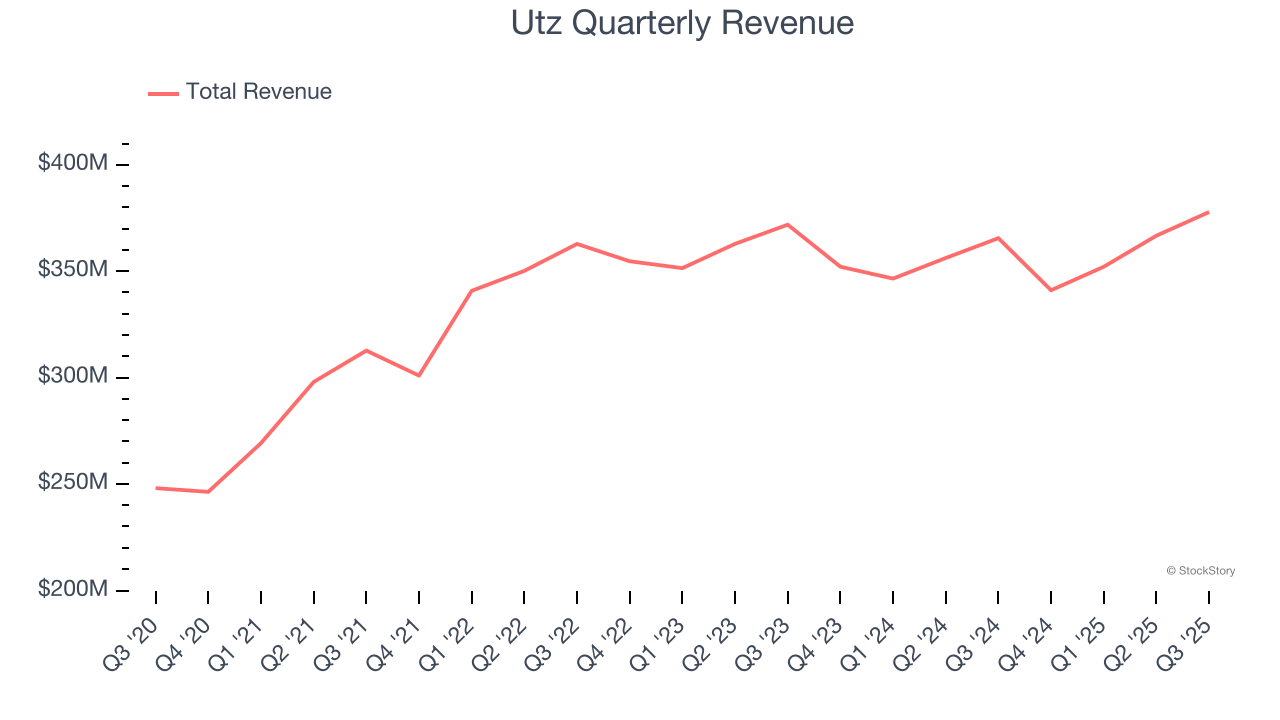

As you can see below, Utz’s 2% annualized revenue growth over the last three years was sluggish, but to its credit, consumers bought more of its products.

This quarter, Utz reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and indicates its newer products will not accelerate its top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume Growth

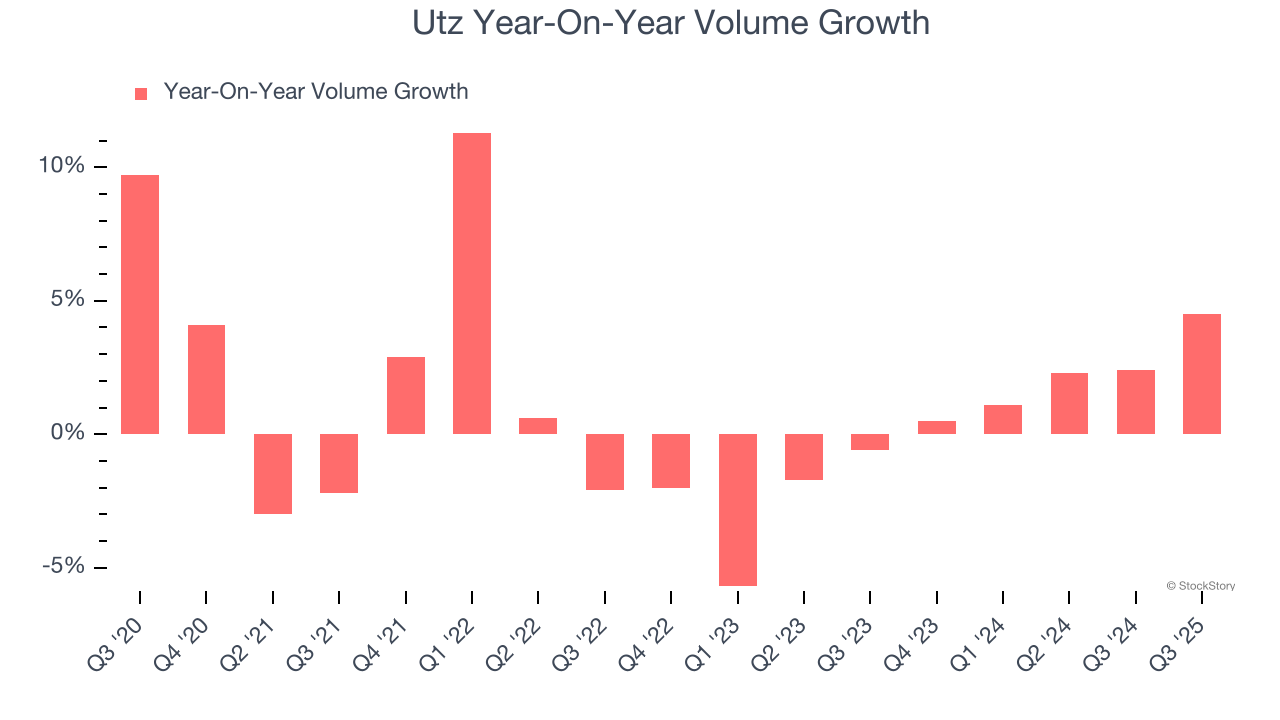

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Utz’s average quarterly volume growth was a healthy 2.2% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Utz’s Q3 2025, sales volumes jumped 4.5% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

Key Takeaways from Utz’s Q3 Results

Revenue and EPS were roughly in line. We were also happy its organic revenue narrowly outperformed Wall Street’s estimates. On the other hand, its gross margin missed. Overall, this print had some key positives. The stock traded up 8.4% to $12.96 immediately after reporting.

Is Utz an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.