Environmental services provider Montrose (NYSE: MEG) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 25.9% year on year to $224.9 million. The company’s full-year revenue guidance of $820 million at the midpoint came in 0.6% above analysts’ estimates. Its non-GAAP profit of $0.36 per share was 11.6% above analysts’ consensus estimates.

Is now the time to buy Montrose? Find out by accessing our full research report, it’s free for active Edge members.

Montrose (MEG) Q3 CY2025 Highlights:

- Revenue: $224.9 million vs analyst estimates of $202.8 million (25.9% year-on-year growth, 10.9% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.32 (11.6% beat)

- Adjusted EBITDA: $33.66 million vs analyst estimates of $28.92 million (15% margin, 16.4% beat)

- The company slightly lifted its revenue guidance for the full year to $820 million at the midpoint from $815 million

- EBITDA guidance for the full year is $115 million at the midpoint, in line with analyst expectations

- Operating Margin: 4.4%, up from -0.6% in the same quarter last year

- Free Cash Flow Margin: 9.9%, up from 5.7% in the same quarter last year

- Market Capitalization: $885.7 million

Montrose Chief Executive Officer and Director, Vijay Manthripragada, commented, “I am thrilled to announce another outstanding quarter as our record 2025 continues. The credit goes to our ~3,500 colleagues around the world to whom I am incredibly grateful. Demand for our services is elevated, driven by broader market forces, increased domestic industrial production in our key geographies and state and provincial regulations. This is our third consecutive quarter of record results, including free cash flow1 generation that exceeded expectations. Our outperformance year to date is primarily due to strong organic growth across all three of our segments and the resultant operating leverage, which continues to drive margin accretion. "

Company Overview

Founded to protect a tree-lined two-lane road, Montrose (NYSE: MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Revenue Growth

