Higher education company Laureate Education (NASDAQ: LAUR) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 27.9% year on year to $541.4 million. The company’s full-year revenue guidance of $1.90 billion at the midpoint came in 2.2% above analysts’ estimates. Its GAAP profit of $1.17 per share was 48.5% above analysts’ consensus estimates.

Is now the time to buy Laureate Education? Find out by accessing our full research report, it’s free.

Laureate Education (LAUR) Q4 CY2025 Highlights:

- Revenue: $541.4 million vs analyst estimates of $526.7 million (27.9% year-on-year growth, 2.8% beat)

- EPS (GAAP): $1.17 vs analyst estimates of $0.79 (48.5% beat)

- Adjusted EBITDA: $204.3 million vs analyst estimates of $199.1 million (37.7% margin, 2.6% beat)

- EBITDA guidance for the upcoming financial year 2026 is $588 million at the midpoint, above analyst estimates of $576.9 million

- Operating Margin: 33.2%, up from 29.3% in the same quarter last year

- Free Cash Flow Margin: 4.9%, up from 2.4% in the same quarter last year

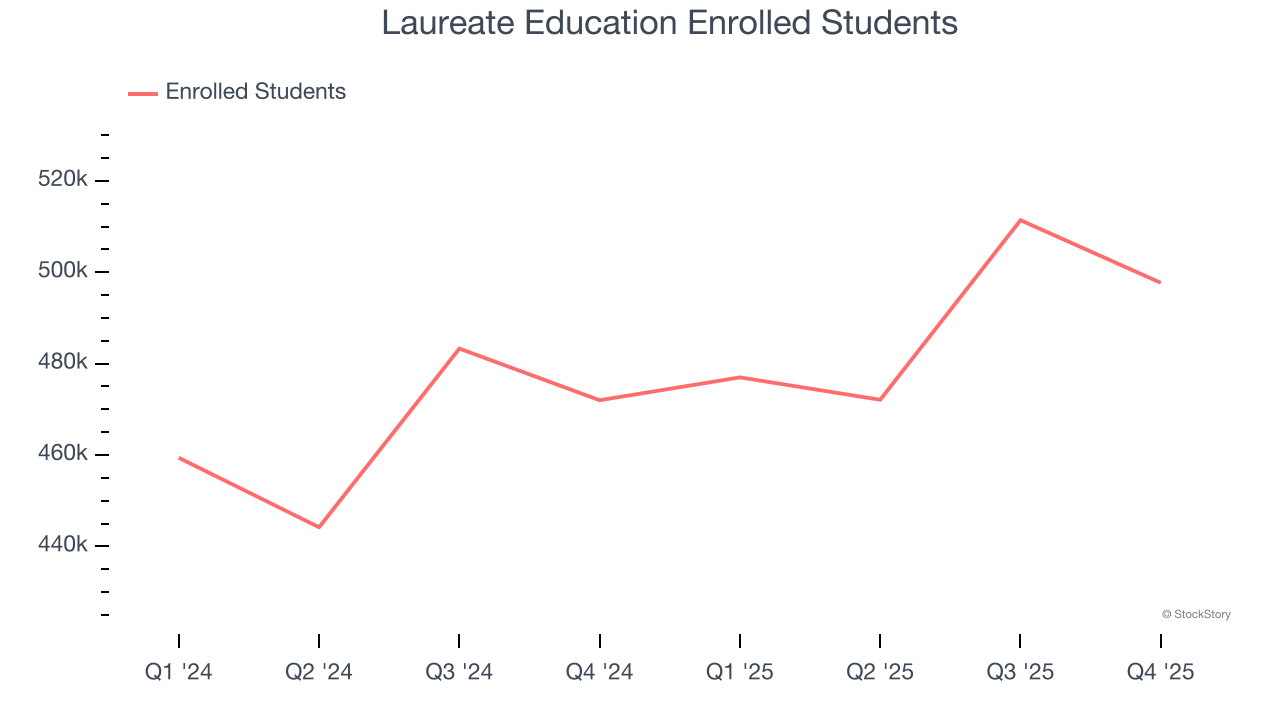

- Enrolled Students: 497,700, up 25,700 year on year

- Market Capitalization: $5.17 billion

Eilif Serck-Hanssen, President and Chief Executive Officer, said, “Laureate delivered another strong year of performance in 2025, with sustained revenue growth and expanding margins. Our robust balance sheet and significant free cash flow generation enabled us to continue investing in our long-term growth strategy, including the opening of two new campuses and further innovation in digital and AI capabilities, while returning more than $200 million of excess capital to shareholders through share repurchases. As we enter 2026, we continue to see attractive growth opportunities across our local markets and remain focused on executing our growth agenda while continuing to return excess capital to shareholders.”

