CNA Financial trades at $46.42 and has moved in lockstep with the market. Its shares have returned 6.1% over the last six months while the S&P 500 has gained 10.6%.

Is now the time to buy CNA Financial, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think CNA Financial Will Underperform?

We're cautious about CNA Financial. Here are three reasons we avoid CNA and a stock we'd rather own.

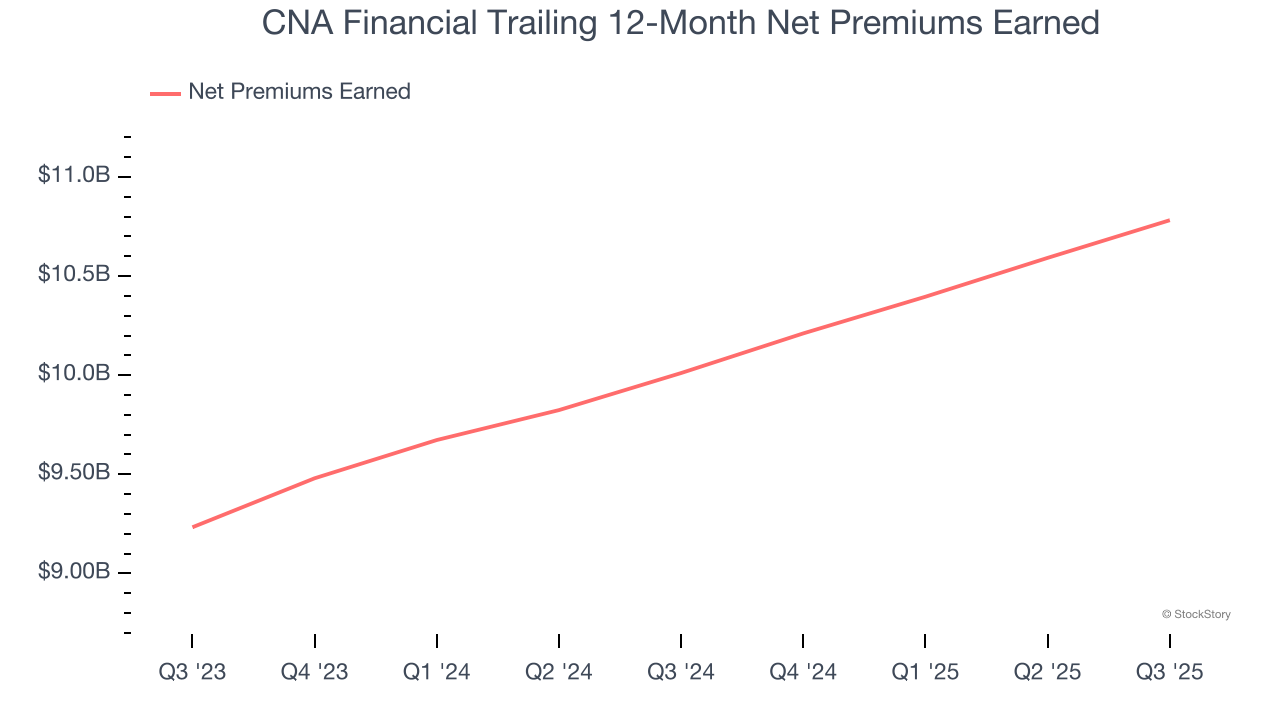

1. Net Premiums Earned Point to Soft Demand

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

CNA Financial’s net premiums earned has grown at a 7.3% annualized rate over the last five years, slightly worse than the broader insurance industry and in line with its total revenue.

