Looking back on custody bank stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Invesco (NYSE: IVZ) and its peers.

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

The 16 custody bank stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 5%.

Luckily, custody bank stocks have performed well with share prices up 10.9% on average since the latest earnings results.

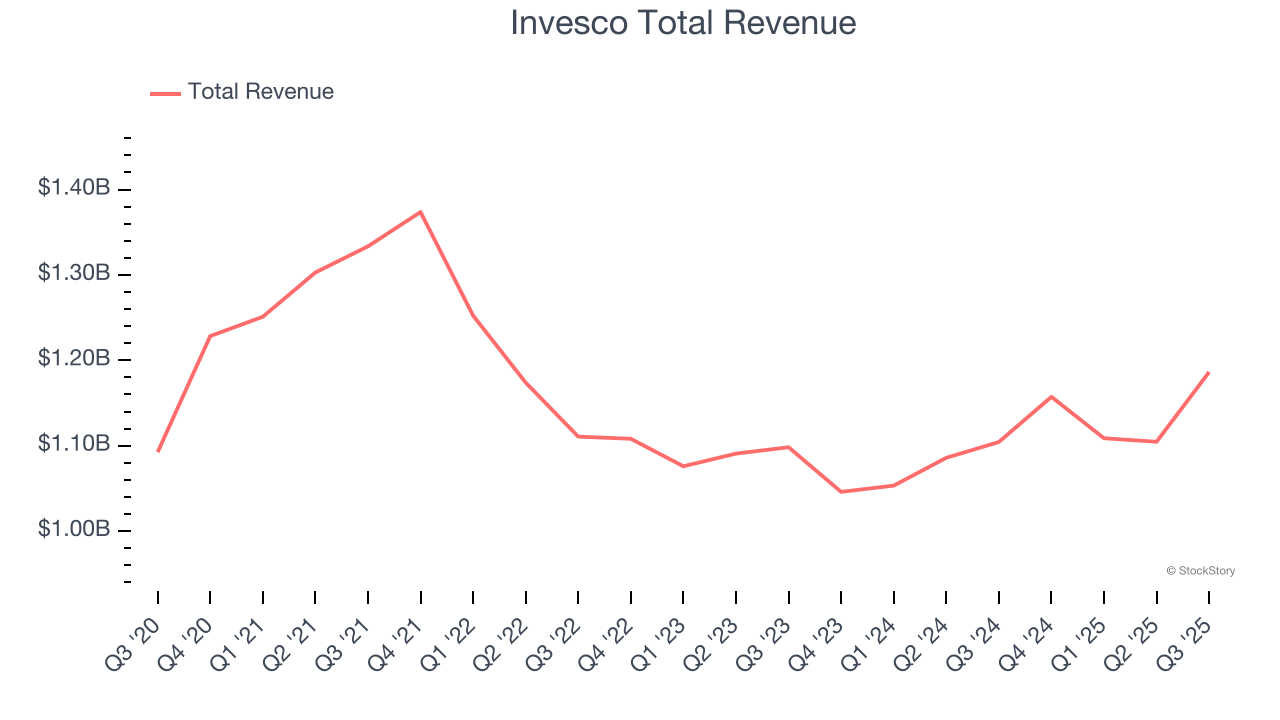

Invesco (NYSE: IVZ)

With roots dating back to 1935 when it pioneered the first mutual fund with an objective of capital growth, Invesco (NYSE: IVZ) is a global asset management firm that offers investment solutions across equities, fixed income, alternatives, and multi-asset strategies.

Invesco reported revenues of $1.19 billion, up 7.4% year on year. This print was in line with analysts’ expectations, and overall, it was a very strong quarter for the company with a beat of analysts’ EPS and AUM estimates.

Interestingly, the stock is up 18.1% since reporting and currently trades at $27.70.

Is now the time to buy Invesco? Access our full analysis of the earnings results here, it’s free for active Edge members.

