Hamilton Lane currently trades at $149.30 per share and has shown little upside over the past six months, posting a small loss of 0.7%. The stock also fell short of the S&P 500’s 11.1% gain during that period.

Is now the time to buy HLNE? Find out in our full research report, it’s free.

Why Are We Positive On Hamilton Lane?

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ: HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

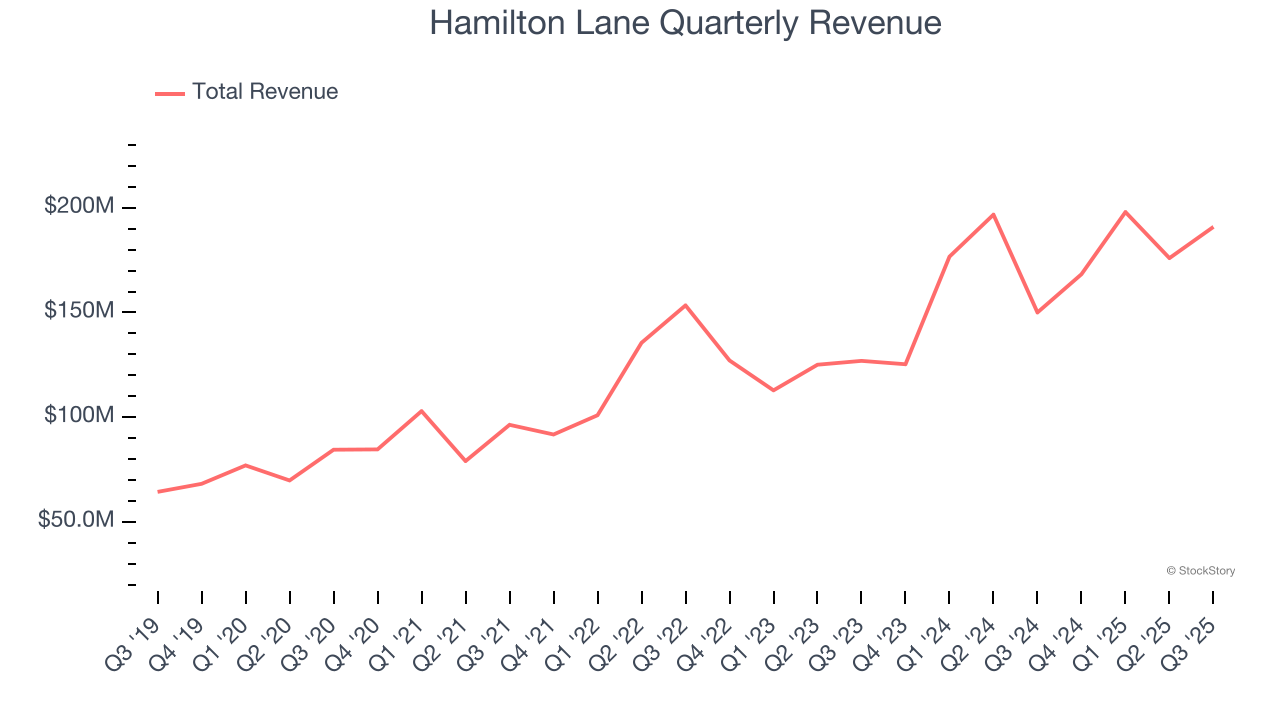

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

Luckily, Hamilton Lane’s revenue grew at an excellent 19.6% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers.

