Looking back on casino operator stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Bally's (NYSE: BALY) and its peers.

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

The 11 casino operator stocks we track reported a slower Q3. As a group, revenues beat analysts’ consensus estimates by 1.9%.

In light of this news, share prices of the companies have held steady as they are up 1.6% on average since the latest earnings results.

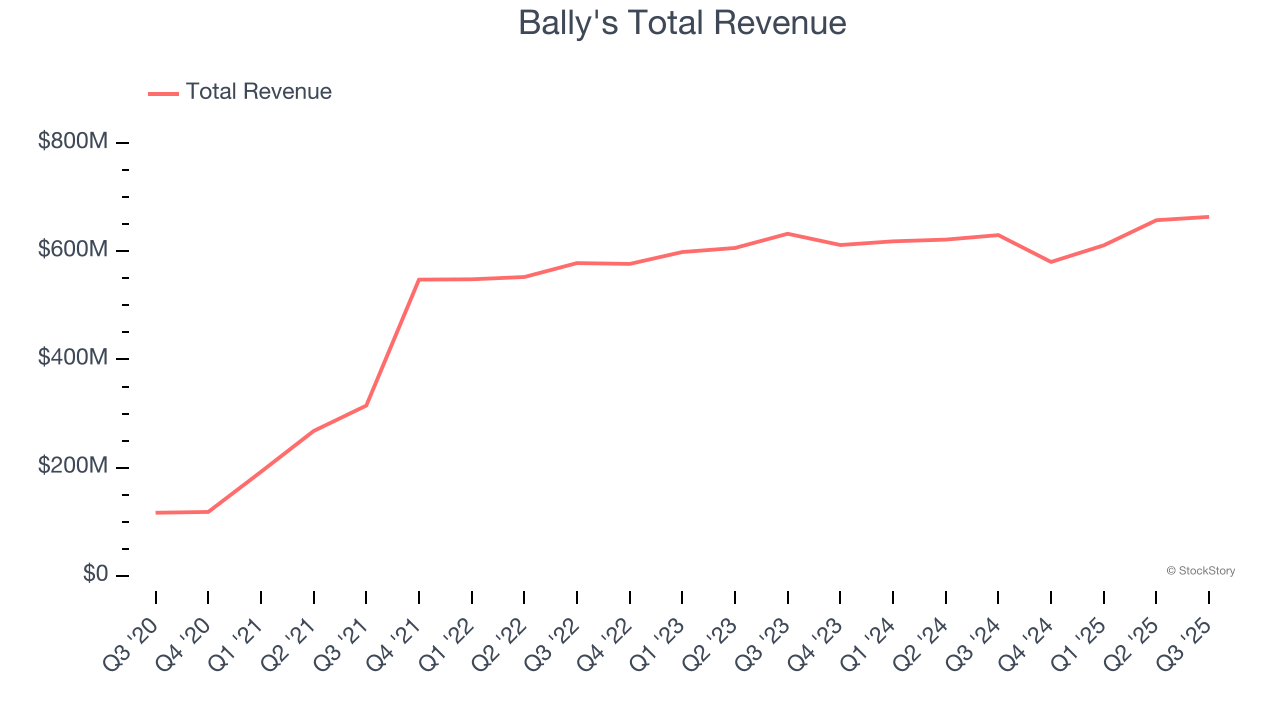

Bally's (NYSE: BALY)

Headquartered in Providence, Rhode Island, Bally's Corporation (NYSE: BALY) is a diversified global casino-entertainment company that owns and manages casinos, resorts, and online gaming platforms.

Bally's reported revenues of $663.7 million, up 5.4% year on year. This print fell short of analysts’ expectations by 0.7%. Overall, it was a softer quarter for the company with a significant miss of analysts’ adjusted operating income and EPS estimates.

The stock is down 7.1% since reporting and currently trades at $17.26.

Read our full report on Bally's here, it’s free.