Company Overview

Founded in 1998 by Douglas L. Becker and based in Miami, Laureate Education (NASDAQ: LAUR) is a global network of higher education institutions.

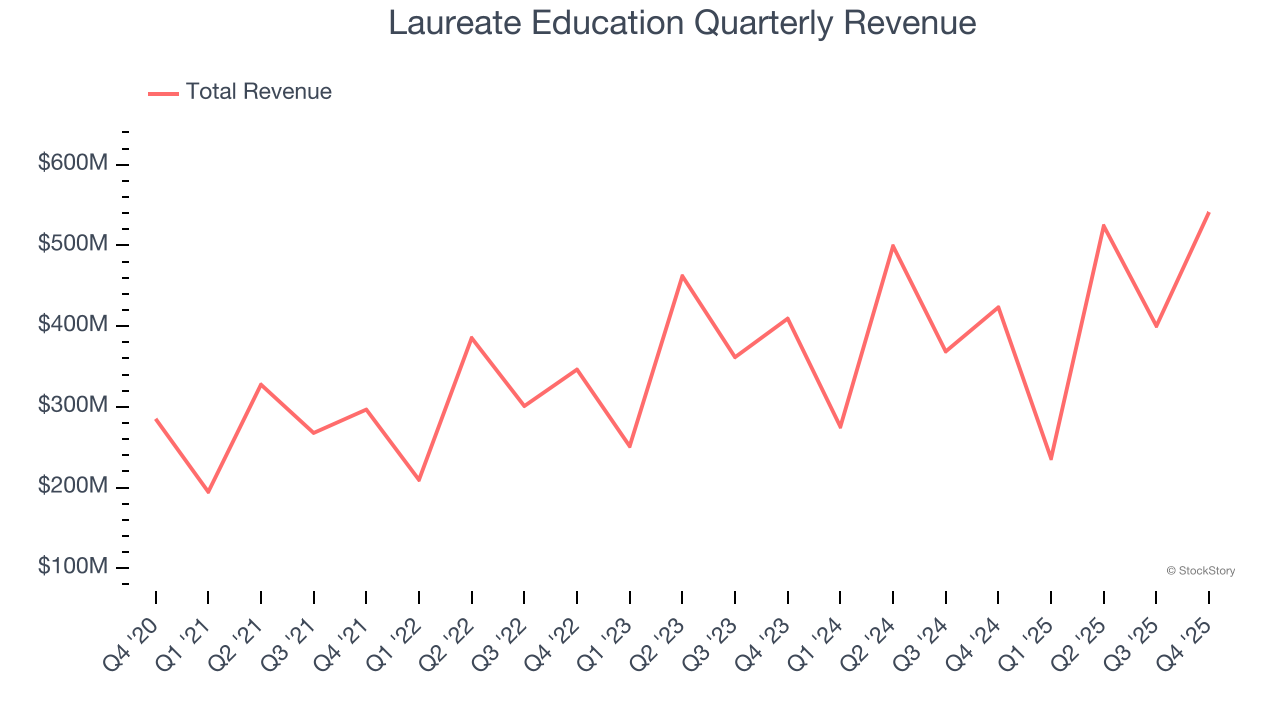

Revenue Growth

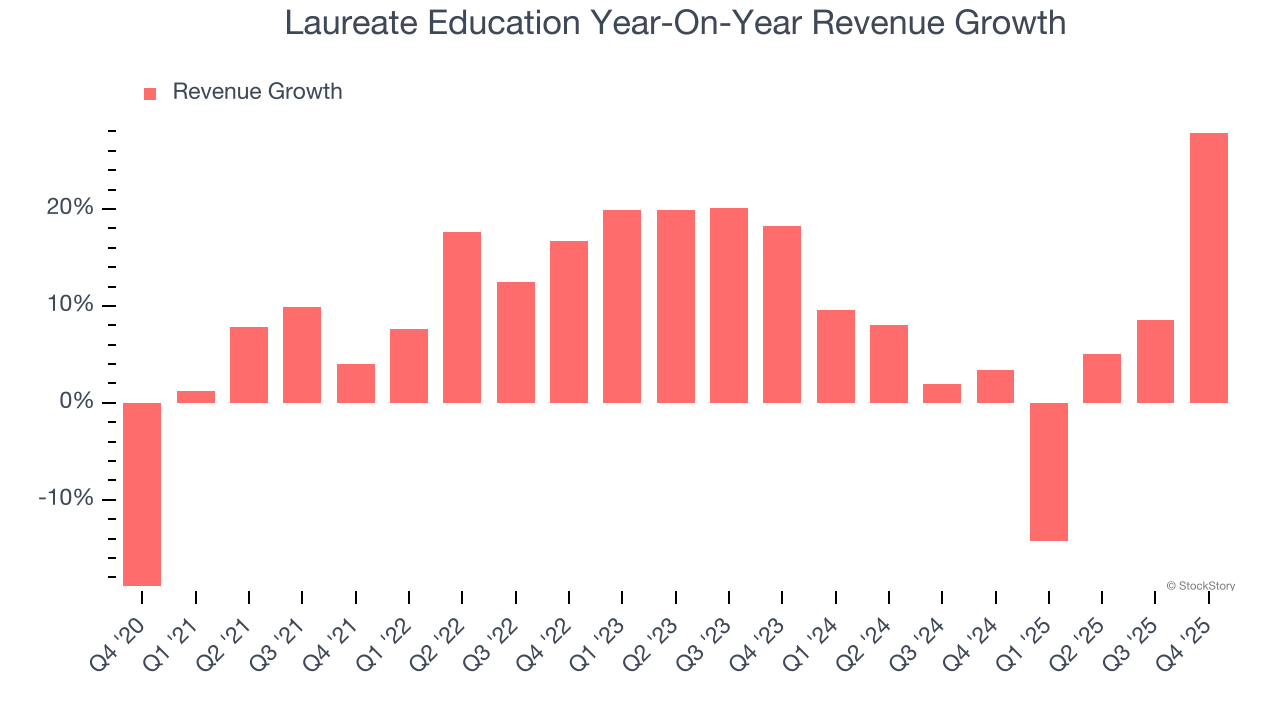

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Laureate Education grew its sales at a 10.7% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Laureate Education’s recent performance shows its demand has slowed as its annualized revenue growth of 7.1% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can better understand the company’s revenue dynamics by analyzing its number of enrolled students, which reached 497,700 in the latest quarter. Over the last two years, Laureate Education’s enrolled students averaged 5.3% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Laureate Education reported robust year-on-year revenue growth of 27.9%, and its $541.4 million of revenue topped Wall Street estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

