Nelnet has been treading water for the past six months, recording a small return of 3.8% while holding steady at $131.52.

Does this present a buying opportunity for NNI? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Is NNI a Good Business?

Starting as a student loan servicer in the 1970s and evolving through the changing landscape of education finance, Nelnet (NYSE: NNI) provides student loan servicing, education technology, payment processing, and banking services while managing a portfolio of education loans.

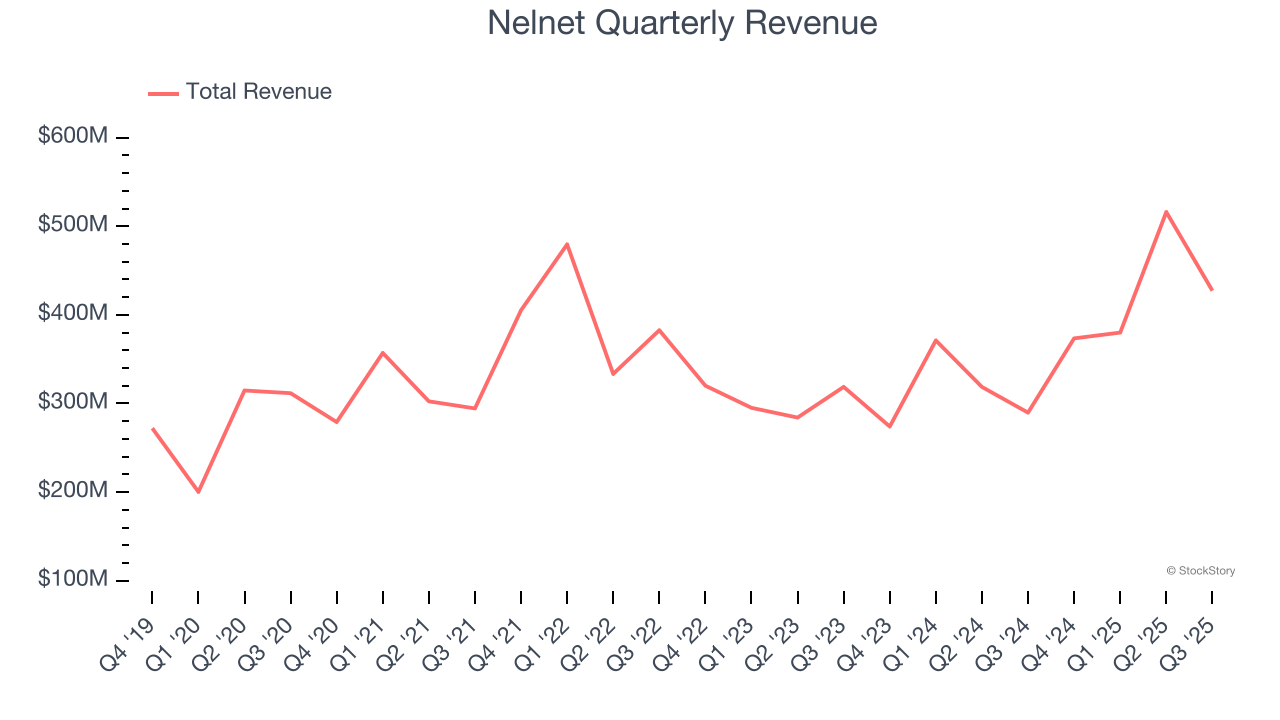

1. Long-Term Revenue Growth Shows Momentum

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Luckily, Nelnet’s revenue grew at a decent 9.1% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

