The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Hanesbrands (NYSE: HBI) and the rest of the apparel and accessories stocks fared in Q2.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 16 apparel and accessories stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.1% while next quarter’s revenue guidance was 15.4% below.

Thankfully, share prices of the companies have been resilient as they are up 7.8% on average since the latest earnings results.

Hanesbrands (NYSE: HBI)

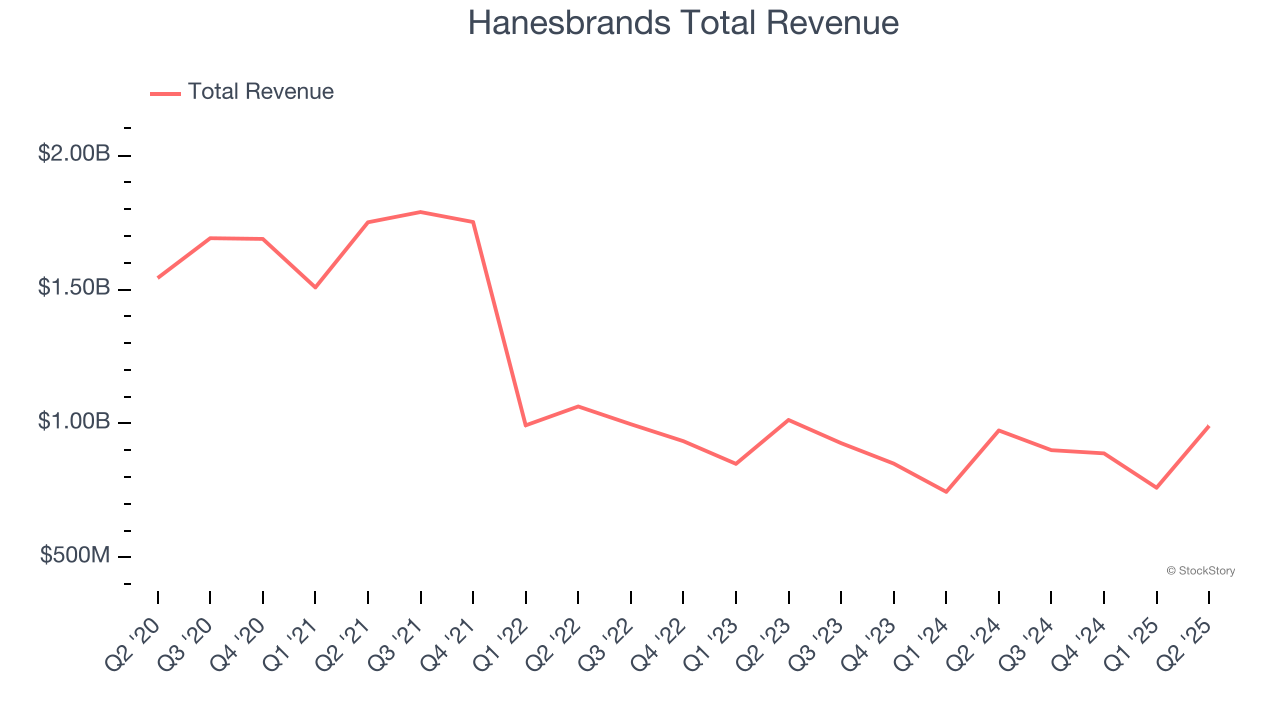

A classic American staple founded in 1901, Hanesbrands (NYSE: HBI) is a clothing company known for its array of basic apparel including innerwear and activewear.

Hanesbrands reported revenues of $991.3 million, up 1.8% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ constant currency revenue estimates and EPS guidance for next quarter exceeding analysts’ expectations.

“For the third consecutive quarter, we delivered revenue, profit and earnings per share growth that exceeded our expectations as we continue to see the benefits of our growth strategy and prior transformation initiatives,” said Steve Bratspies, CEO.

Interestingly, the stock is up 48.9% since reporting and currently trades at $6.21.

Is now the time to buy Hanesbrands? Access our full analysis of the earnings results here, it’s free.

