Procore Technologies currently trades at $70.90 per share and has shown little upside over the past six months, posting a small loss of 1.5%. The stock also fell short of the S&P 500’s 10.6% gain during that period.

Is there a buying opportunity in Procore Technologies, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Procore Technologies Not Exciting?

We're swiping left on Procore Technologies for now. Here are three reasons we avoid PCOR and a stock we'd rather own.

1. Weak Billings Point to Soft Demand

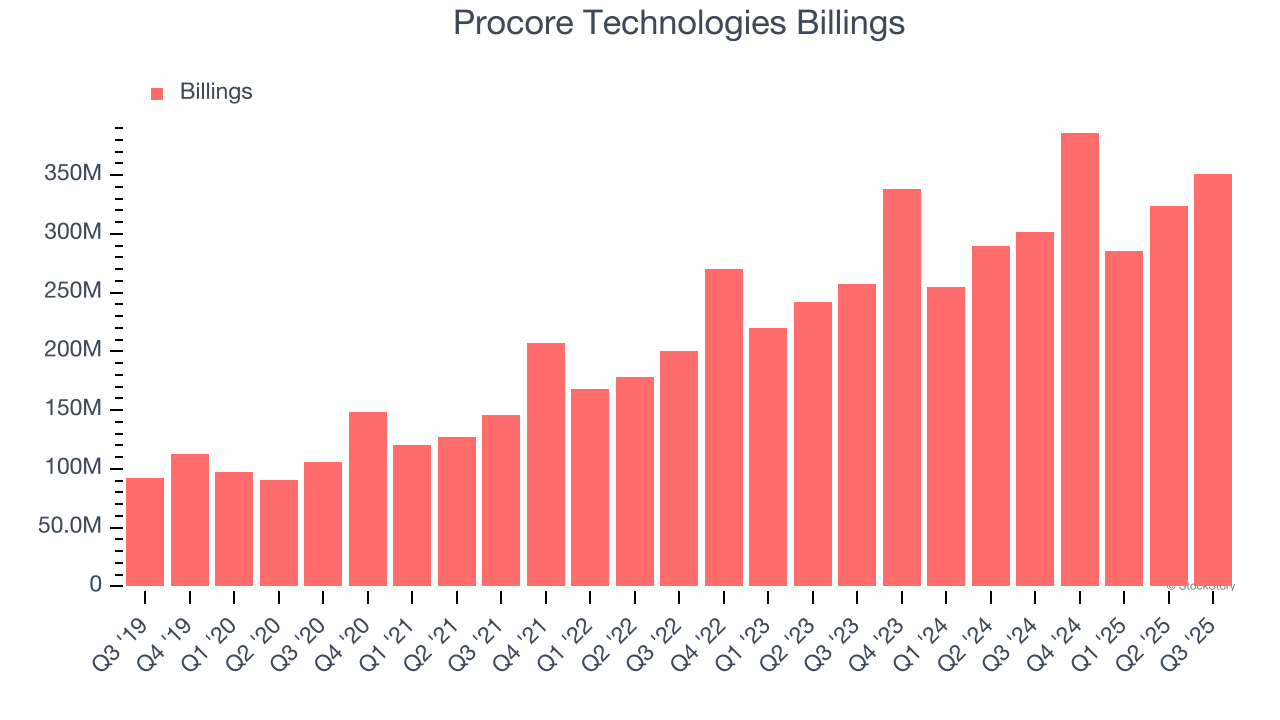

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Procore Technologies’s billings came in at $351.3 million in Q3, and over the last four quarters, its year-on-year growth averaged 13.6%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in acquiring/retaining customers.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Procore Technologies’s revenue to rise by 12%, a deceleration versus its 27.7% annualized growth for the past five years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

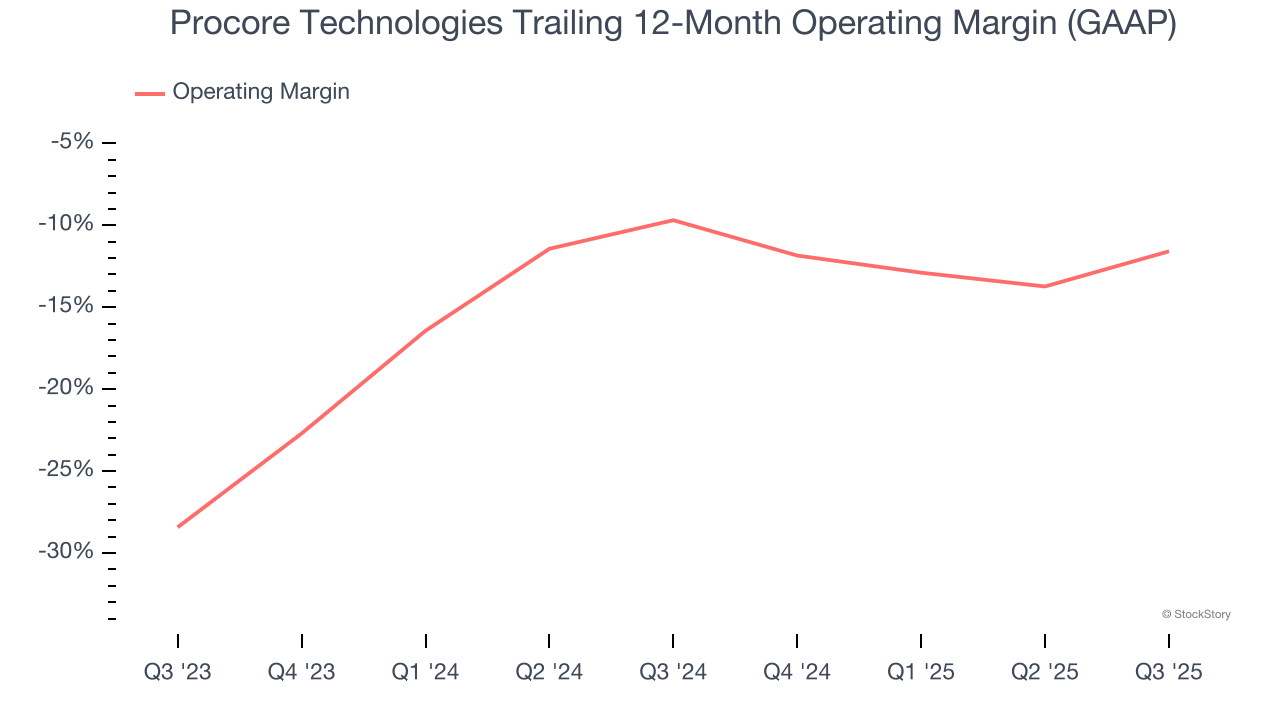

3. Shrinking Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Looking at the trend in its profitability, Procore Technologies’s operating margin decreased by 1.9 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Procore Technologies’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was negative 11.6%.

Final Judgment

Procore Technologies isn’t a terrible business, but it isn’t one of our picks. With its shares underperforming the market lately, the stock trades at 7.6× forward price-to-sales (or $70.90 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Procore Technologies

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.