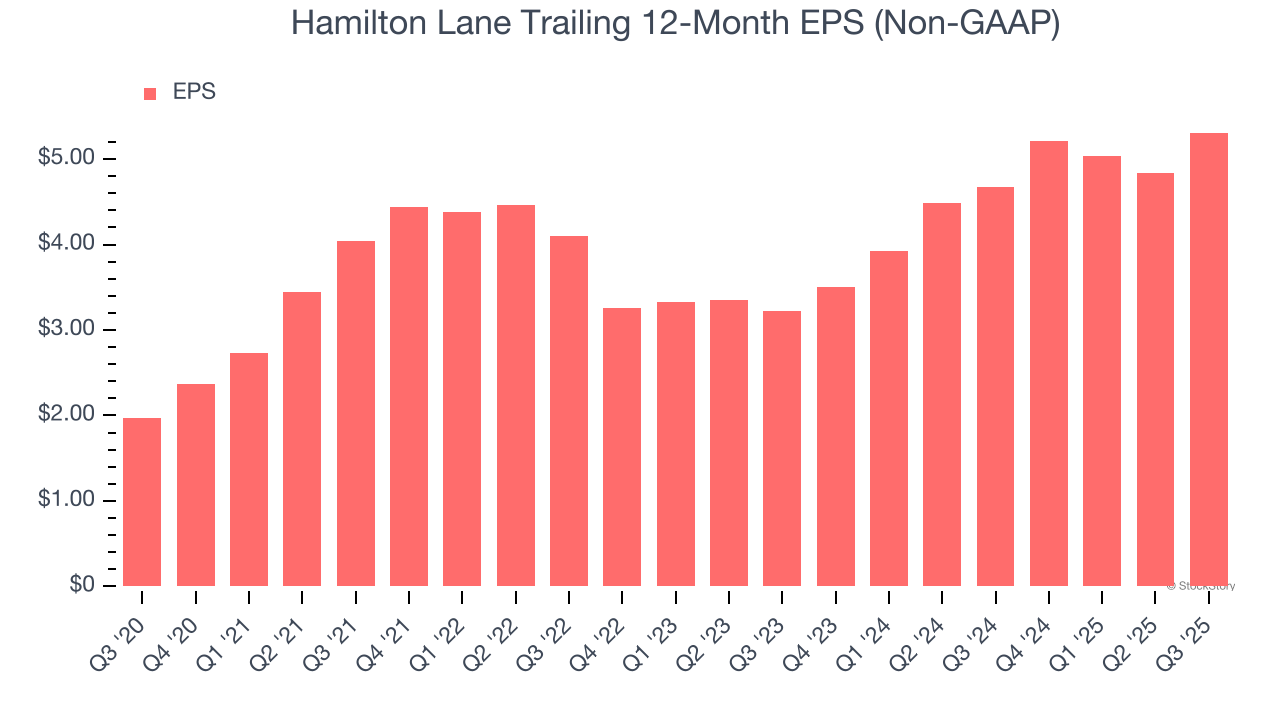

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Hamilton Lane’s EPS grew at a spectacular 21.9% compounded annual growth rate over the last five years, higher than its 19.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

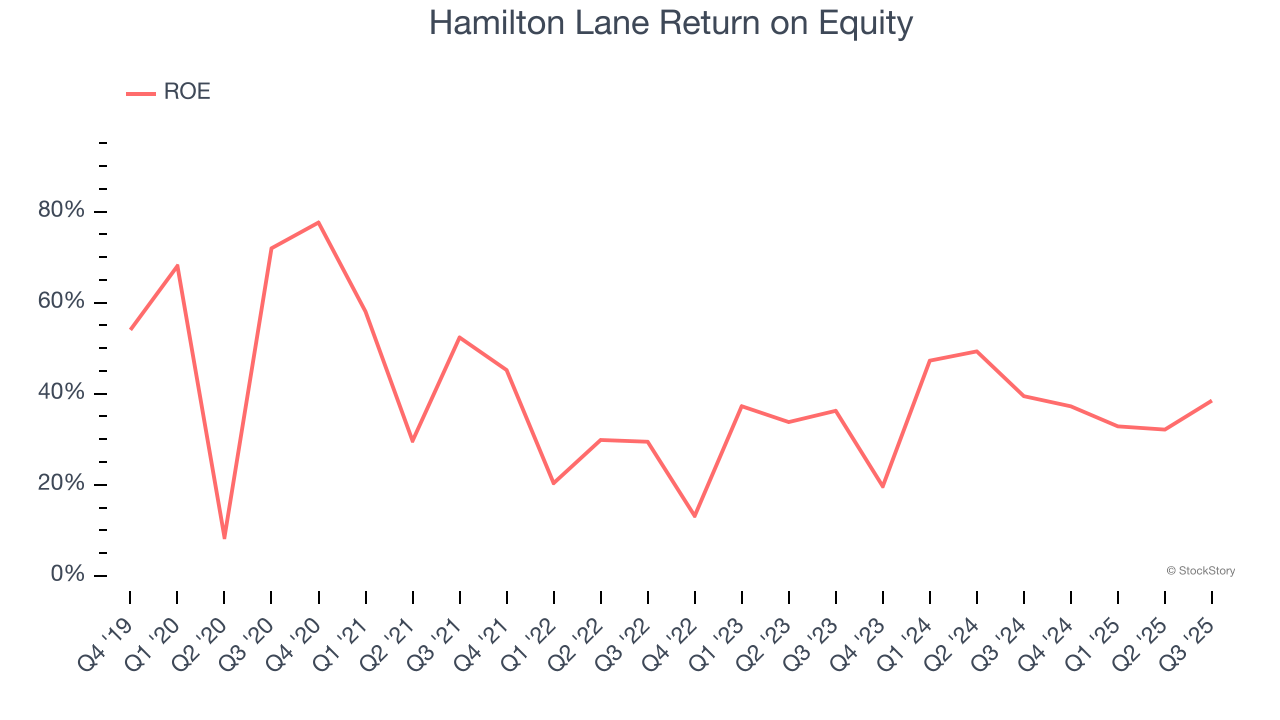

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Hamilton Lane has averaged an ROE of 38%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Hamilton Lane has a strong competitive moat.

Final Judgment

These are just a few reasons why we think Hamilton Lane is one of the best financials companies out there. With its shares lagging the market recently, the stock trades at 26.1× forward P/E (or $149.30 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Hamilton Lane

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.