Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Intuitive Surgical (NASDAQ: ISRG) and the best and worst performers in the surgical equipment & consumables - specialty industry.

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

The 4 surgical equipment & consumables - specialty stocks we track reported a mixed Q3. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1.4% on average since the latest earnings results.

Best Q3: Intuitive Surgical (NASDAQ: ISRG)

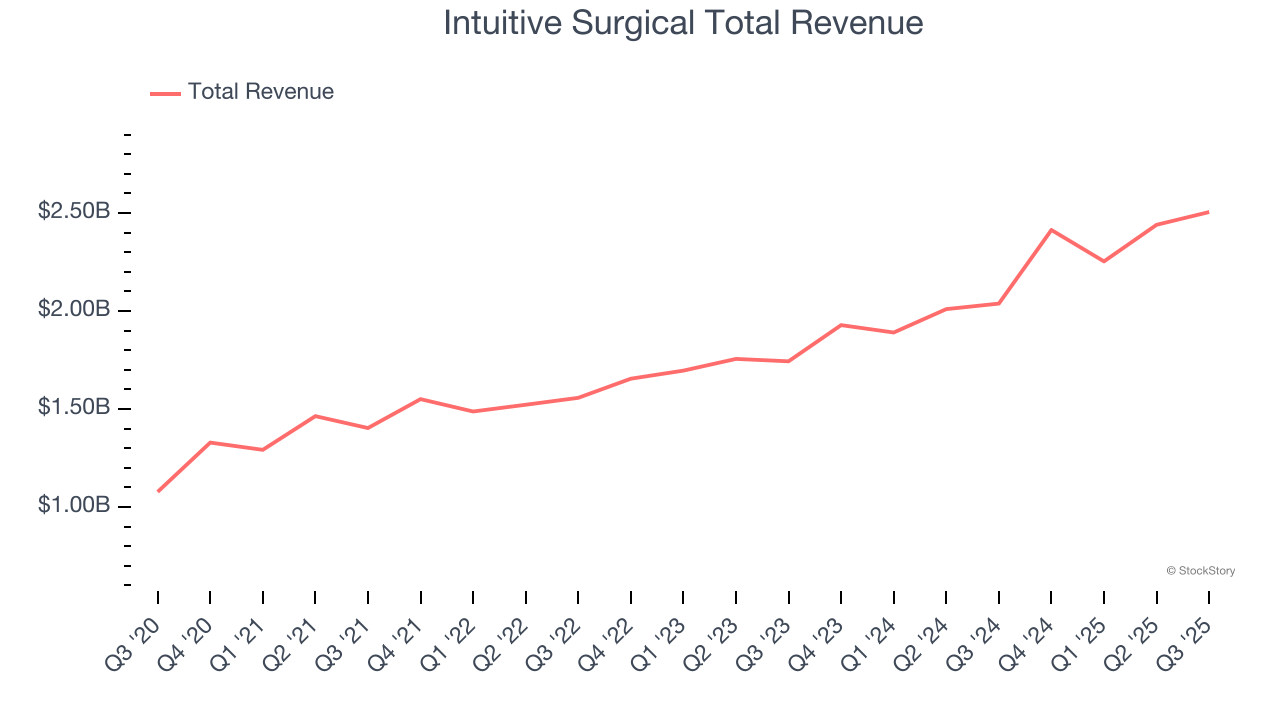

Pioneering minimally invasive surgery since its first da Vinci system was FDA-cleared in 2000, Intuitive Surgical (NASDAQ: ISRG) develops and manufactures robotic-assisted surgical systems that enable minimally invasive procedures across various medical specialties.

Intuitive Surgical reported revenues of $2.51 billion, up 22.9% year on year. This print exceeded analysts’ expectations by 3%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

“We’re pleased with our strong results this quarter, underscored by continued growth in customer use and adoption of our Ion and da Vinci platforms, including da Vinci 5,” said Dave Rosa, Intuitive CEO.

Intuitive Surgical pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 24.3% since reporting and currently trades at $575.22.

