Photo from Unsplash

Photo from Unsplash

Originally Posted On: https://victoryrealestateinc.com/maximizing-rental-property-tax-deductions-a-guide-to-landlord-tax-benefits/

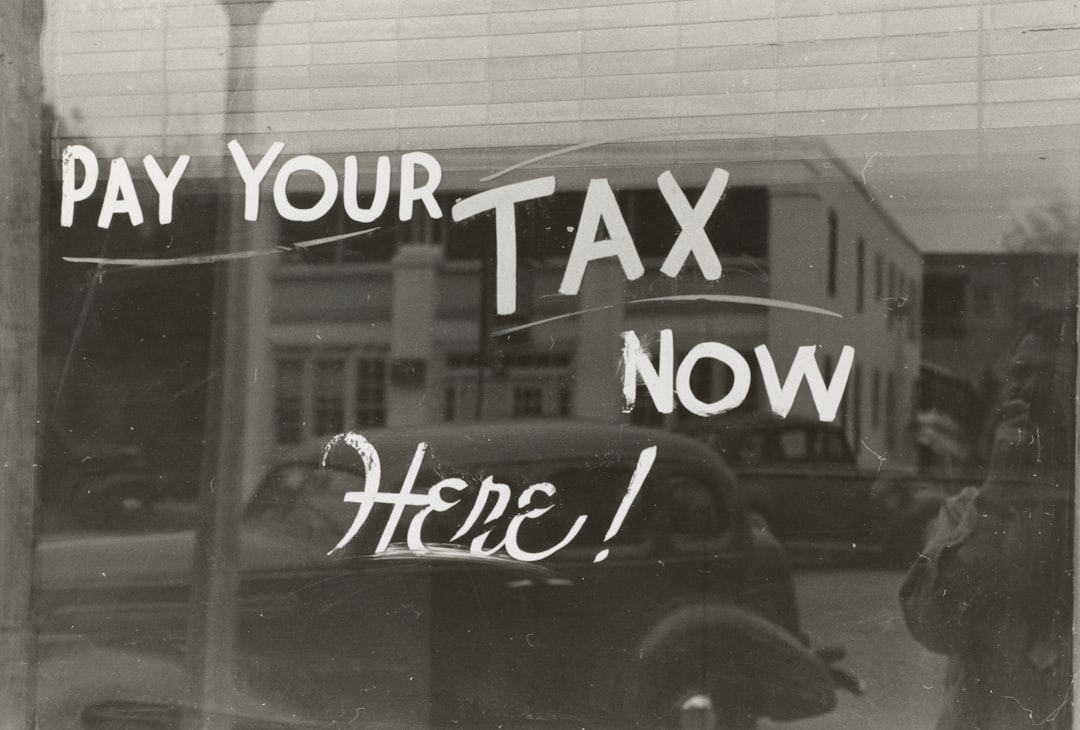

As a rental property owner or investor, it’s important to understand the tax benefits available to you. Knowing which deductions you can take and how to maximize them can help you save big on your tax bill. In this article, we’ll dive into the world of rental property tax deductions and provide you with a comprehensive guide to making the most of your investments.

What are rental property tax deductions?

Rental property tax deductions are deductions that you can take on your taxes to reduce the amount of taxable income you have to report. These deductions are available to rental property owners and investors and can significantly reduce your tax bill.

Rental property tax deductions are available for a variety of expenses, both large and small. Common deductions include mortgage interest, repairs, depreciation, and insurance. There are also some deductions available to landlords that are related to the cost of running the property, such as advertising and legal fees.

Property Management Expenses

Property management expenses are tax-deductible for property owners who earn rental income. These expenses include property management fees, advertising and marketing costs, repairs and maintenance, insurance, legal and professional fees, and utilities. The Internal Revenue Service (IRS) considers these expenses to be ordinary and necessary expenses for the maintenance and operation of a rental property. However, it is essential to keep accurate records and receipts of all property management expenses to ensure that they can be properly claimed on tax returns.

Other common tax deductions for rental property owners

The most common tax deduction for rental property owners is the mortgage interest deduction. This deduction allows you to deduct the interest you pay on your mortgage from your taxable income. This deduction is available for both primary residences and rental properties, though the amount you can deduct may vary depending on the type of loan and the amount of interest paid.