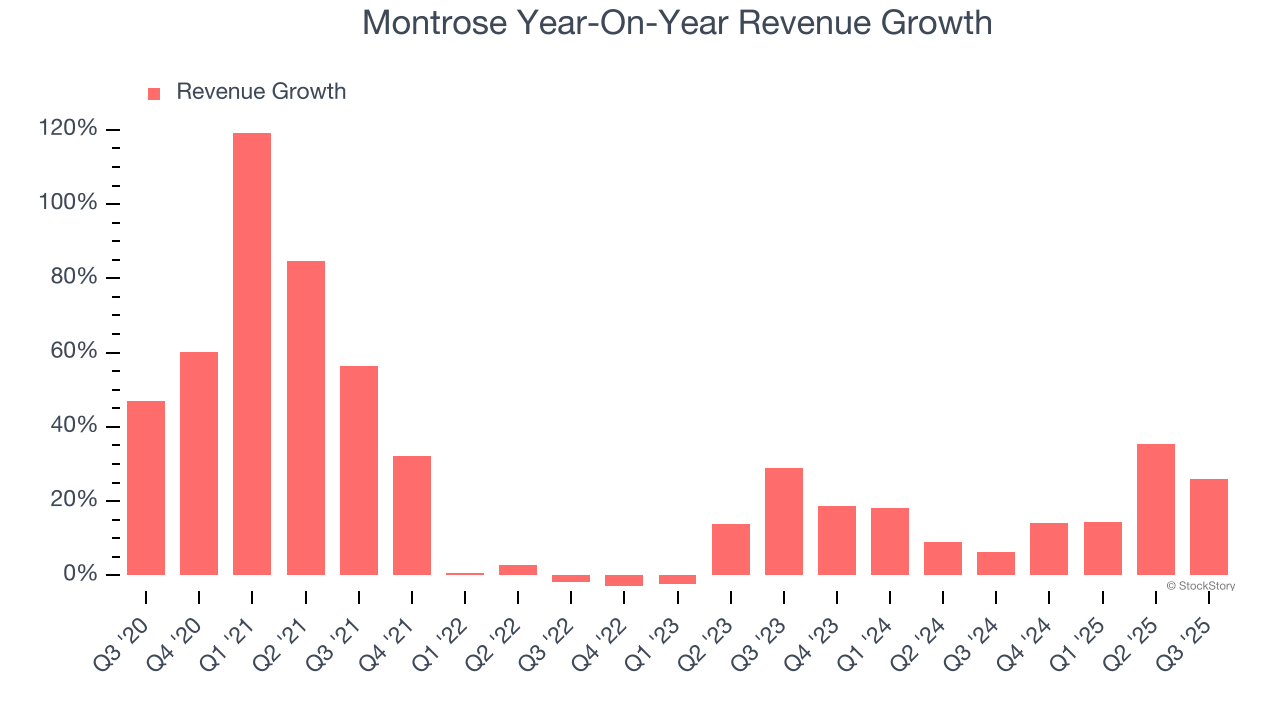

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Montrose grew its sales at an incredible 23.5% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Montrose’s annualized revenue growth of 17.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Montrose reported robust year-on-year revenue growth of 25.9%, and its $224.9 million of revenue topped Wall Street estimates by 10.9%.

Looking ahead, sell-side analysts expect revenue to decline by 1.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

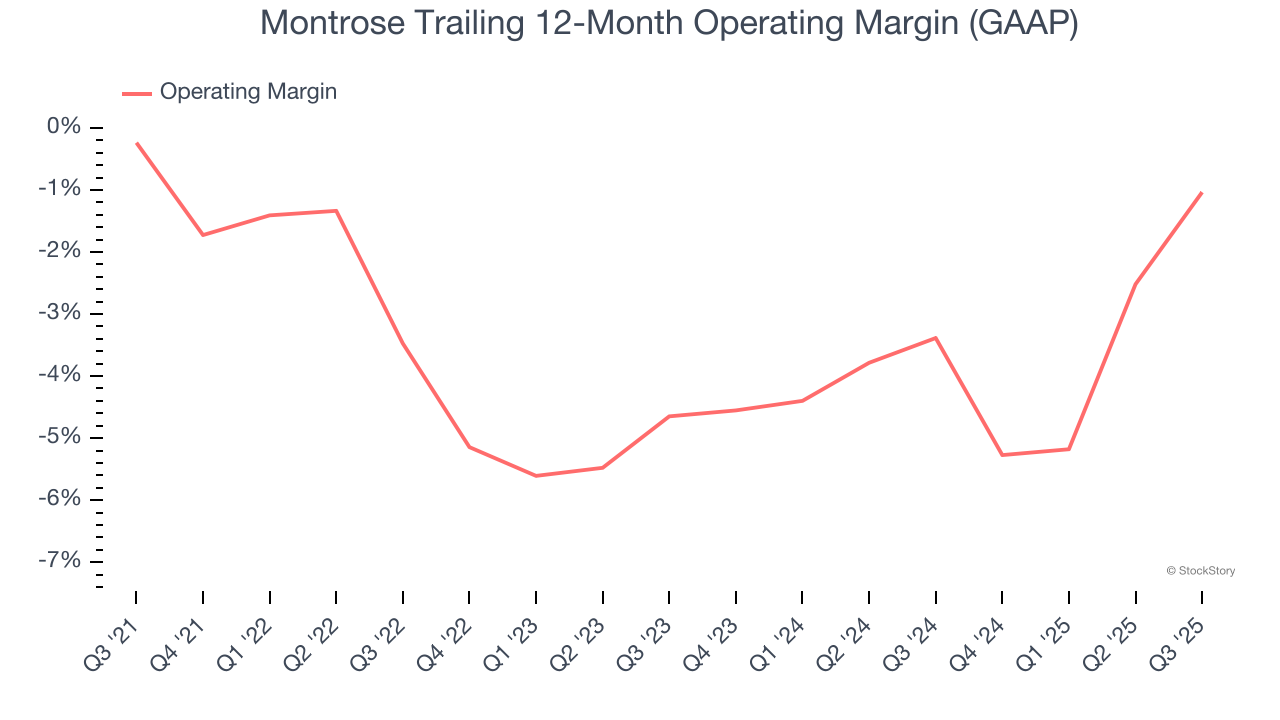

Montrose’s operating margin has risen over the last 12 months, but it still averaged negative 2.5% over the last five years. This is due to its large expense base and inefficient cost structure. It might have a shot at long-term profitability if it can scale quickly and gain operating leverage.

