As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at household products stocks, starting with Colgate-Palmolive (NYSE: CL).

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

The 10 household products stocks we track reported a mixed Q2. As a group, revenues missed analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady as they are up 2.7% on average since the latest earnings results.

Colgate-Palmolive (NYSE: CL)

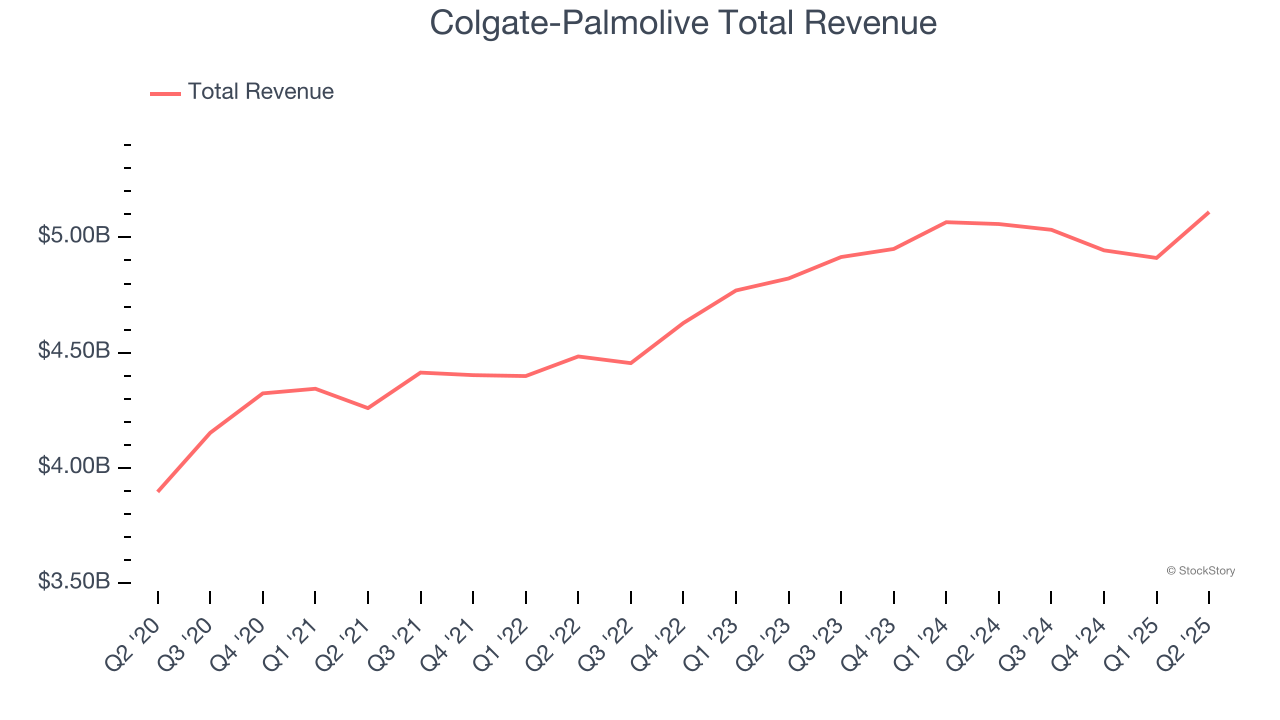

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE: CL) is a consumer products company that focuses on personal, household, and pet products.

Colgate-Palmolive reported revenues of $5.11 billion, up 1% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a satisfactory quarter for the company with a narrow beat of analysts’ EBITDA estimates but gross margin in line with analysts’ estimates.

Colgate-Palmolive Company (NYSE: CL) today reported results for second quarter 2025. Noel Wallace, Chairman, President and Chief Executive Officer, commented on the Base Business second quarter results, “I am pleased that Colgate-Palmolive people achieved another quarter of net sales, organic sales and earnings per share growth in the face of continued difficult market conditions worldwide, with organic sales growth improving sequentially versus the first quarter despite an even greater negative impact from lower private label pet sales.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $84.

Is now the time to buy Colgate-Palmolive? Access our full analysis of the earnings results here, it’s free.

