Video game retailer GameStop (NYSE: GME) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 4.6% year on year to $821 million. Its non-GAAP profit of $0.24 per share was 20% above analysts’ consensus estimates.

Is now the time to buy GameStop? Find out by accessing our full research report, it’s free for active Edge members.

GameStop (GME) Q3 CY2025 Highlights:

- Revenue: $821 million vs analyst estimates of $987.3 million (4.6% year-on-year decline, 16.8% miss)

- Adjusted EPS: $0.24 vs analyst estimates of $0.20 (20% beat)

- Adjusted EBITDA: $64.4 million (7.8% margin, 675% year-on-year growth)

- Operating Margin: 5%, up from -2.9% in the same quarter last year

- Free Cash Flow Margin: 13%, up from 2.3% in the same quarter last year

- Market Capitalization: $10.46 billion

Company Overview

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE: GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

Note that our analysis is rooted in fundamentals, not meme-stock technicals.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $3.81 billion in revenue over the past 12 months, GameStop is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

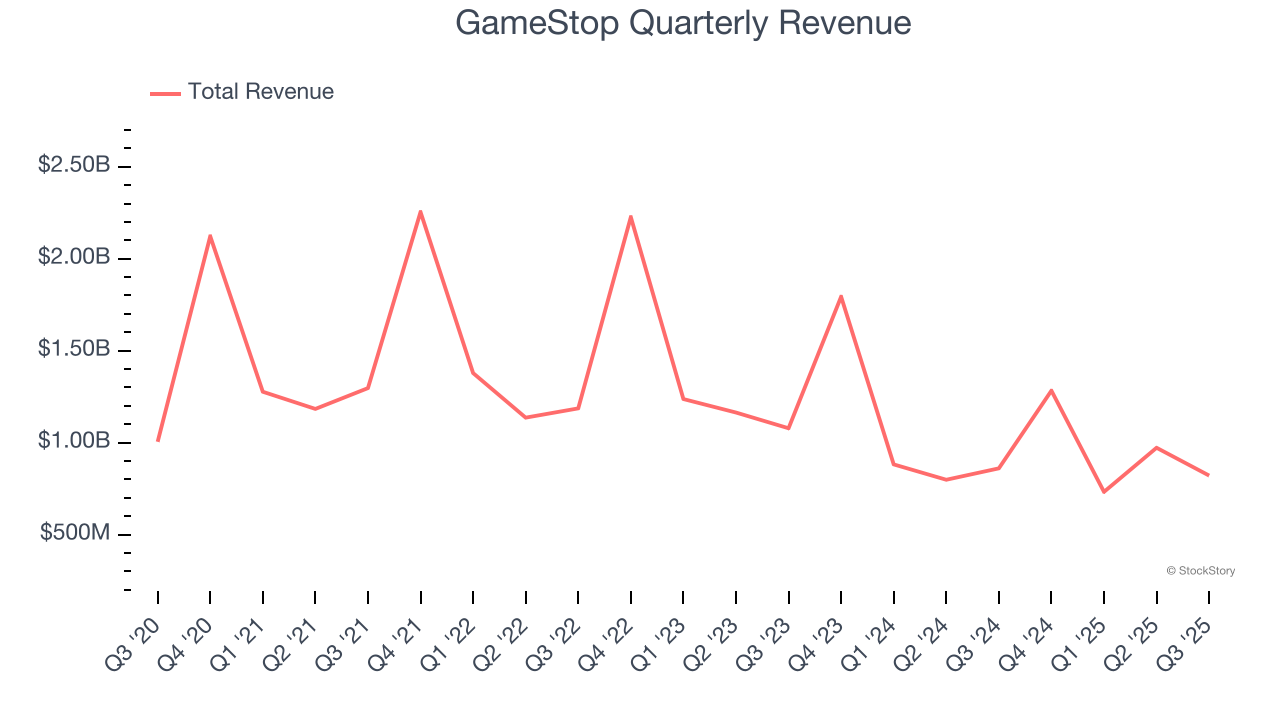

As you can see below, GameStop’s demand was weak over the last three years (we compare to 2019 to normalize for COVID-19 impacts). Its sales fell by 13.8% annually, a poor baseline for our analysis.

This quarter, GameStop missed Wall Street’s estimates and reported a rather uninspiring 4.6% year-on-year revenue decline, generating $821 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 14% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and implies its newer products will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

GameStop has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.4% over the last two years, quite impressive for a consumer retail business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that GameStop’s margin expanded by 16 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

GameStop’s free cash flow clocked in at $107 million in Q3, equivalent to a 13% margin. This result was good as its margin was 10.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from GameStop’s Q3 Results

We liked that gross margin and EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed by a large amount. Overall, this was a mixed quarter. The stock traded down 5.4% to $21.94 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.