Let’s dig into the relative performance of Shutterstock (NYSE: SSTK) and its peers as we unravel the now-completed Q3 online marketplace earnings season.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 12 online marketplace stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.7% since the latest earnings results.

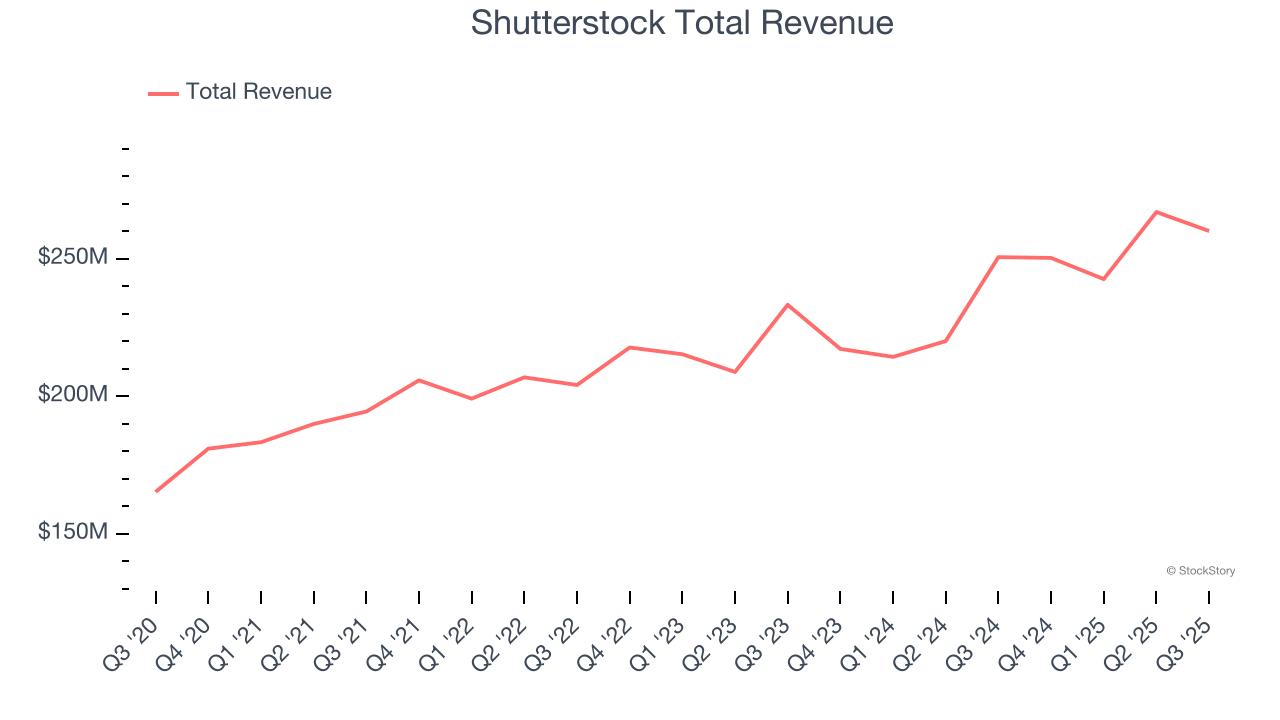

Shutterstock (NYSE: SSTK)

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE: SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

Shutterstock reported revenues of $260.1 million, up 3.8% year on year. This print exceeded analysts’ expectations by 1.6%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ number of paid downloads estimates.

Commenting on the Company's performance, Paul Hennessy, the Company's Chief Executive Officer, said, "Shutterstock achieved another strong quarter of financial results. Revenue grew 4% on the back of the fast-growing Data, Distribution, and Services business, while Adjusted EBITDA margins remained over 30% for the second consecutive quarter, and Free Cash Flow significantly increased. Despite the evolving competitive landscape, we continue to improve the value proposition of our unlimited content products by including AI image, video, and audio generative models as part of our offering. Additionally, we are attracting new logos and expanding relationships with existing customers within our Data, Distribution, and Services business. "

Unsurprisingly, the stock is down 7.6% since reporting and currently trades at $20.05.

Is now the time to buy Shutterstock? Access our full analysis of the earnings results here, it’s free.