Best Q2: Clorox (NYSE: CLX)

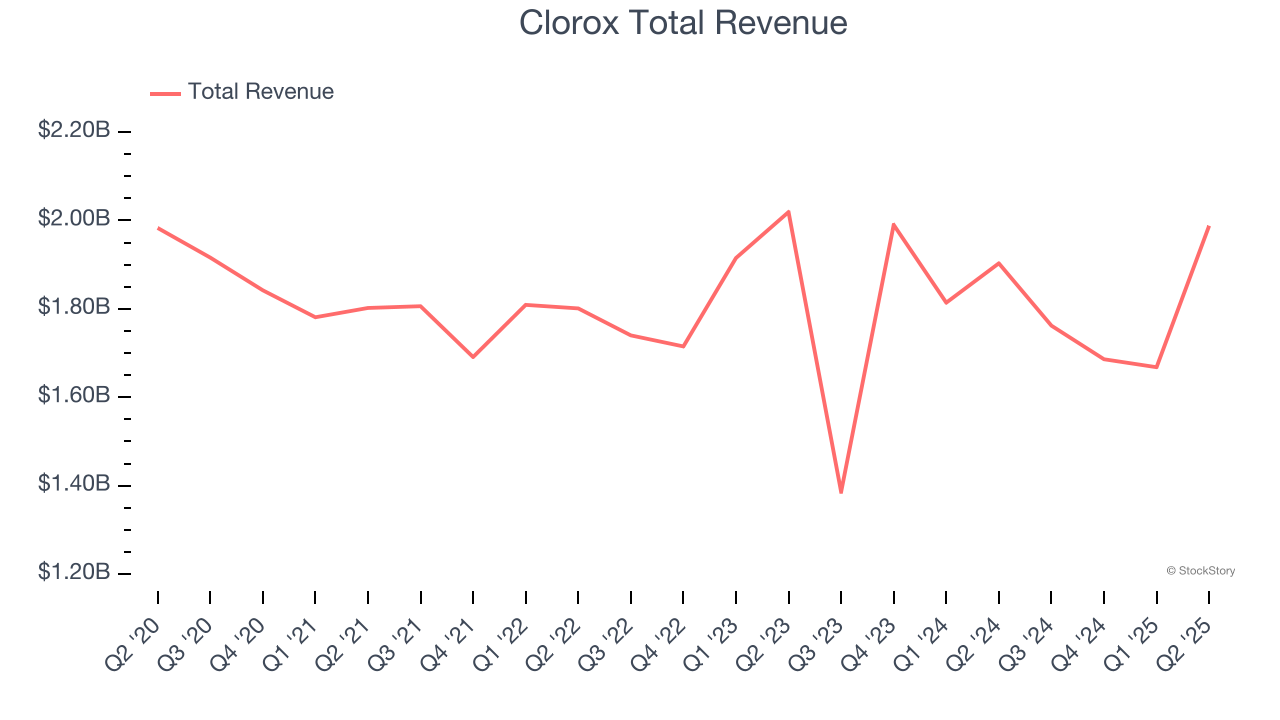

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE: CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Clorox reported revenues of $1.99 billion, up 4.5% year on year, outperforming analysts’ expectations by 3.3%. The business had a very strong quarter with a solid beat of analysts’ EBITDA and organic revenue estimates.

Clorox achieved the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 1.4% since reporting. It currently trades at $123.51.

Is now the time to buy Clorox? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Spectrum Brands (NYSE: SPB)

A leader in multiple consumer product categories, Spectrum Brands (NYSE: SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Spectrum Brands reported revenues of $699.6 million, down 10.2% year on year, falling short of analysts’ expectations by 5.5%. It was a disappointing quarter as it posted a significant miss of analysts’ organic revenue and EBITDA estimates.

Spectrum Brands delivered the slowest revenue growth in the group. The stock is flat since the results and currently trades at $53.36.

Read our full analysis of Spectrum Brands’s results here.

Kimberly-Clark (NASDAQ: KMB)

Originally founded as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE: KMB) is now a household products powerhouse known for personal care and tissue products.

Kimberly-Clark reported revenues of $4.16 billion, down 1.6% year on year. This result came in 9.6% below analysts' expectations. Taking a step back, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but a miss of analysts’ gross margin estimates.

Kimberly-Clark had the weakest performance against analyst estimates among its peers. The stock is up 3.1% since reporting and currently trades at $128.46.

Read our full, actionable report on Kimberly-Clark here, it’s free.

Central Garden & Pet (NASDAQ: CENT)

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ: CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Central Garden & Pet reported revenues of $960.9 million, down 3.6% year on year. This number lagged analysts' expectations by 2.1%. Taking a step back, it was still a satisfactory quarter as it recorded an impressive beat of analysts’ EBITDA estimates.

The stock is down 9.9% since reporting and currently trades at $35.50.

Read our full, actionable report on Central Garden & Pet here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.