Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Nike (NYSE: NKE) and its peers.

This sector includes everything from cable TV services to hotel stays to gym memberships. While diverse, the way people buy and experience these products is being upended by the internet and digitization. Consumer discretionary companies are working to adapt to secular trends such as streaming video, online marketplaces for lodging accommodations, and connected fitness. That discretionary purchases are, by definition, something consumers can give up makes it even more imperative for companies in the space to adapt.

The 4 consumer discretionary stocks we track reported a strong Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.5% above.

Thankfully, share prices of the companies have been resilient as they are up 5.4% on average since the latest earnings results.

Best Q4: Nike (NYSE: NKE)

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE: NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

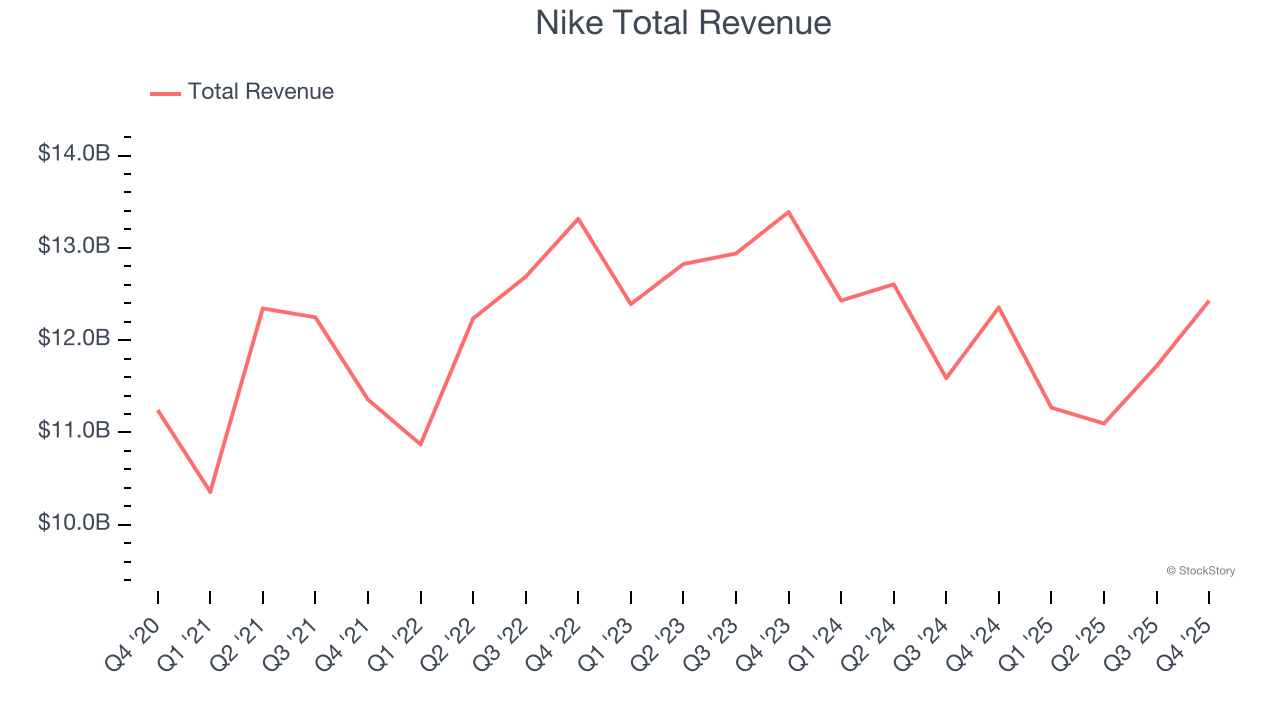

Nike reported revenues of $12.43 billion, flat year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

Nike achieved the biggest analyst estimates beat but had the slowest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 2% since reporting and currently trades at $64.59.

Is now the time to buy Nike? Access our full analysis of the earnings results here, it’s free.