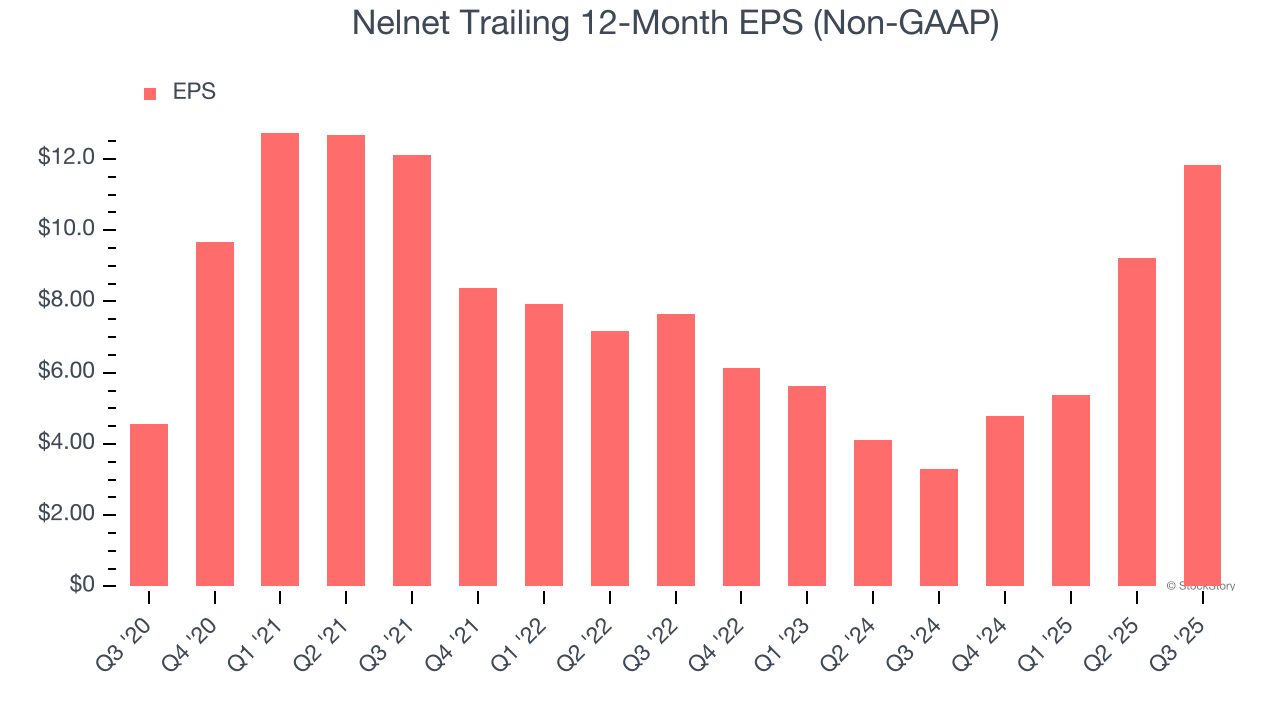

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Nelnet’s EPS grew at a spectacular 21% compounded annual growth rate over the last five years, higher than its 9.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

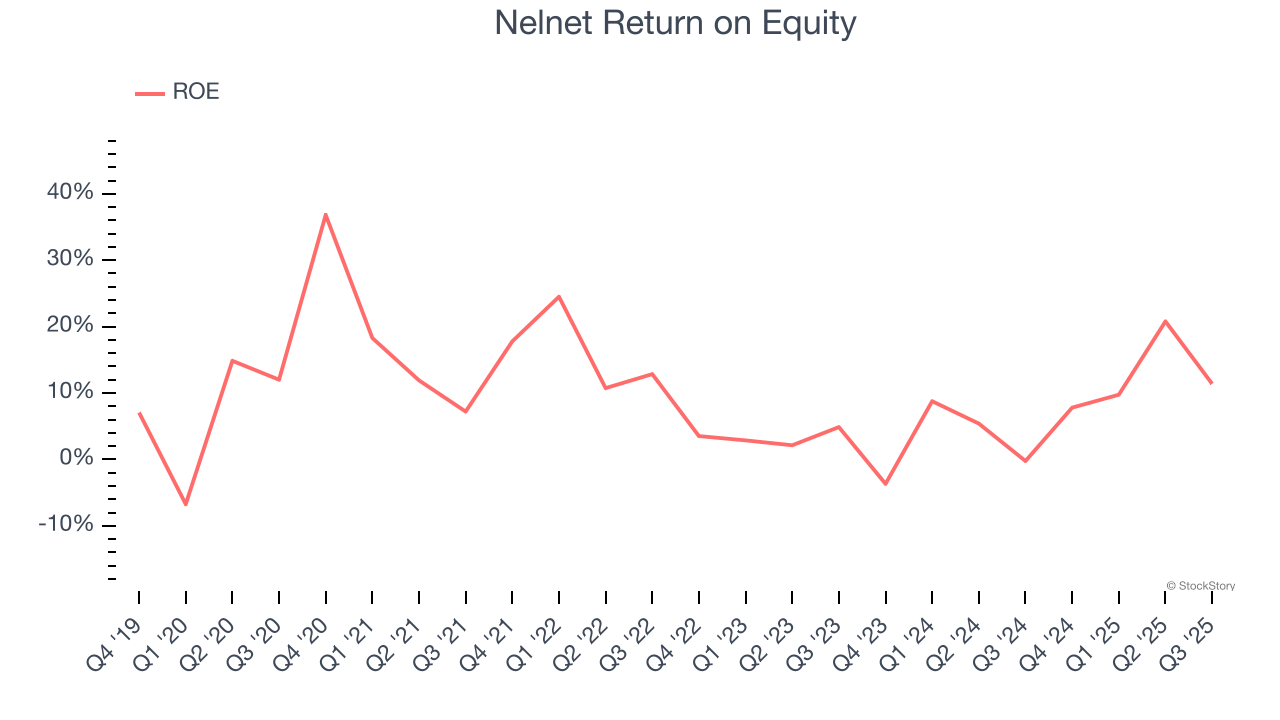

3. Previous Growth Initiatives Are Paying Off

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Nelnet has averaged an ROE of 10.7%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Nelnet has a narrow competitive moat.

Final Judgment

These are just a few reasons Nelnet is a high-quality business worth owning, but at $131.52 per share (or 16× forward P/E), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.