Best Q2: Figs (NYSE: FIGS)

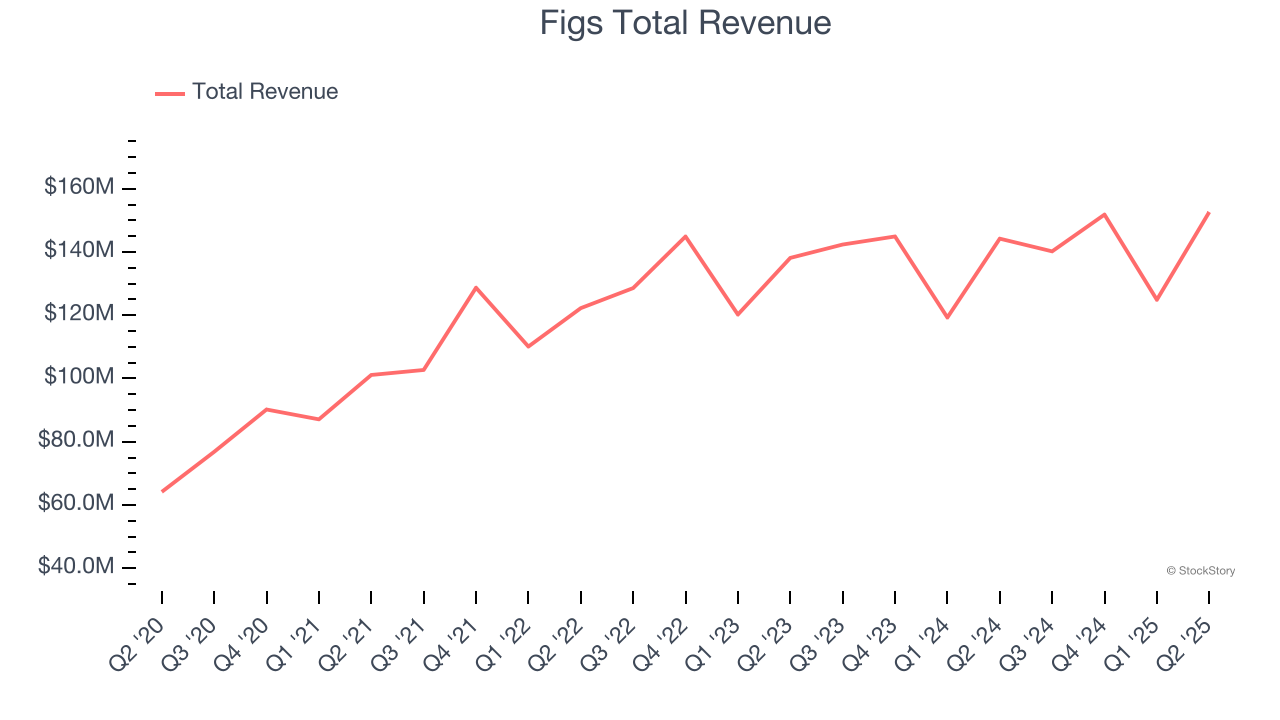

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE: FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $152.6 million, up 5.8% year on year, outperforming analysts’ expectations by 5.5%. The business had a stunning quarter with a solid beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 6.4% since reporting. It currently trades at $6.98.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Carter's (NYSE: CRI)

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE: CRI) is an American designer and marketer of children's apparel.

Carter's reported revenues of $585.3 million, up 3.7% year on year, exceeding analysts’ expectations by 3.4%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 9.5% since the results and currently trades at $29.60.

Read our full analysis of Carter’s results here.

Columbia Sportswear (NASDAQ: COLM)

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ: COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Columbia Sportswear reported revenues of $605.2 million, up 6.1% year on year. This print topped analysts’ expectations by 2.8%. Taking a step back, it was a mixed quarter as it also logged a solid beat of analysts’ constant currency revenue estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is down 1.7% since reporting and currently trades at $55.60.

Read our full, actionable report on Columbia Sportswear here, it’s free.

Kontoor Brands (NYSE: KTB)

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE: KTB) is a clothing company known for its high-quality denim products.

Kontoor Brands reported revenues of $658.3 million, up 8.5% year on year. This result beat analysts’ expectations by 3.7%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ constant currency revenue and EPS estimates.

The stock is up 42.7% since reporting and currently trades at $80.93.

Read our full, actionable report on Kontoor Brands here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.