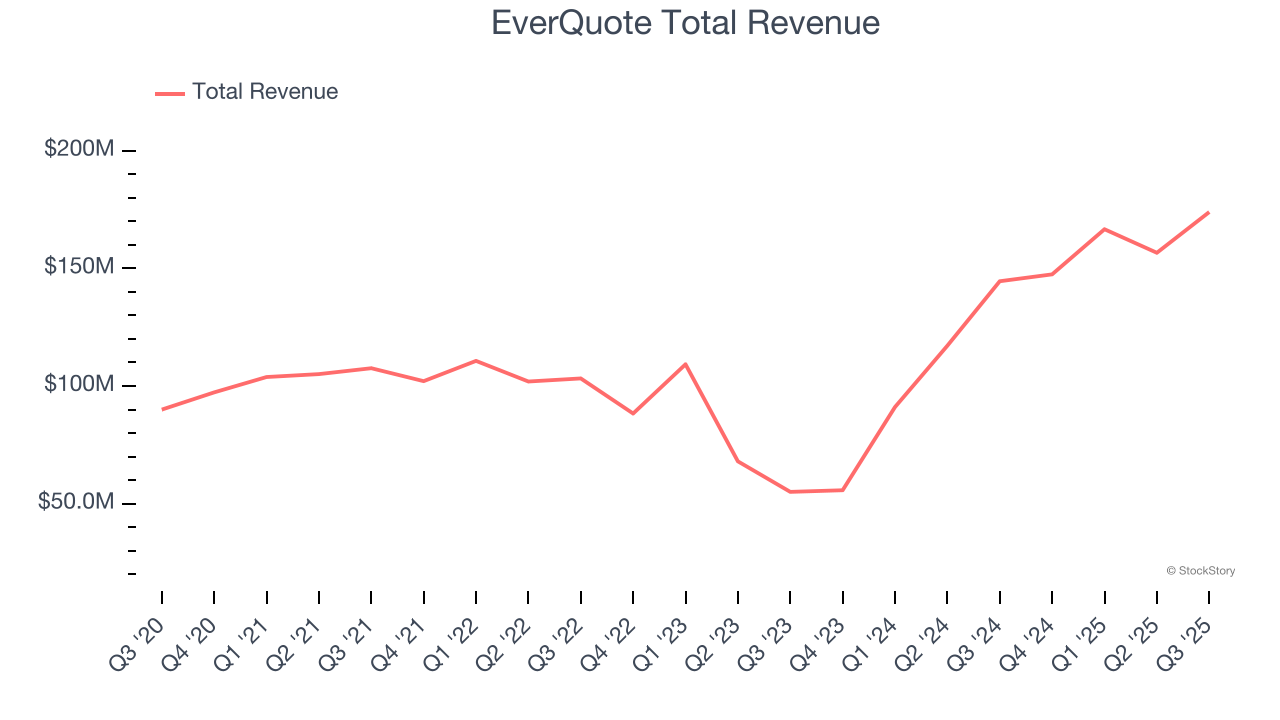

Best Q3: EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $173.9 million, up 20.3% year on year, outperforming analysts’ expectations by 4.3%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems content with the results as the stock is up 1.5% since reporting. It currently trades at $22.75.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: ACV Auctions (NYSE: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $199.6 million, up 16.5% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance slightly missing analysts’ expectations and full-year EBITDA guidance missing analysts’ expectations significantly.

ACV Auctions delivered the highest full-year guidance raise but had the weakest performance against analyst estimates in the group. The company reported 218,065 units sold, up 9.9% year on year. As expected, the stock is down 2.9% since the results and currently trades at $7.91.

Read our full analysis of ACV Auctions’s results here.

Etsy (NYSE: ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NYSE: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $678 million, up 2.4% year on year. This number beat analysts’ expectations by 3.3%. It was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

The company reported 93.16 million active buyers, down 3.7% year on year. The stock is down 29.3% since reporting and currently trades at $52.86.

Read our full, actionable report on Etsy here, it’s free.

CarGurus (NASDAQ: CARG)

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ: CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

CarGurus reported revenues of $238.7 million, up 3.2% year on year. This print surpassed analysts’ expectations by 1.6%. Overall, it was a strong quarter as it also produced EBITDA guidance for next quarter topping analysts’ expectations and a decent beat of analysts’ EBITDA estimates.

The company reported 33,673 users, up 6.3% year on year. The stock is down 2.2% since reporting and currently trades at $32.40.

Read our full, actionable report on CarGurus here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.