Carnival (NYSE: CCL)

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE: CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

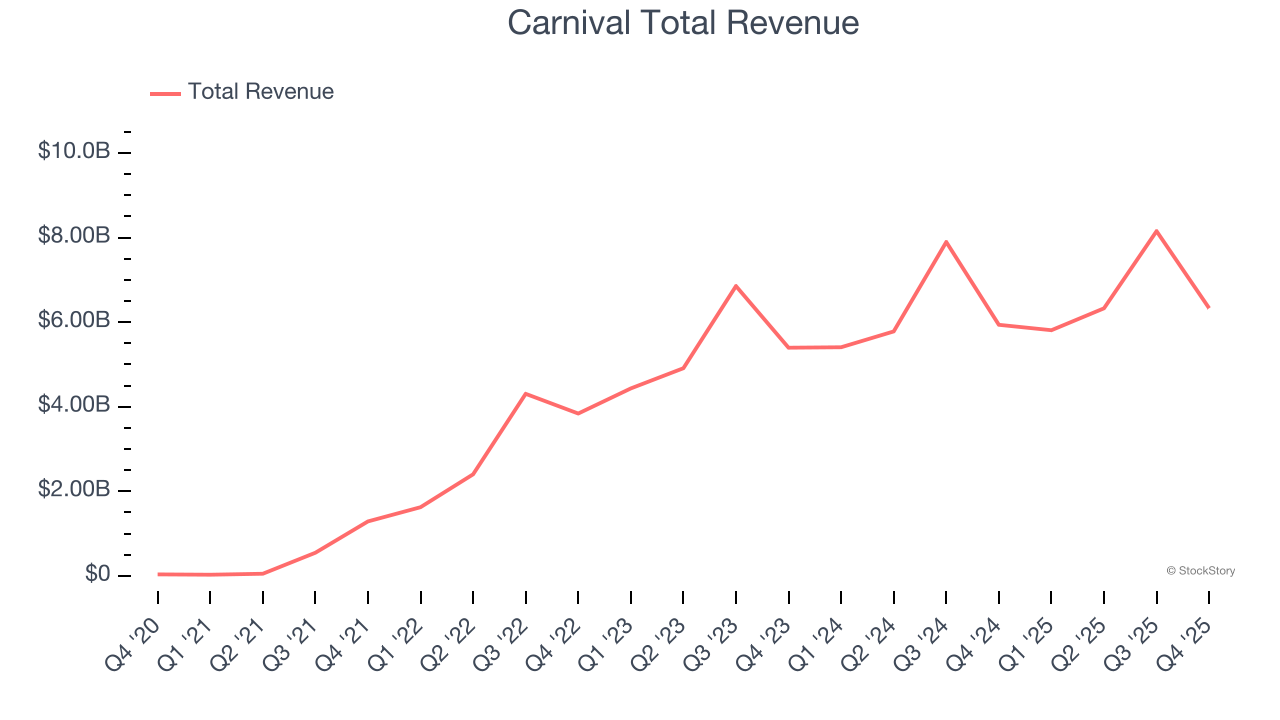

Carnival reported revenues of $6.33 billion, up 6.6% year on year, falling short of analysts’ expectations by 0.6%. However, the business still had a strong quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Carnival pulled off the fastest revenue growth among its peers. The market seems content with the results as the stock is up 4% since reporting. It currently trades at $29.47.

Is now the time to buy Carnival? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Delta (NYSE: DAL)

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE: DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

Delta reported revenues of $16 billion, up 2.9% year on year, exceeding analysts’ expectations by 1.6%. Still, it was a mixed quarter as it posted a miss of analysts’ revenue passenger miles estimates.

The stock is flat since the results and currently trades at $71.26.

Read our full analysis of Delta’s results here.

Scholastic (NASDAQ: SCHL)

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ: SCHL) is an international company specializing in children's publishing, education, and media services.

Scholastic reported revenues of $551.1 million, up 1.2% year on year. This print missed analysts’ expectations by 1%. Taking a step back, it was a mixed quarter as it also recorded a beat of analysts’ EPS estimates but full-year EBITDA guidance missing analysts’ expectations.

Scholastic had the weakest performance against analyst estimates among its peers. The stock is up 19.2% since reporting and currently trades at $34.58.

Read our full, actionable report on Scholastic here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.