The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Clean Harbors (NYSE: CLH) and the rest of the waste management stocks fared in Q3.

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 9 waste management stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 2.6%.

Luckily, waste management stocks have performed well with share prices up 15.4% on average since the latest earnings results.

Weakest Q3: Clean Harbors (NYSE: CLH)

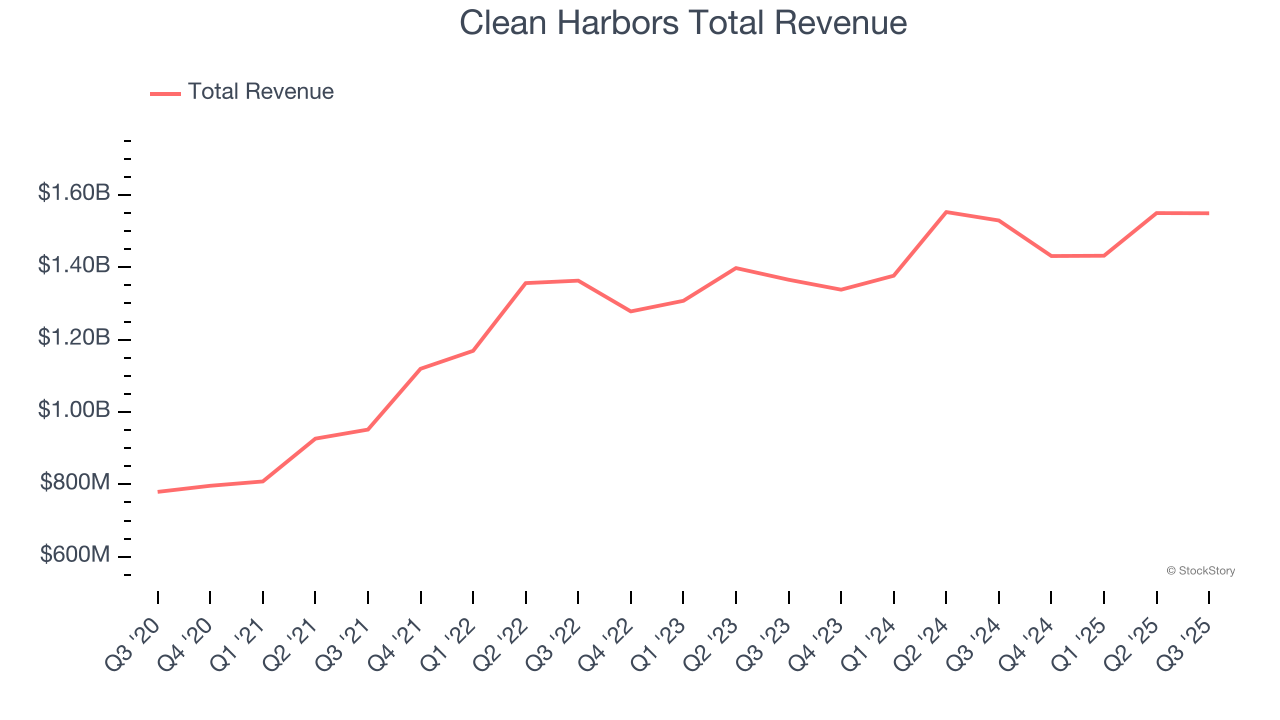

Established in 1980, Clean Harbors (NYSE: CLH) provides environmental and industrial services like hazardous and non-hazardous waste disposal and emergency spill cleanups.

Clean Harbors reported revenues of $1.55 billion, up 1.3% year on year. This print fell short of analysts’ expectations by 1.6%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income and EPS estimates.

“Our third-quarter performance reflected continued growth in our Technical Services and Safety-Kleen Environmental Services revenues,” said Eric Gerstenberg, Co-Chief Executive Officer.

Clean Harbors delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 8.5% since reporting and currently trades at $267.02.

Read our full report on Clean Harbors here, it’s free.