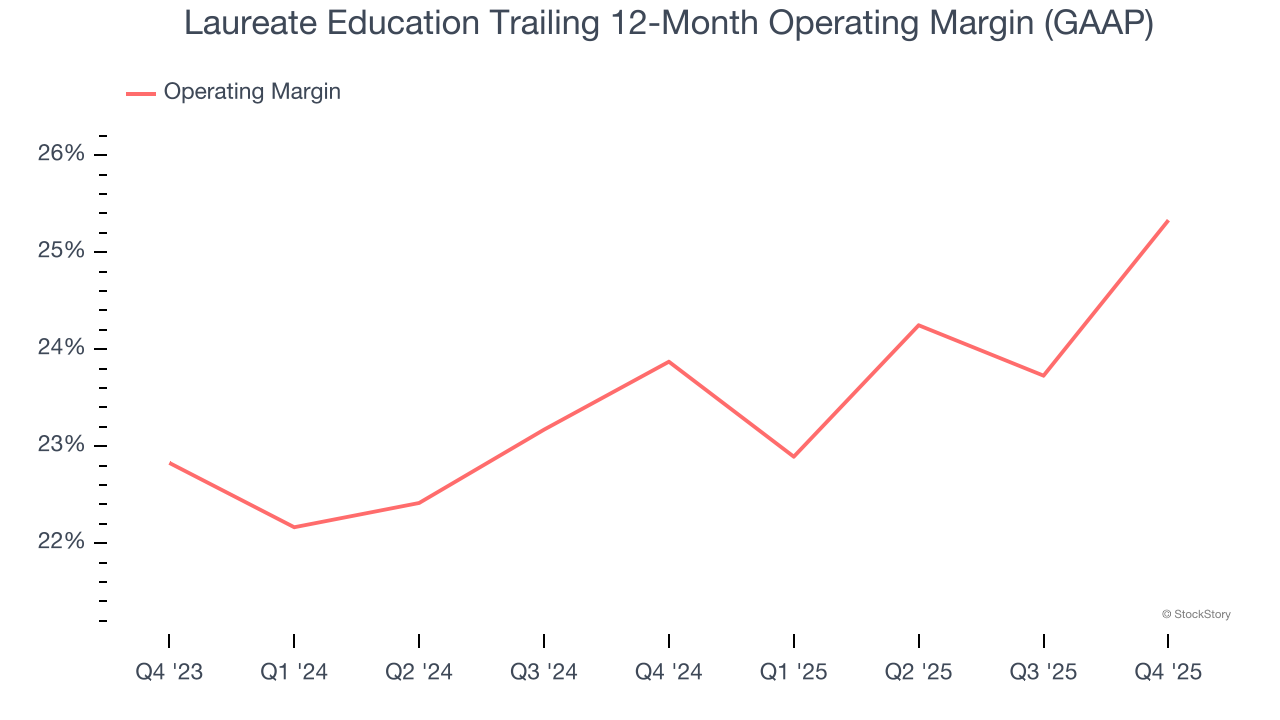

Operating Margin

Laureate Education’s operating margin has risen over the last 12 months and averaged 24.6% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

In Q4, Laureate Education generated an operating margin profit margin of 33.2%, up 3.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

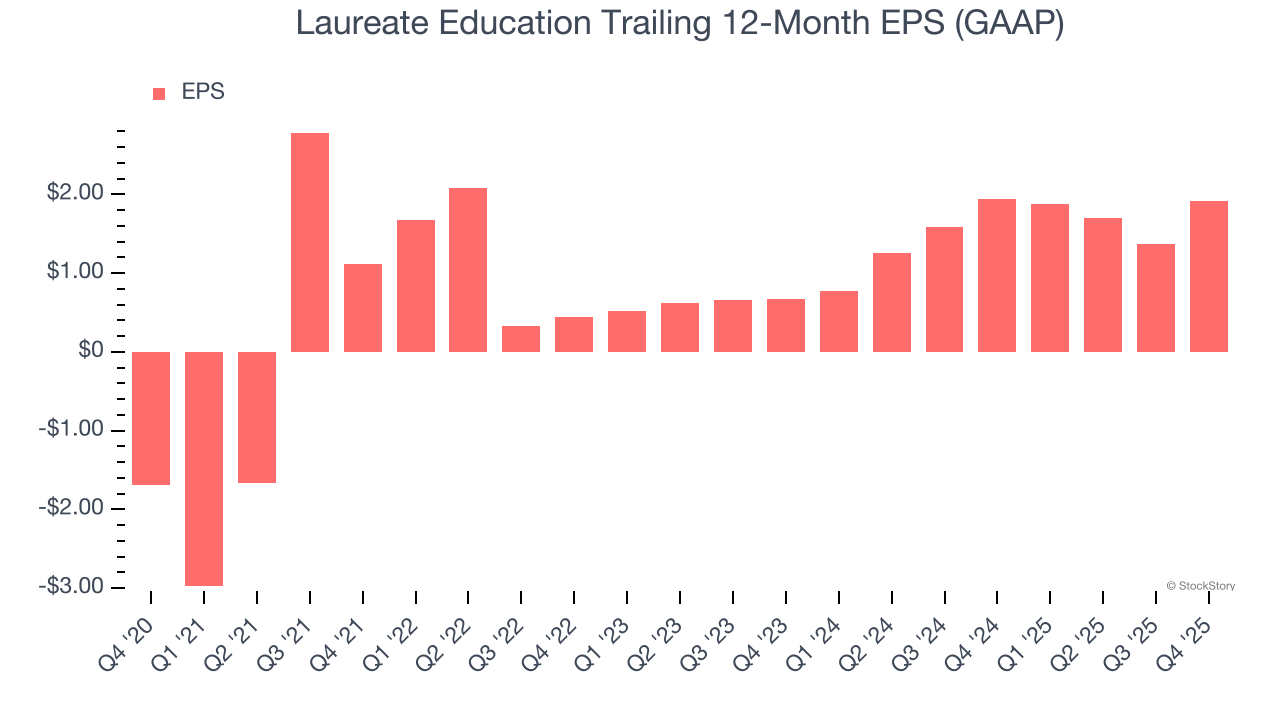

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Laureate Education’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Laureate Education reported EPS of $1.17, up from $0.62 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Laureate Education’s full-year EPS of $1.92 to grow 7.3%.

Key Takeaways from Laureate Education’s Q4 Results

It was good to see Laureate Education beat analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 3.1% to $36.18 immediately after reporting.

Laureate Education had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).