Ibotta’s stock price has taken a beating over the past six months, shedding 37.8% of its value and falling to $22.96 per share. This may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy IBTA? Find out in our full research report, it’s free.

Why Does IBTA Stock Spark Debate?

Originally launched as a way to make grocery shopping more rewarding for budget-conscious consumers, Ibotta (NYSE: IBTA) is a mobile shopping app that allows consumers to earn cash back on everyday purchases by completing tasks and submitting receipts.

Two Positive Attributes:

1. Growth in Total Redemptions Shows Increasing Demand

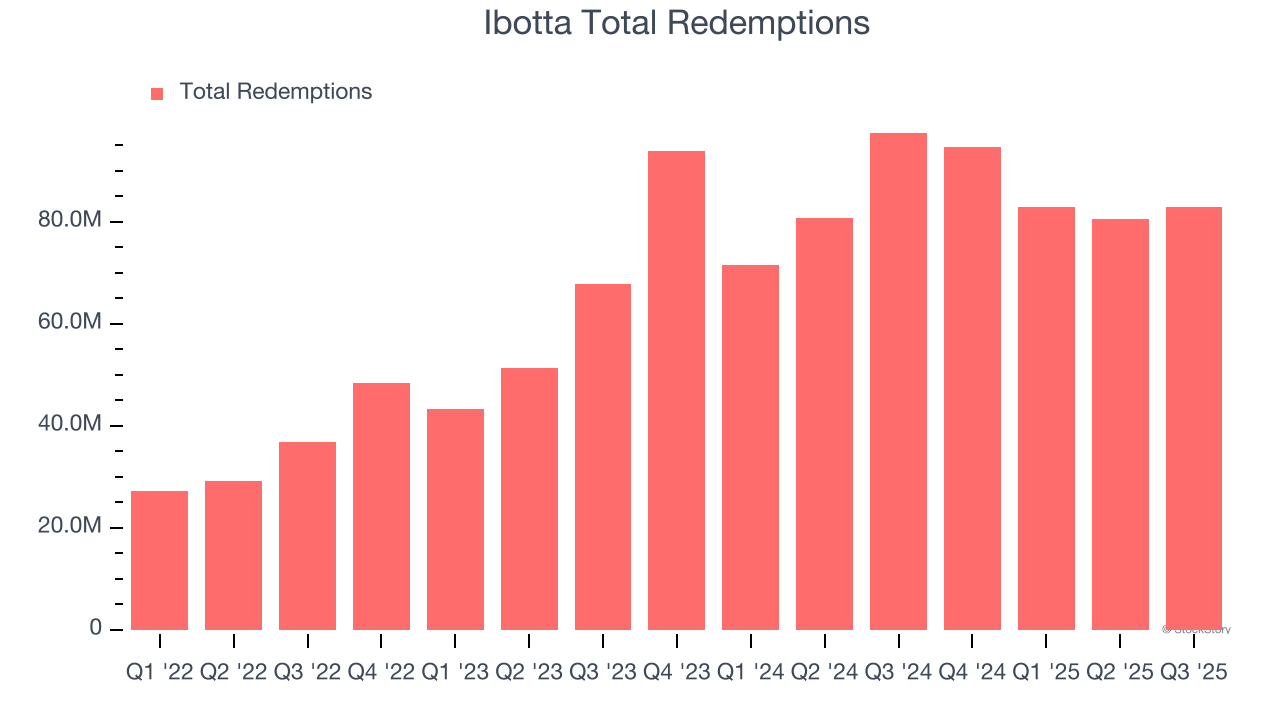

Revenue growth can be broken down into changes in price and volume (for companies like Ibotta, our preferred volume metric is total redemptions). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Ibotta’s total redemptions punched in at 82.85 million in the latest quarter, and over the last two years, averaged 32.7% year-on-year growth. This performance was fantastic and shows its services have a unique value proposition.

2. Increasing Free Cash Flow Margin Juices Financials

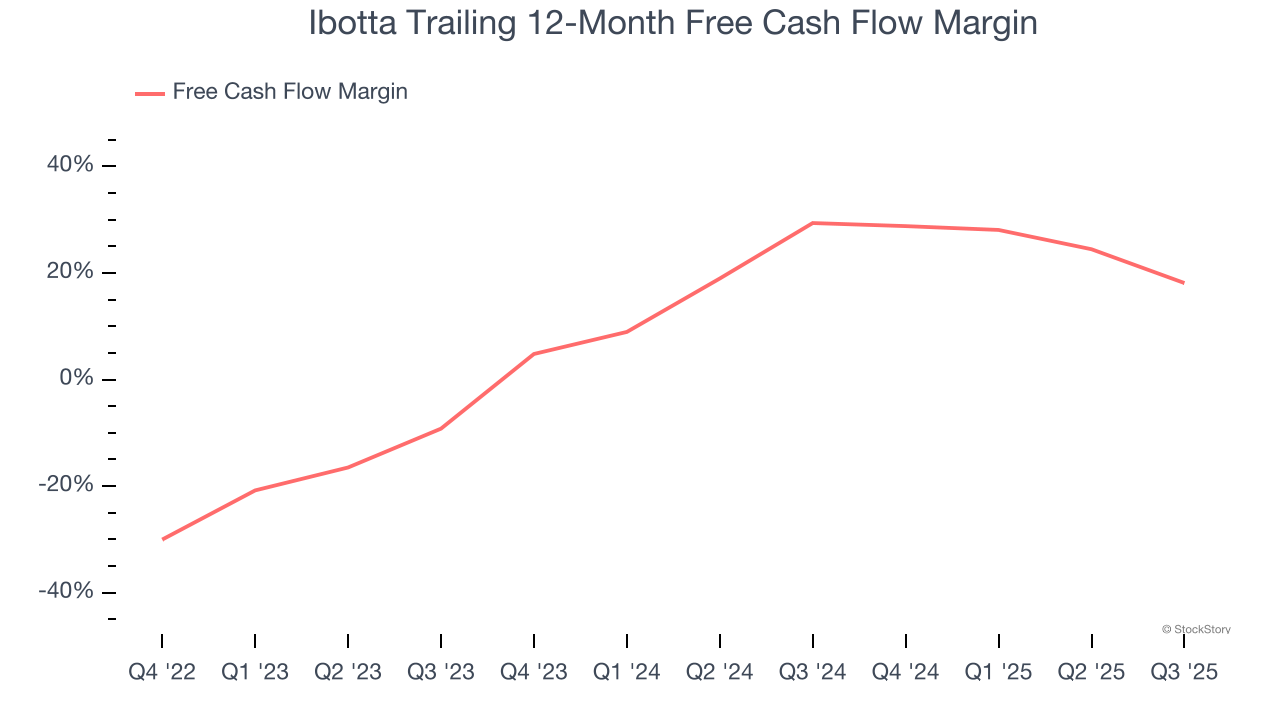

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Ibotta’s margin expanded by 48.6 percentage points over the last four years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Ibotta’s free cash flow margin for the trailing 12 months was 18.1%.

One Reason to be Careful:

Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Ibotta’s revenue to drop by 9.7%, a decrease from This projection doesn't excite us and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Final Judgment

Ibotta’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 18.6× forward P/E (or $22.96 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.