Over the past six months, Broadridge’s stock price fell to $219.37. Shareholders have lost 6.6% of their capital, which is disappointing considering the S&P 500 has climbed by 10.6%. This may have investors wondering how to approach the situation.

Given the weaker price action, is now the time to buy BR? Find out in our full research report, it’s free.

Why Does BR Stock Spark Debate?

Processing over $10 trillion in equity and fixed income trades daily and managing proxy voting for over 800 million equity positions, Broadridge Financial Solutions (NYSE: BR) provides technology-driven solutions that power investing, governance, and communications for banks, broker-dealers, asset managers, and public companies.

Two Positive Attributes:

1. Long-Term Revenue Growth Shows Strong Momentum

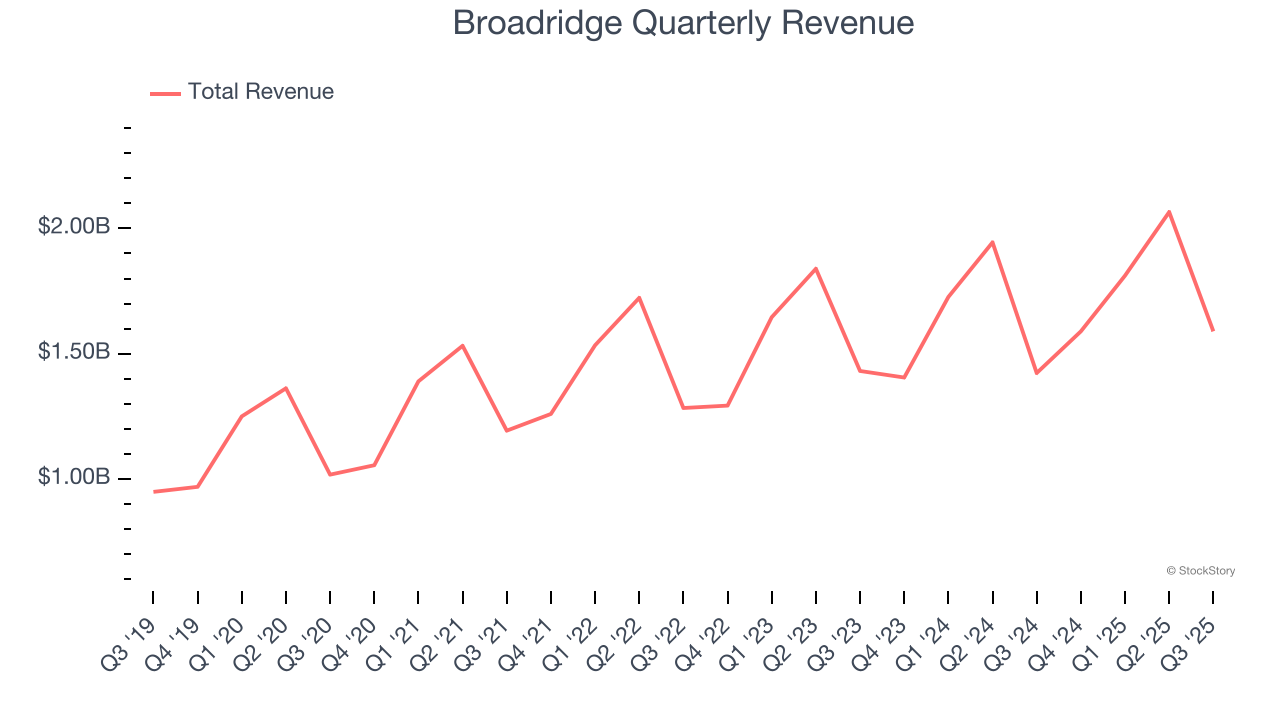

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Broadridge’s sales grew at a solid 8.9% compounded annual growth rate over the last five years. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Increasing Free Cash Flow Margin Juices Financials

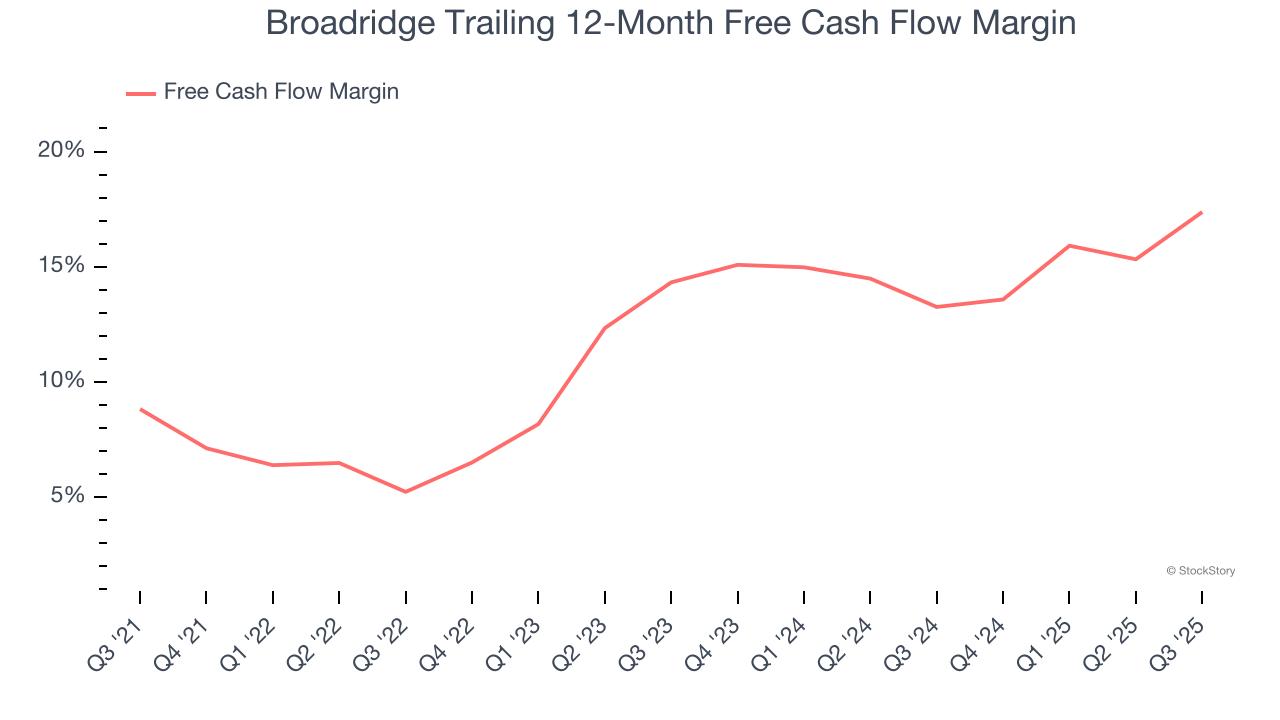

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Broadridge’s margin expanded by 8.6 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Broadridge’s free cash flow margin for the trailing 12 months was 17.4%.

One Reason to be Careful:

Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Broadridge’s revenue to rise by 3.6%, a deceleration versus its 8.9% annualized growth for the past five years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Final Judgment

Broadridge has huge potential even though it has some open questions. With the recent decline, the stock trades at 23.5× forward P/E (or $219.37 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.