What a time it’s been for American Eagle. In the past six months alone, the company’s stock price has increased by a massive 164%, reaching $25.96 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in American Eagle, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is American Eagle Not Exciting?

We’re glad investors have benefited from the price increase, but we don't have much confidence in American Eagle. Here are three reasons there are better opportunities than AEO and a stock we'd rather own.

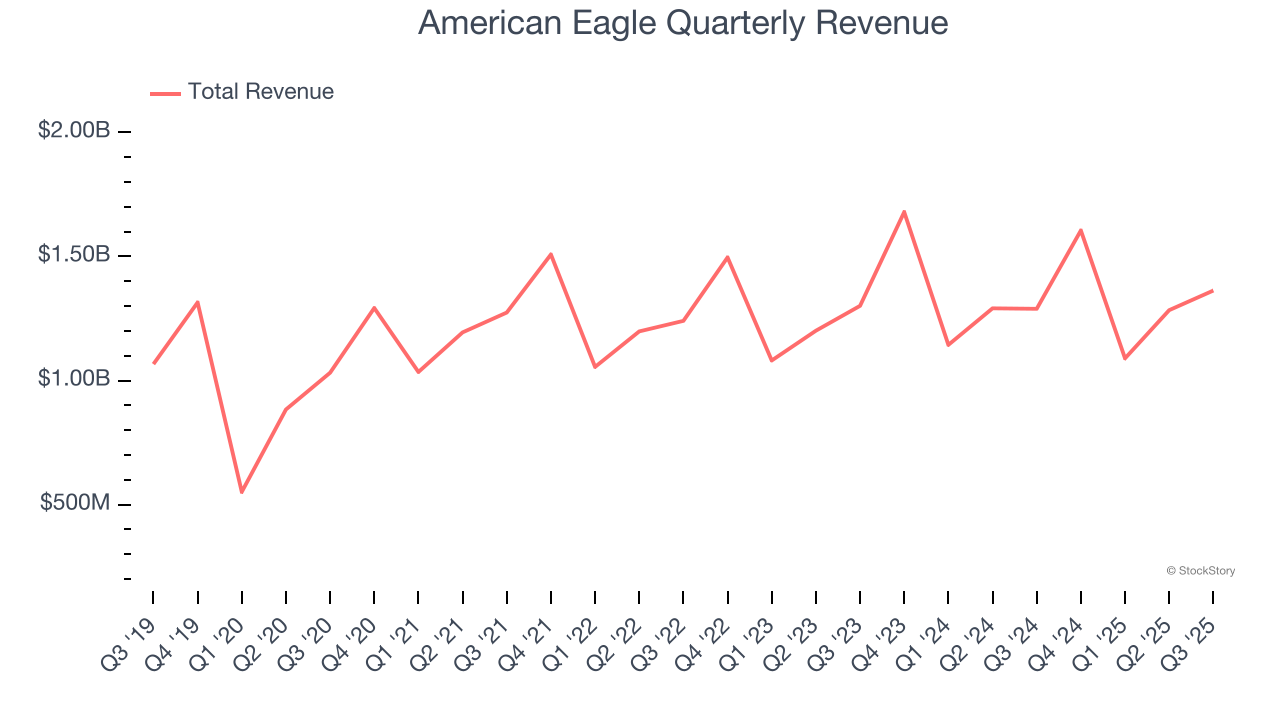

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, American Eagle grew its sales at a sluggish 2.2% compounded annual growth rate. This was below our standards.

2. Lack of New Stores, a Headwind for Revenue

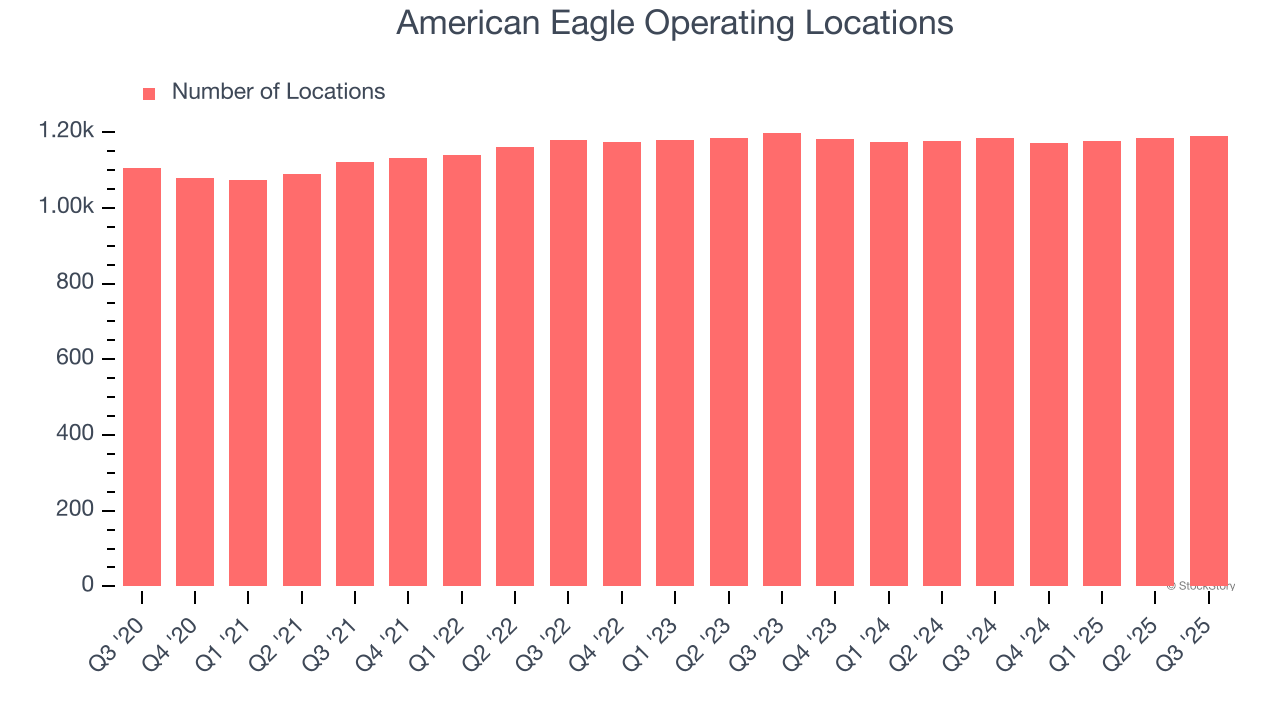

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

American Eagle operated 1,190 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

American Eagle historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

Final Judgment

American Eagle isn’t a terrible business, but it doesn’t pass our bar. After the recent surge, the stock trades at 15.6× forward P/E (or $25.96 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of American Eagle

Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.