Automotive company Lucid Group, Inc. (LCID) engages in the Electric Vehicle (EV) business. The company recently reached a deal with carmaker Aston Martin, giving LCID a 3.7% stake in return for access to its high-performance technology to produce EVs. This could be strategically beneficial for the company.

However, the company faces intense competition in the EV market. Its second-quarter production declined, presumably due to Tesla, Inc.’s (TSLA) price war that intensified competition in the EV industry. The company delivered 1,404 vehicles in the quarter, compared with 1,406 deliveries in the previous quarter, while its production fell 6% sequentially to 2,173 vehicles.

Given this backdrop, let’s look at LCID’s key financial metrics to understand why it could be wise to avoid the stock now.

Analyzing LCID's Financial Fluctuations: Unpacking Gross Margin, Net Income, and Other Metrics

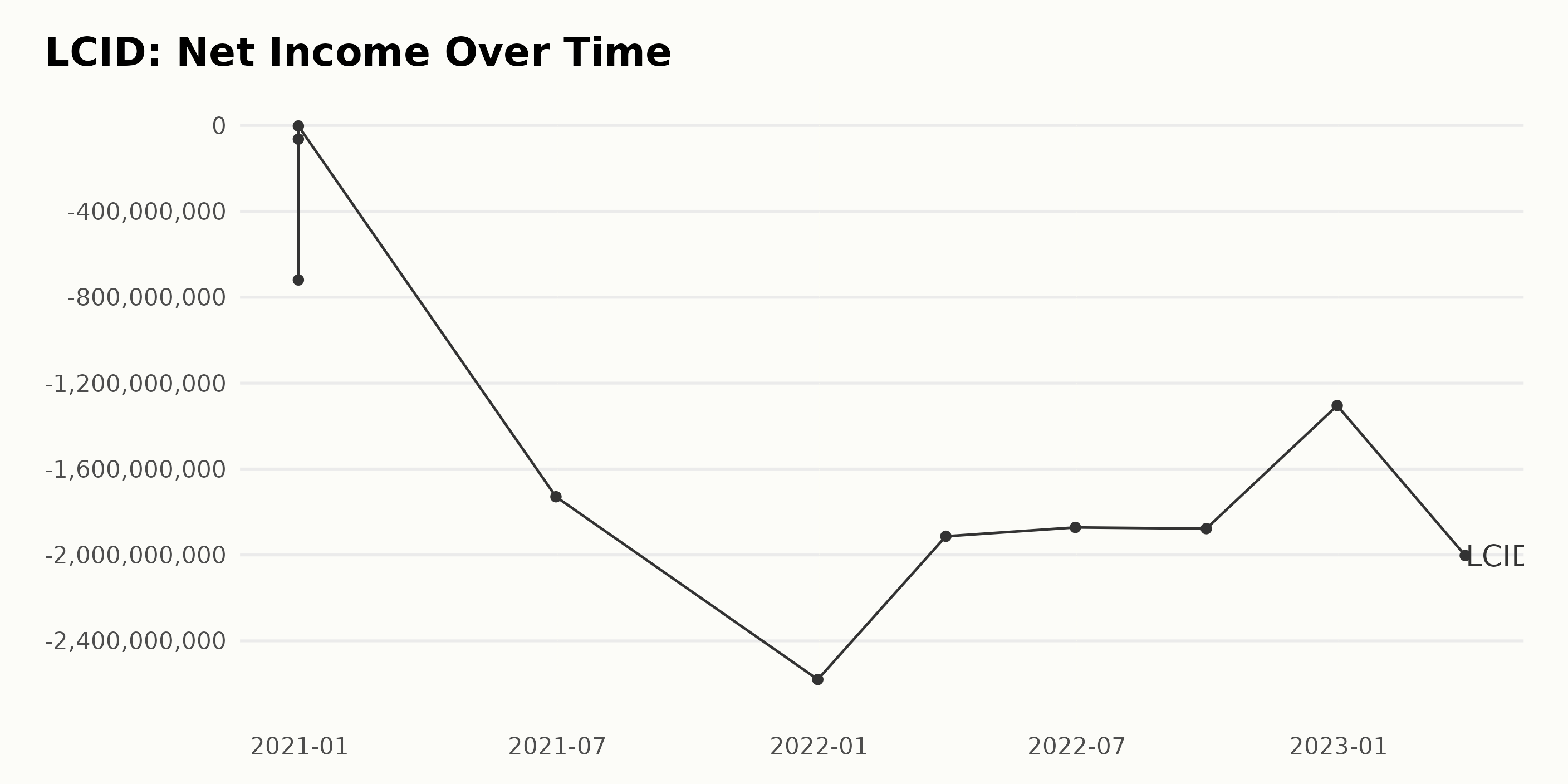

The trailing-12-month net income of LCID has seen considerable fluctuation over the past couple of years. The trend, however, has been towards an increasing loss.

- At the end of 2020, the net income was -$71.94 million, -$63.47 million, and -$2.52 million, respectively.

- The loss was accentuated harshly by mid-2021, hitting a value of -$1.729 billion.

- Though there was a temporary reduction in the loss by late 2021, standing at -$1.917 billion, it subsequently increased to -$2.58 billion by the end of 2021.

- Across 2022, the net income stabilized, albeit at a significant loss. It hovered around a loss of -$1.87 billion, being reported at the end of the second and third quarters of 2022.

