Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at AppLovin (NASDAQ: APP) and the best and worst performers in the advertising software industry.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 6 advertising software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was 1.1% below.

Thankfully, share prices of the companies have been resilient as they are up 7.9% on average since the latest earnings results.

Best Q3: AppLovin (NASDAQ: APP)

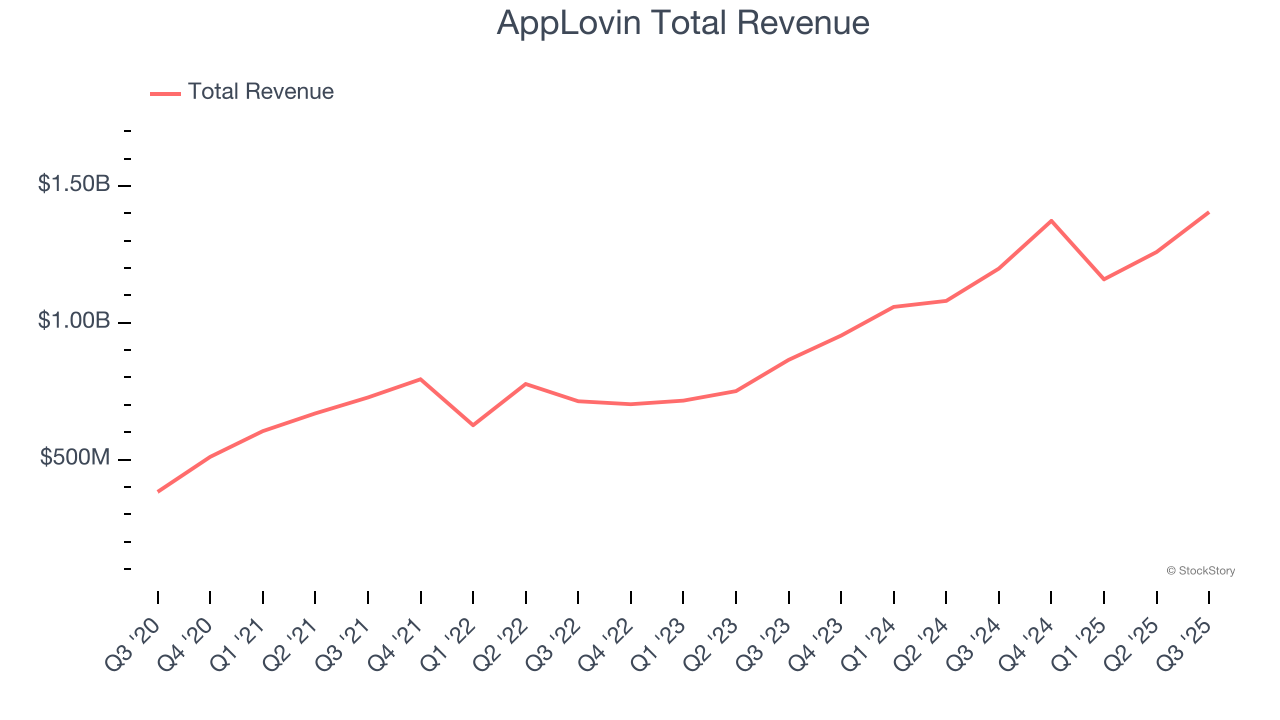

Sitting at the crossroads of the mobile advertising ecosystem with over 200 free-to-play games in its portfolio, AppLovin (NASDAQ: APP) provides software solutions that help mobile app developers market, monetize, and grow their apps through AI-powered advertising and analytics tools.

AppLovin reported revenues of $1.41 billion, up 17.3% year on year. This print exceeded analysts’ expectations by 4.5%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

Interestingly, the stock is up 6.1% since reporting and currently trades at $648.25.

Zeta Global (NYSE: ZETA)

