What a time it’s been for Medpace. In the past six months alone, the company’s stock price has increased by a massive 96.1%, reaching $617.27 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is MEDP a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does MEDP Stock Spark Debate?

Founded in 1992 as a scientifically-driven alternative to traditional contract research organizations, Medpace (NASDAQ: MEDP) provides outsourced clinical trial management and research services to help pharmaceutical, biotechnology, and medical device companies develop new treatments.

Two Positive Attributes:

1. Core Business Firing on All Cylinders

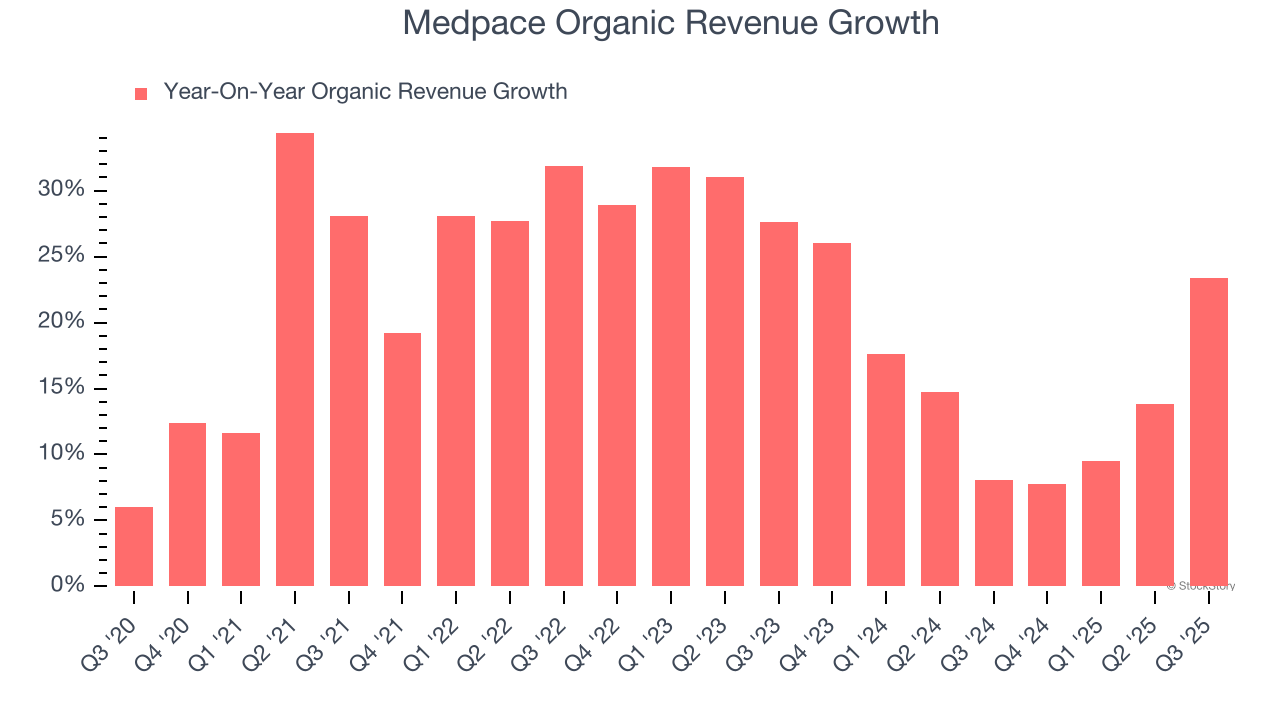

Investors interested in Drug Development Inputs & Services companies should track organic revenue in addition to reported revenue. This metric gives visibility into Medpace’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Medpace’s organic revenue averaged 15.1% year-on-year growth. This performance was impressive and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Outstanding Long-Term EPS Growth

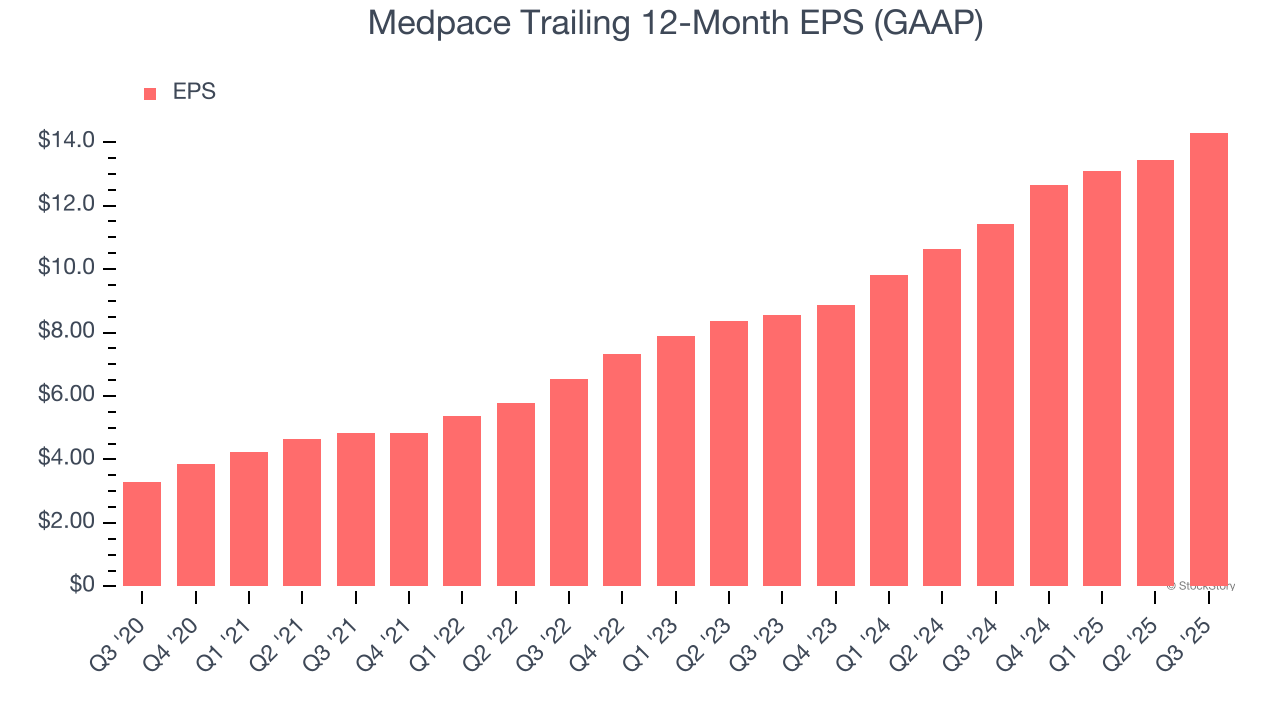

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Medpace’s EPS grew at an astounding 34.2% compounded annual growth rate over the last five years, higher than its 21.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Fewer Distribution Channels than Larger Competitors

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $2.36 billion in revenue over the past 12 months, Medpace lacks scale in an industry where it matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, Medpace’s smaller revenue base allows it to grow faster if it can execute well.

Final Judgment

Medpace’s merits more than compensate for its flaws, and after the recent rally, the stock trades at 38.7× forward P/E (or $617.27 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.