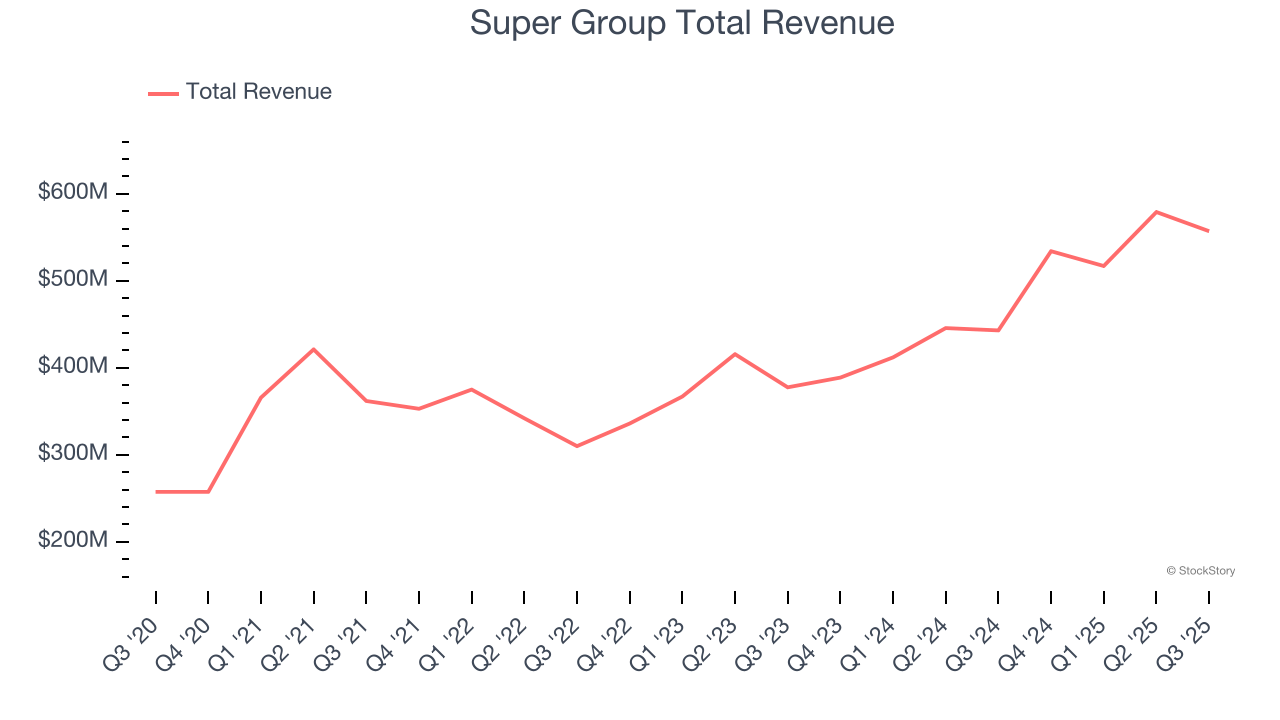

Best Q3: Super Group (NYSE: SGHC)

With betting operations spanning 20 jurisdictions and attracting nearly 5 million monthly customers, Super Group (NYSE: SGHC) operates global online sports betting and gaming platforms through its two primary offerings: the Betway sports betting brand and Spin multi-brand casino portfolio.

Super Group reported revenues of $557 million, up 25.7% year on year, outperforming analysts’ expectations by 9.2%. The business had an incredible quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

Super Group scored the fastest revenue growth among its peers. The company added 11,666.667 customers to reach a total of 5.51 million. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 16.6% since reporting. It currently trades at $10.11.

Is now the time to buy Super Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: MGM Resorts (NYSE: MGM)

Operating several properties on the Las Vegas Strip, MGM Resorts (NYSE: MGM) is a global hospitality and entertainment company known for its resorts and casinos.

MGM Resorts reported revenues of $4.25 billion, up 1.6% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a miss of analysts’ Hotel revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 14.5% since the results and currently trades at $35.47.

Read our full analysis of MGM Resorts’s results here.

Boyd Gaming (NYSE: BYD)

Run by the Boyd family, Boyd Gaming (NYSE: BYD) is a diversified operator of gaming entertainment properties across the United States, offering casino games, hotel accommodations, and dining.

Boyd Gaming reported revenues of $1.00 billion, up 4.5% year on year. This number beat analysts’ expectations by 15.7%. Taking a step back, it was a mixed quarter as it also recorded an impressive beat of analysts’ revenue estimates but a significant miss of analysts’ adjusted operating income estimates.

Boyd Gaming scored the biggest analyst estimates beat among its peers. The stock is up 5.5% since reporting and currently trades at $89.63.

Read our full, actionable report on Boyd Gaming here, it’s free.

Monarch (NASDAQ: MCRI)

Established in 1993, Monarch (NASDAQ: MCRI) operates luxury casinos and resorts, offering high-end gaming, dining, and hospitality experiences.

Monarch reported revenues of $142.8 million, up 3.6% year on year. This print missed analysts’ expectations by 1.7%. Zooming out, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a miss of analysts’ Dining revenue estimates.

Monarch had the weakest performance against analyst estimates among its peers. The stock is down 5.2% since reporting and currently trades at $92.18.

Read our full, actionable report on Monarch here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.