Over the past six months, Wyndham’s shares (currently trading at $81.11) have posted a disappointing 10.5% loss, well below the S&P 500’s 10.4% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Wyndham, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Wyndham Will Underperform?

Even though the stock has become cheaper, we don't have much confidence in Wyndham. Here are three reasons we avoid WH and a stock we'd rather own.

1. Weak RevPAR Growth Points to Soft Demand

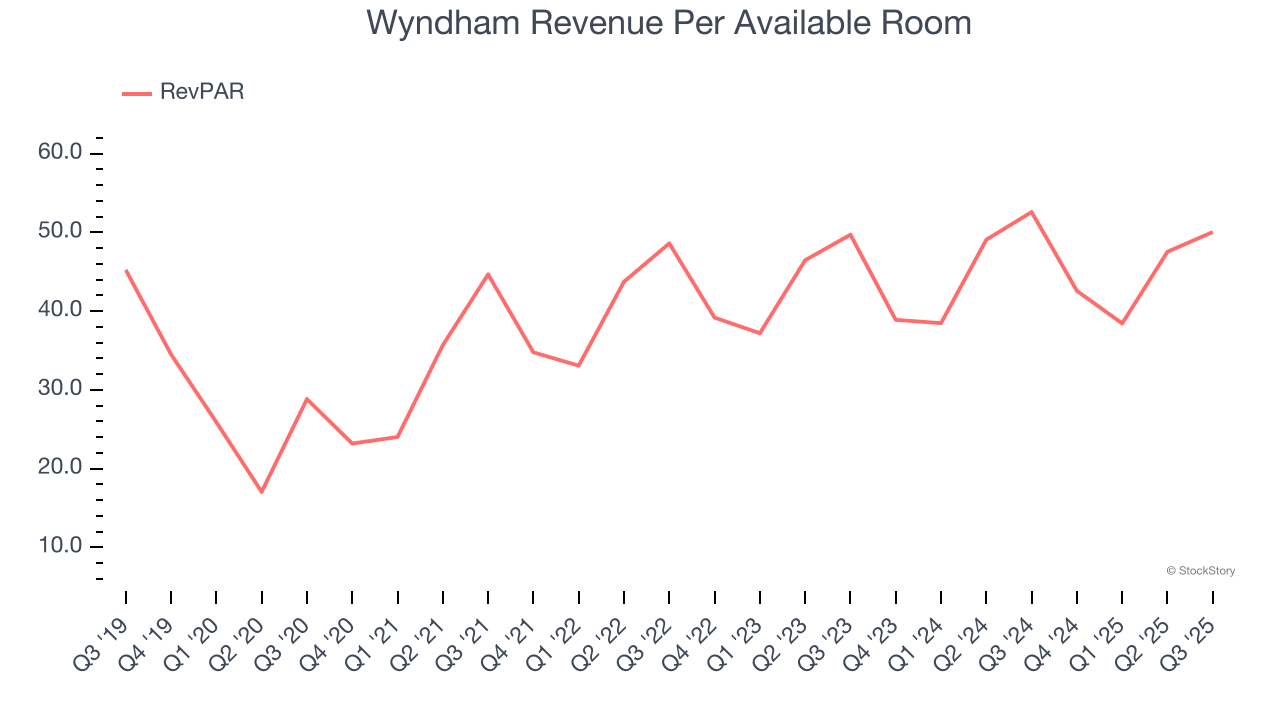

We can better understand Travel and Vacation Providers companies by analyzing their RevPAR, or revenue per available room. This metric accounts for daily rates and occupancy levels, painting a holistic picture of Wyndham’s demand characteristics.

Wyndham’s RevPAR came in at $50.05 in the latest quarter, and over the last two years, its year-on-year growth averaged 1.9%. This performance was underwhelming and suggests it might have to invest in new amenities such as restaurants and bars to attract customers - this isn’t ideal because expansions can complicate operations and be quite expensive (i.e., renovations and increased overhead).

2. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Wyndham historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 12%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Wyndham’s ROIC averaged 2 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Wyndham doesn’t pass our quality test. After the recent drawdown, the stock trades at 16.8× forward P/E (or $81.11 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Wyndham

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.