What a brutal six months it’s been for CONMED. The stock has dropped 20.6% and now trades at $42.52, rattling many shareholders. This may have investors wondering how to approach the situation.

Is there a buying opportunity in CONMED, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is CONMED Not Exciting?

Even with the cheaper entry price, we don't have much confidence in CONMED. Here are three reasons you should be careful with CNMD and a stock we'd rather own.

1. Lackluster Revenue Growth

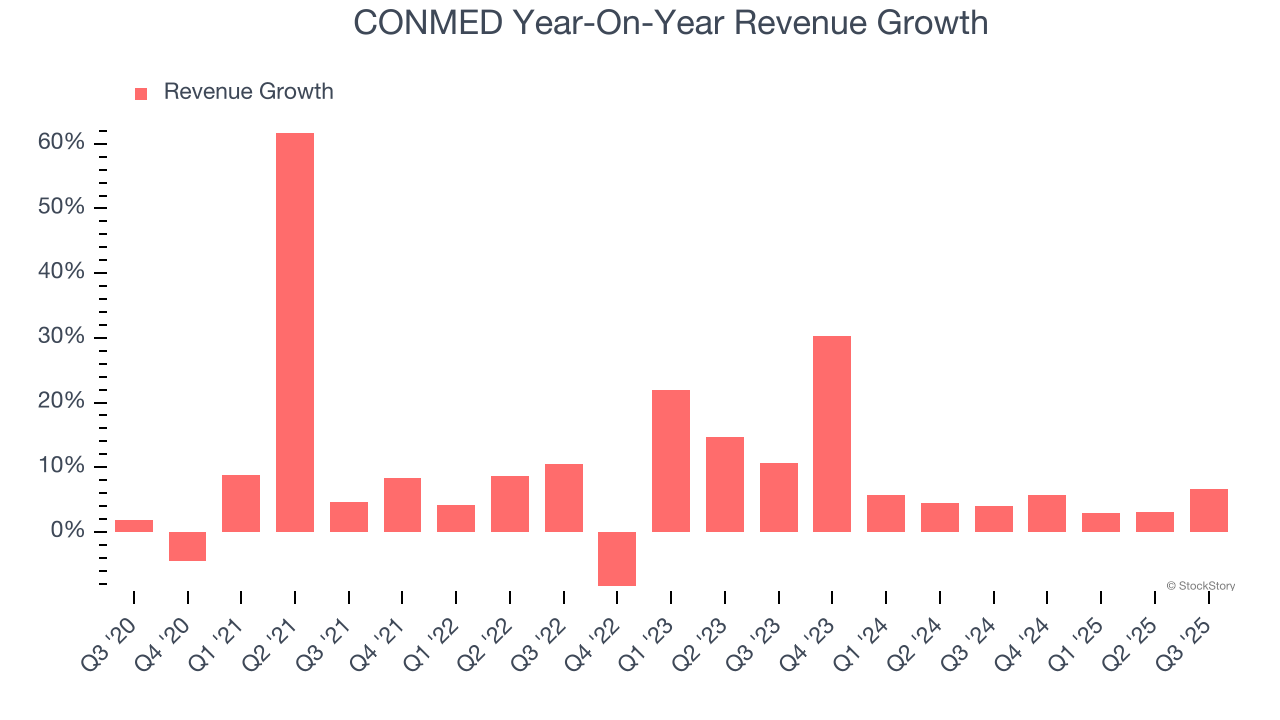

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. CONMED’s recent performance shows its demand has slowed as its annualized revenue growth of 7.4% over the last two years was below its five-year trend.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.35 billion in revenue over the past 12 months, CONMED is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect CONMED’s revenue to rise by 1.8%, a deceleration versus its 9% annualized growth for the past five years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Final Judgment

CONMED isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 10.1× forward P/E (or $42.52 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.