Best Q3: Perma-Fix (NASDAQ: PESI)

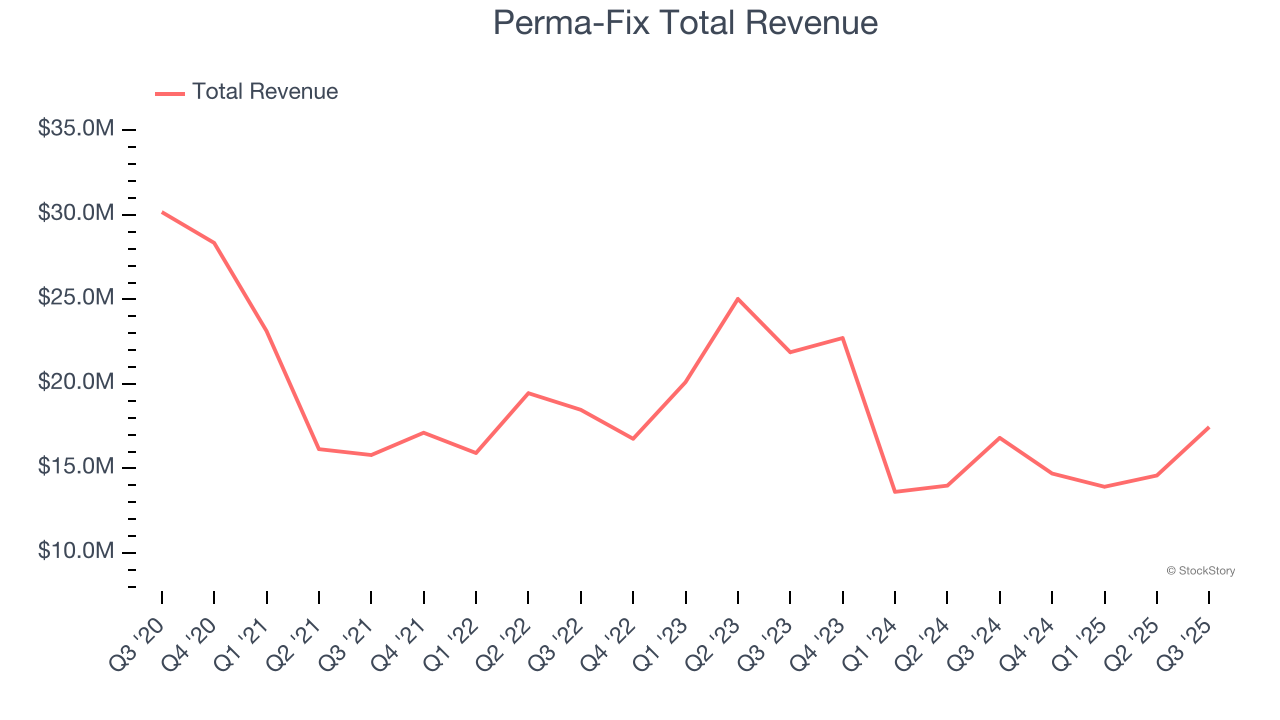

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ: PESI) provides environmental waste treatment services.

Perma-Fix reported revenues of $17.45 million, up 3.8% year on year, outperforming analysts’ expectations by 7.1%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 13.8% since reporting. It currently trades at $14.64.

Is now the time to buy Perma-Fix? Access our full analysis of the earnings results here, it’s free.

Enviri (NYSE: NVRI)

Cooling America’s first indoor ice rink in the 19th century, Enviri (NYSE: NVRI) offers steel and waste handling services.

Enviri reported revenues of $574.8 million, flat year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and a significant miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 52.3% since the results and currently trades at $18.57.

Read our full analysis of Enviri’s results here.

Montrose (NYSE: MEG)

Founded to protect a tree-lined two-lane road, Montrose (NYSE: MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Montrose reported revenues of $224.9 million, up 25.9% year on year. This print beat analysts’ expectations by 10.9%. Overall, it was an exceptional quarter as it also recorded a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EBITDA estimates.

Montrose achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 3.9% since reporting and currently trades at $23.62.

Read our full, actionable report on Montrose here, it’s free.

Casella Waste Systems (NASDAQ: CWST)

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ: CWST) offers waste management services for businesses, residents, and the government.

Casella Waste Systems reported revenues of $485.4 million, up 17.9% year on year. This number surpassed analysts’ expectations by 1.9%. Aside from that, it was a mixed quarter as it also logged a beat of analysts’ EPS estimates but a significant miss of analysts’ adjusted operating income estimates.

Casella Waste Systems had the weakest full-year guidance update among its peers. The stock is up 26.5% since reporting and currently trades at $104.80.

Read our full, actionable report on Casella Waste Systems here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.