Teleflex (NYSE: TFX)

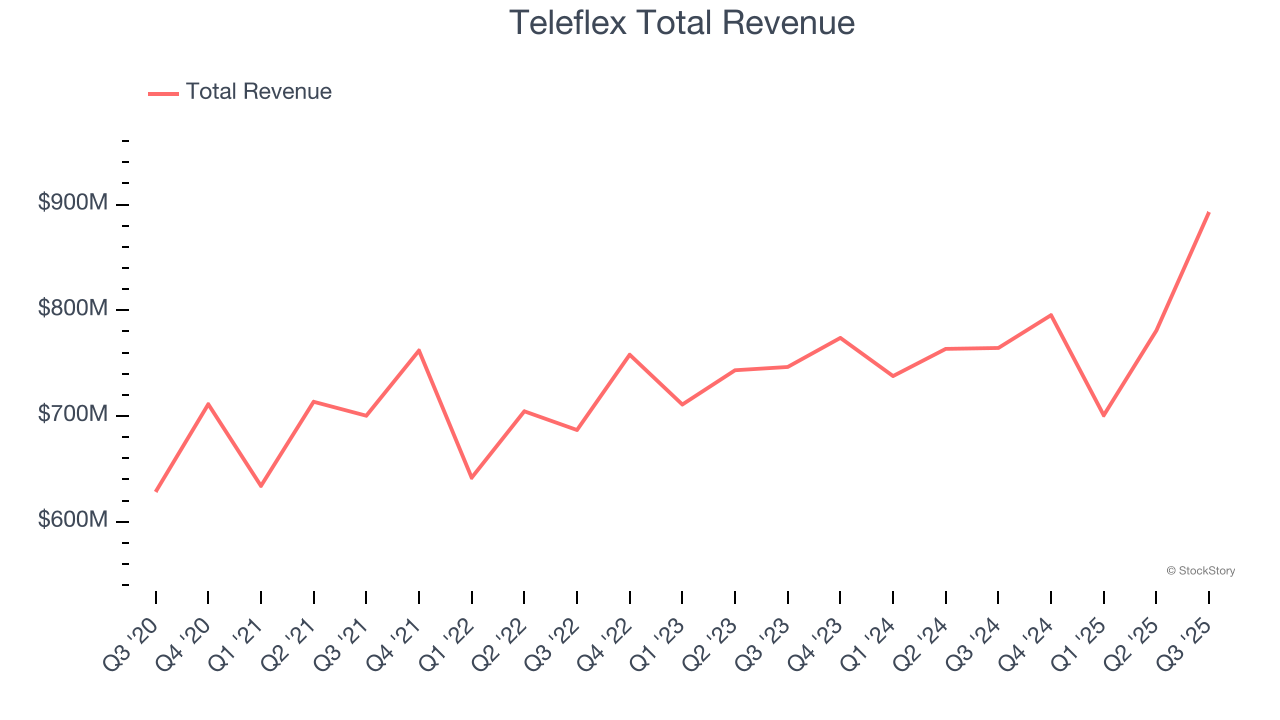

With a portfolio spanning from vascular access catheters to minimally invasive surgical tools, Teleflex (NYSE: TFX) designs, manufactures, and supplies single-use medical devices used in critical care and surgical procedures across hospitals worldwide.

Teleflex reported revenues of $892.9 million, up 16.8% year on year, in line with analysts’ expectations. The business performed better than its peers, but it was unfortunately a mixed quarter with a beat of analysts’ EPS estimates but constant currency revenue in line with analysts’ estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 3.4% since reporting. It currently trades at $120.52.

Is now the time to buy Teleflex? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Integra LifeSciences (NASDAQ: IART)

Founded in 1989 as a pioneer in regenerative medicine technology, Integra LifeSciences (NASDAQ: IART) develops and manufactures medical technologies for neurosurgery, wound care, and surgical reconstruction, including regenerative tissue products and surgical instruments.

Integra LifeSciences reported revenues of $402.1 million, up 5.6% year on year, falling short of analysts’ expectations by 2.9%. It was a softer quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and a significant miss of analysts’ revenue estimates.

Integra LifeSciences delivered the highest full-year guidance raise but had the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 14.3% since the results and currently trades at $13.23.

Read our full analysis of Integra LifeSciences’s results here.

LeMaitre (NASDAQ: LMAT)

Founded in 1983 and named after a pioneering vascular surgeon, LeMaitre Vascular (NASDAQGM:LMAT) develops and manufactures specialized medical devices used by vascular surgeons to treat peripheral vascular disease and other circulatory conditions.

LeMaitre reported revenues of $61.05 million, up 11.4% year on year. This number lagged analysts' expectations by 2%. Taking a step back, it was a mixed quarter as it also logged a beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

LeMaitre had the weakest full-year guidance update among its peers. The stock is down 1.3% since reporting and currently trades at $84.53.

Read our full, actionable report on LeMaitre here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.