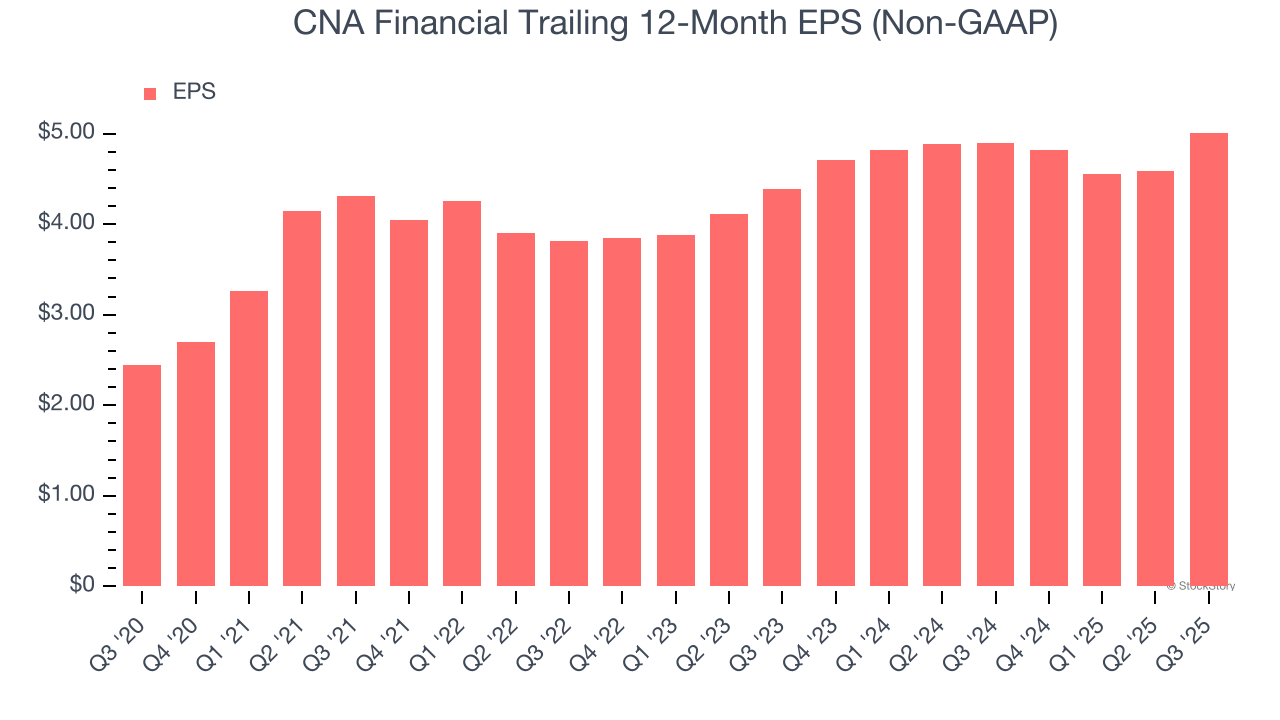

2. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

CNA Financial’s weak 6.8% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

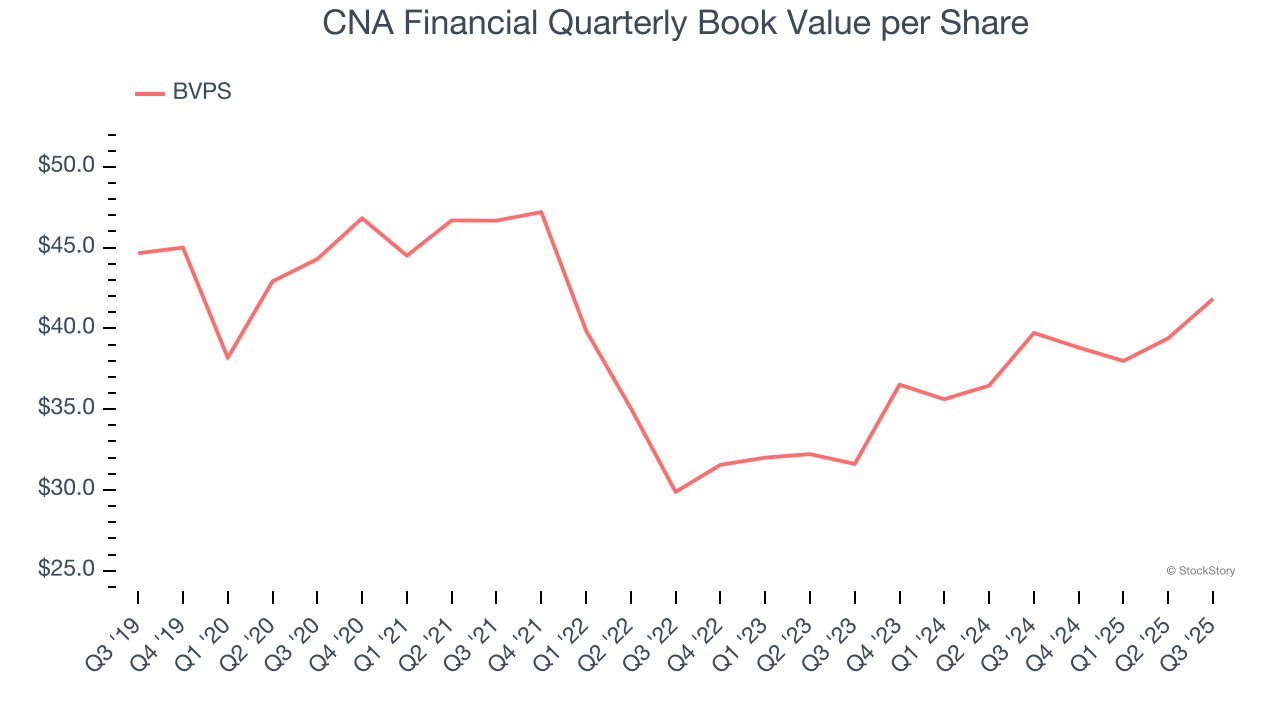

3. Steady Increase in BVPS Highlights Solid Asset Growth

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Although CNA Financial’s BVPS declined at a 1.1% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as BVPS grew at a solid 15% annual clip (from $31.61 to $41.83 per share).

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of CNA Financial, we’ll be cheering from the sidelines. That said, the stock currently trades at 9.7× forward P/E (or $46.42 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than CNA Financial

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.