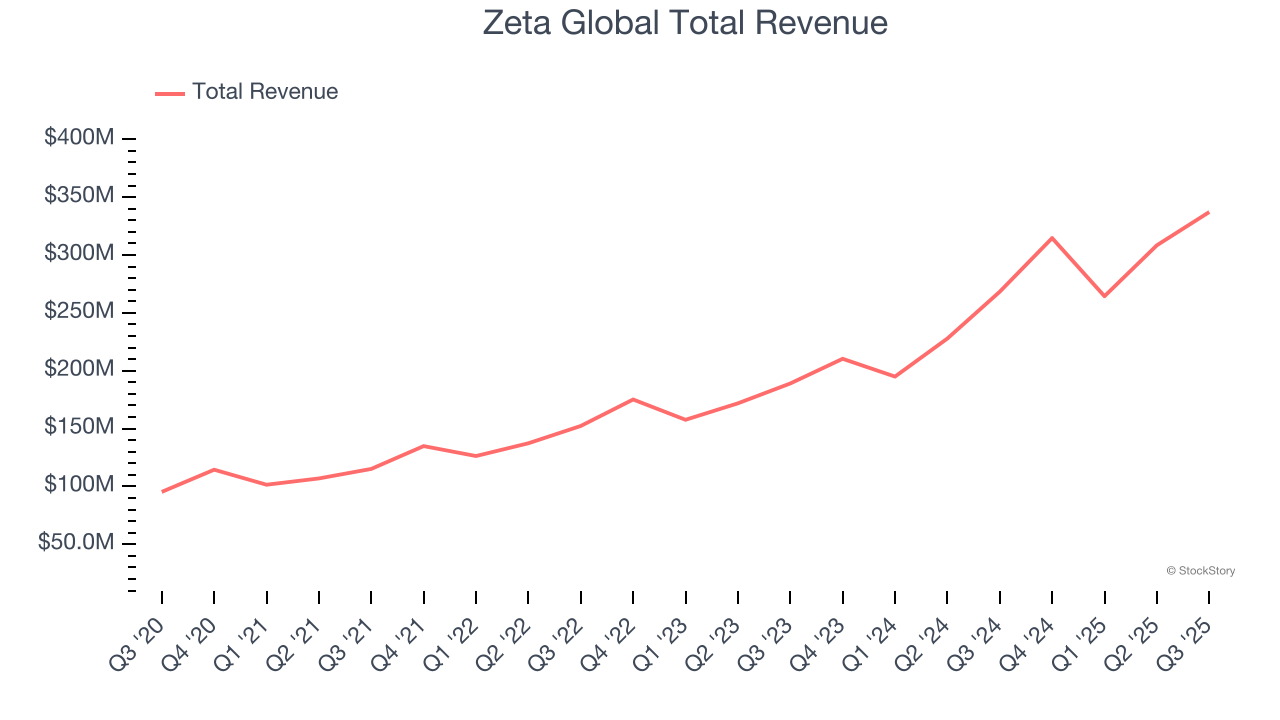

Powered by an AI engine that processes over one trillion consumer signals monthly, Zeta Global (NYSE: ZETA) operates a data-driven cloud platform that helps companies target, connect, and engage with consumers through personalized marketing across channels like email, social media, and video.

Zeta Global reported revenues of $337.2 million, up 25.7% year on year, outperforming analysts’ expectations by 2.7%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Zeta Global delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 47% since reporting. It currently trades at $24.65.

Is now the time to buy Zeta Global? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: DoubleVerify (NYSE: DV)

Using advanced analytics to evaluate over 17 billion digital ad transactions daily, DoubleVerify (NYSE: DV) provides AI-powered technology that verifies digital ads are viewable, fraud-free, brand-suitable, and displayed in the intended geographic location.

DoubleVerify reported revenues of $188.6 million, up 11.2% year on year, falling short of analysts’ expectations by 0.8%. It was a slower quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations and a slight miss of analysts’ revenue estimates.

DoubleVerify delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 1.4% since the results and currently trades at $11.12.

Read our full analysis of DoubleVerify’s results here.

The Trade Desk (NASDAQ: TTD)

Built as an alternative to "walled garden" advertising ecosystems, The Trade Desk (NASDAQ: TTD) provides a cloud-based platform that helps advertisers and agencies plan, manage, and optimize digital advertising campaigns across multiple channels and devices.

The Trade Desk reported revenues of $739.4 million, up 17.7% year on year. This result topped analysts’ expectations by 2.8%. It was a very strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and EBITDA guidance for next quarter topping analysts’ expectations.

The stock is down 19% since reporting and currently trades at $37.28.

Read our full, actionable report on The Trade Desk here, it’s free.

PubMatic (NASDAQ: PUBM)

Powering billions of daily ad impressions across the open internet, PubMatic (NASDAQ: PUBM) operates a technology platform that helps publishers maximize revenue from their digital advertising inventory while giving advertisers more control and transparency.

PubMatic reported revenues of $67.96 million, down 5.3% year on year. This print surpassed analysts’ expectations by 6.1%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

PubMatic scored the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 9.6% since reporting and currently trades at $8.39.

Read our full, actionable report on PubMatic here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.