Analyzing the trend in its profitability, Montrose’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Montrose generated an operating margin profit margin of 4.4%, up 5.1 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

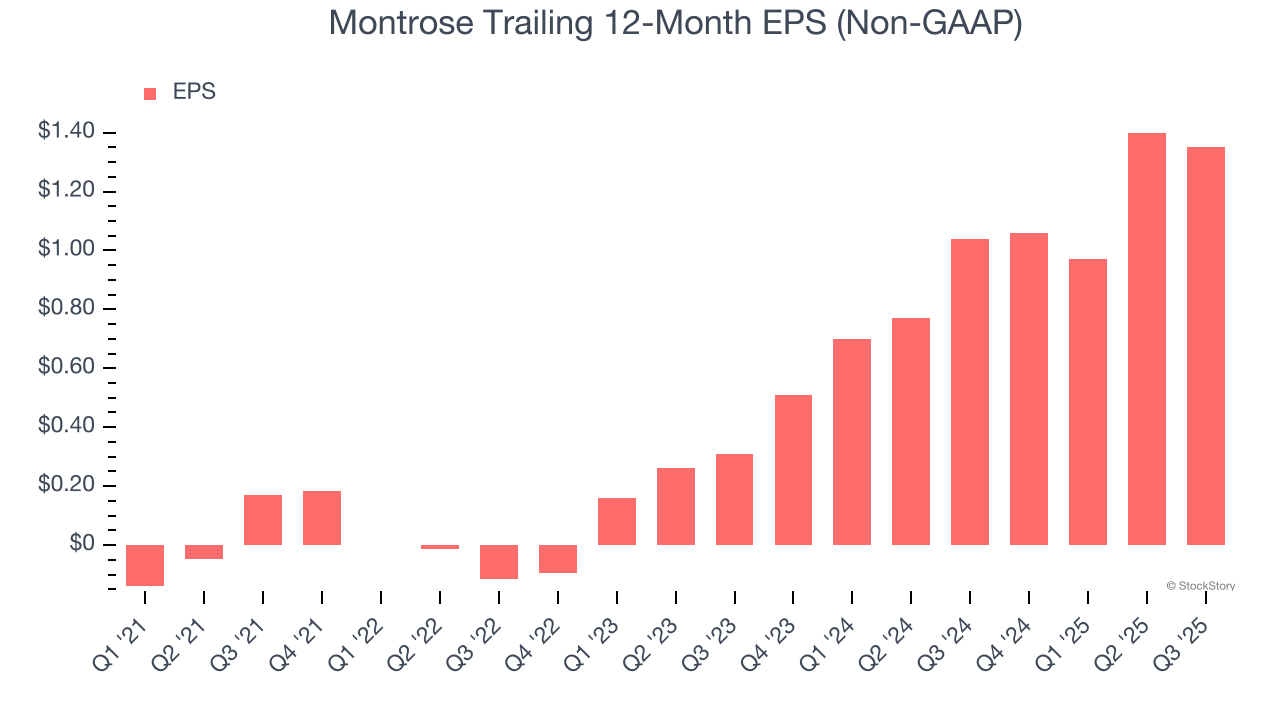

Montrose’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Montrose’s EPS grew at an astounding 109% compounded annual growth rate over the last two years, higher than its 17.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Montrose’s earnings quality to better understand the drivers of its performance. Montrose’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Montrose reported adjusted EPS of $0.36, down from $0.41 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Montrose’s full-year EPS of $1.35 to shrink by 10.7%.

Key Takeaways from Montrose’s Q3 Results

We were impressed by how significantly Montrose blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 14.1% to $28.03 immediately following the results.

Sure, Montrose had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.