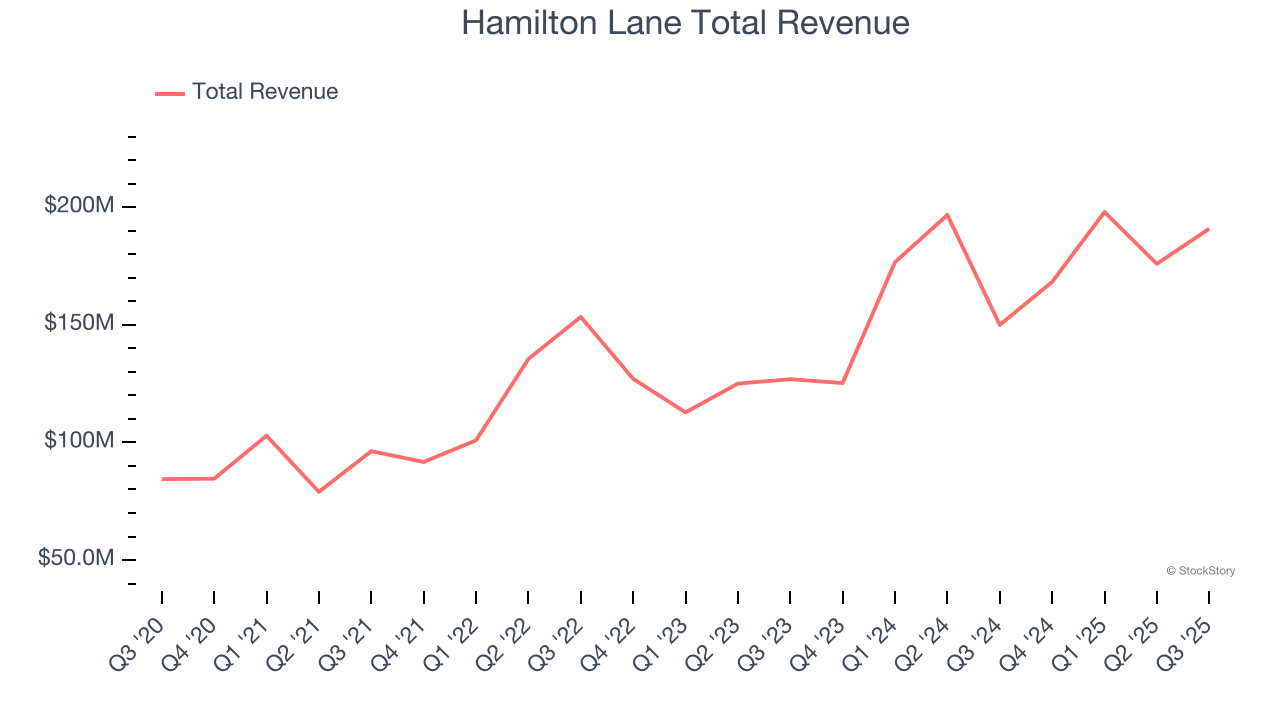

Best Q3: Hamilton Lane (NASDAQ: HLNE)

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ: HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

Hamilton Lane reported revenues of $190.9 million, up 27.3% year on year, outperforming analysts’ expectations by 12.8%. The business had an incredible quarter with a beat of analysts’ EPS and revenue estimates.

The market seems happy with the results as the stock is up 26% since reporting. It currently trades at $144.87.

Is now the time to buy Hamilton Lane? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: P10 (NYSE: PX)

Operating as a bridge between institutional investors and hard-to-access private market opportunities, P10 (NYSE: PX) is an alternative asset management firm that provides access to private equity, venture capital, impact investing, and private credit opportunities in the middle and lower middle markets.

P10 reported revenues of $75.93 million, up 2.3% year on year, falling short of analysts’ expectations by 4.5%. It was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ management fees estimates.

P10 delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 3.7% since the results and currently trades at $10.19.

Read our full analysis of P10’s results here.

Northern Trust (NASDAQ: NTRS)

Founded in 1889 during Chicago's post-Great Fire rebuilding boom, Northern Trust (NASDAQ: NTRS) provides wealth management, asset servicing, and banking solutions to corporations, institutions, families, and high-net-worth individuals globally.

Northern Trust reported revenues of $2.03 billion, up 5.8% year on year. This number was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also produced a solid beat of analysts’ AUM estimates but a slight miss of analysts’ advisory and servicing fees estimates.

The stock is up 11% since reporting and currently trades at $142.64.

Read our full, actionable report on Northern Trust here, it’s free for active Edge members.

StepStone Group (NASDAQ: STEP)

Operating as both an advisor and asset manager with over $100 billion in assets under management, StepStone Group (NASDAQ: STEP) is an investment firm that provides clients with access to private market investments across private equity, real estate, private debt, and infrastructure.

StepStone Group reported revenues of $282.3 million, up 35.2% year on year. This result beat analysts’ expectations by 6.4%. It was an exceptional quarter as it also produced a solid beat of analysts’ management fees estimates and an impressive beat of analysts’ revenue estimates.

The stock is up 10.3% since reporting and currently trades at $68.67.

Read our full, actionable report on StepStone Group here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.