Another common deduction is the depreciation deduction. This allows you to deduct a portion of the cost of your rental property over a period of time. This deduction can be used to offset the cost of repairs, maintenance, and other expenses related to your rental property.

What is Cap Rate?

Are you using Cap Rate to determine the potential return on your investment property?

Understanding depreciation and its tax benefits

Depreciation is a tax benefit that allows you to deduct a portion of the cost of your rental property over time. This deduction is based on the estimated useful life of the property, which is typically 27.5 years for residential rental properties and 39 years for commercial rental properties.

The depreciation deduction can be used to offset the cost of repairs and maintenance, as well as the cost of any improvements you make to the property. You can also use the depreciation deduction to offset the cost of any furnishings or appliances you buy for the rental property.

Qualifying for the mortgage interest deduction

The mortgage interest deduction is available to rental property owners and investors and can be used to deduct the interest paid on the mortgage. To qualify for this deduction, you must be the owner of the property, and the mortgage must be used to purchase, build, or substantially improve the property.

The amount of the deduction depends on the amount of interest paid and the type of loan used to finance the property. For example, if you have a fixed-rate loan, you can deduct all of the interest paid on the loan. However, if you have an adjustable-rate loan, the amount of the deduction can vary depending on the interest rate.

Repair Costs.

It gets more expensive every year to do maintenance and repairs. Why??

Maximizing rental property tax deductions with repairs and maintenance

Repairs and maintenance are essential to keeping your rental property in good condition and ensuring its value doesn’t decline over time. Fortunately, these expenses can also be used to maximize your rental property tax deductions.

Repairs and maintenance can be deducted in the year they are incurred, so if you make a significant repair or improvement to your rental property, you can deduct the cost in that year. Additionally, if you make any improvements to the property, such as upgrading the appliances or painting the walls, you can depreciate the cost over time.

Rental property tax deductions: The importance of recordkeeping

To make the most of your rental property tax deductions, it’s important to keep detailed records of all of your expenses. This includes keeping track of all repairs and maintenance, as well as any other expenses related to the rental property.

You should also keep records of any improvements you make to the property, as well as any furnishings and appliances you purchase. This will make it easier to claim the deductions on your taxes and ensure that you don’t miss out on any potential deductions.

TurboTax rental property: Exploring the tax filing options

If you’re looking for an easy way to file your taxes as a rental property owner or investor, TurboTax rental property can help. This online tax filing service makes it easy to file your taxes on your own, and it can help you maximize the deductions available to you.

TurboTax rental property offers step-by-step guidance to help you through the tax filing process. It also offers specialized guidance for rental property investors, including advice on how to claim common deductions and maximize your tax savings.

1031 Exchange

A landlords best friend when selling their investment property.

Tax deductions for landlords: Understanding capital gains and losses

One of the benefits of owning rental property is the potential for capital gains. Capital gains are profits from the sale of an asset, such as a rental property. If you sell your rental property for more than you paid for it, you can claim a capital gain.

However, if you sell your rental property for less than you paid for it, you’ll incur a capital loss. This loss can be used to offset any capital gains you make from the sale of other assets, such as stocks or bonds.

Property investment tax deductions: Hiring a tax professional

Hiring a tax professional can help you maximize your rental property tax deductions and ensure that you’re taking all of the deductions available to you. A tax professional can also help you understand the tax implications of any decisions you make regarding your rental property, such as selling the property or making improvements.

Additionally, a tax professional can help you navigate the complex world of capital gains and losses. They can also provide advice on how to structure your investments to maximize your tax savings.

Conclusion

Rental property tax deductions can be a great way for rental property owners and investors to reduce their tax bills and maximize their savings. Knowing which deductions you can take and how to maximize them is essential for making the most of your investments.

By understanding the common tax deductions for rental property owners, understanding depreciation and its tax benefits, qualifying for the mortgage interest deduction, maximizing rental property tax deductions with repairs and maintenance, and understanding capital gains and losses, you can make the most of your rental property investments. Finally, hiring a tax professional can help you maximize your tax savings and ensure that you’re taking full advantage of the deductions available to you.

Rental Rate Analysis

See what your home is worth in today’s rental market!

See Available Homes

View available Victory rental homes and see the difference!

Innovation

As tech leaders in the industry, we know what our clients want!