- There was a notable improvement by the end of 2022, with the net income reduced to -$1.3 billion.

- Despite the promising shift, the losses augmented again by the end of the first quarter of 2023, reaching -$2.002 billion.

This suggests that although there might have been some brief periods of reduced financial loss, LCID's fiscal standing, as represented through its net income, has significantly deteriorated overall in the observed timescale.

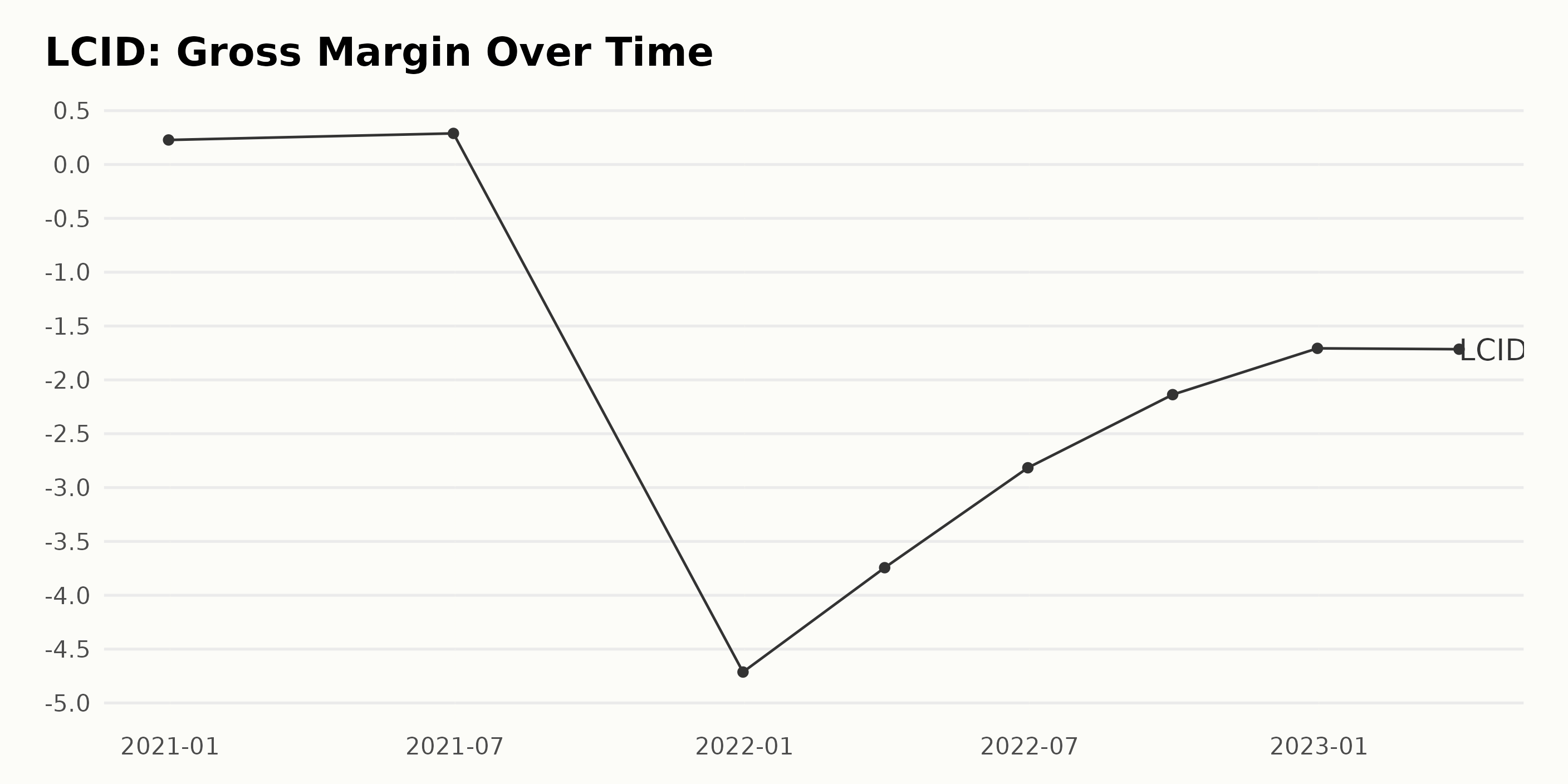

LCID showed a variable gross margin trend in the given data set:

- From 22.8% on December 31, 2020, there had been an upward trend, reaching 28.9% by June 30, 2021.

- Beginning in late 2021, the gross margin dramatically decreased. By December 31, 2021, the gross margin was drastically down to -471.3%.

- Fluctuations were seen in the next quarters of 2022 with incremental improvements. Specifically, it increased from -374.4% on March 31, 2022, to -281.6% by the end of June 2022, showing signs of recovery.

- However, the gross margin continued negatively, with -213.7% as of September 30, 2022, and -170.7% by the end of December 2022.

- The most recent data indicates a slight drop to -171.5% as of March 31, 2023.

This implies that although LCID had initially increased its gross margin between late 2020 and mid-2021, it experienced a significant drop afterward, going into a negative percentage.

The company has shown some improvement over recent quarters in 2022 but seems to be stabilizing at negative values. If we calculate the growth rate from the first value to the last value, LCID's gross margin suffered a drastic decline of about 194.3%.

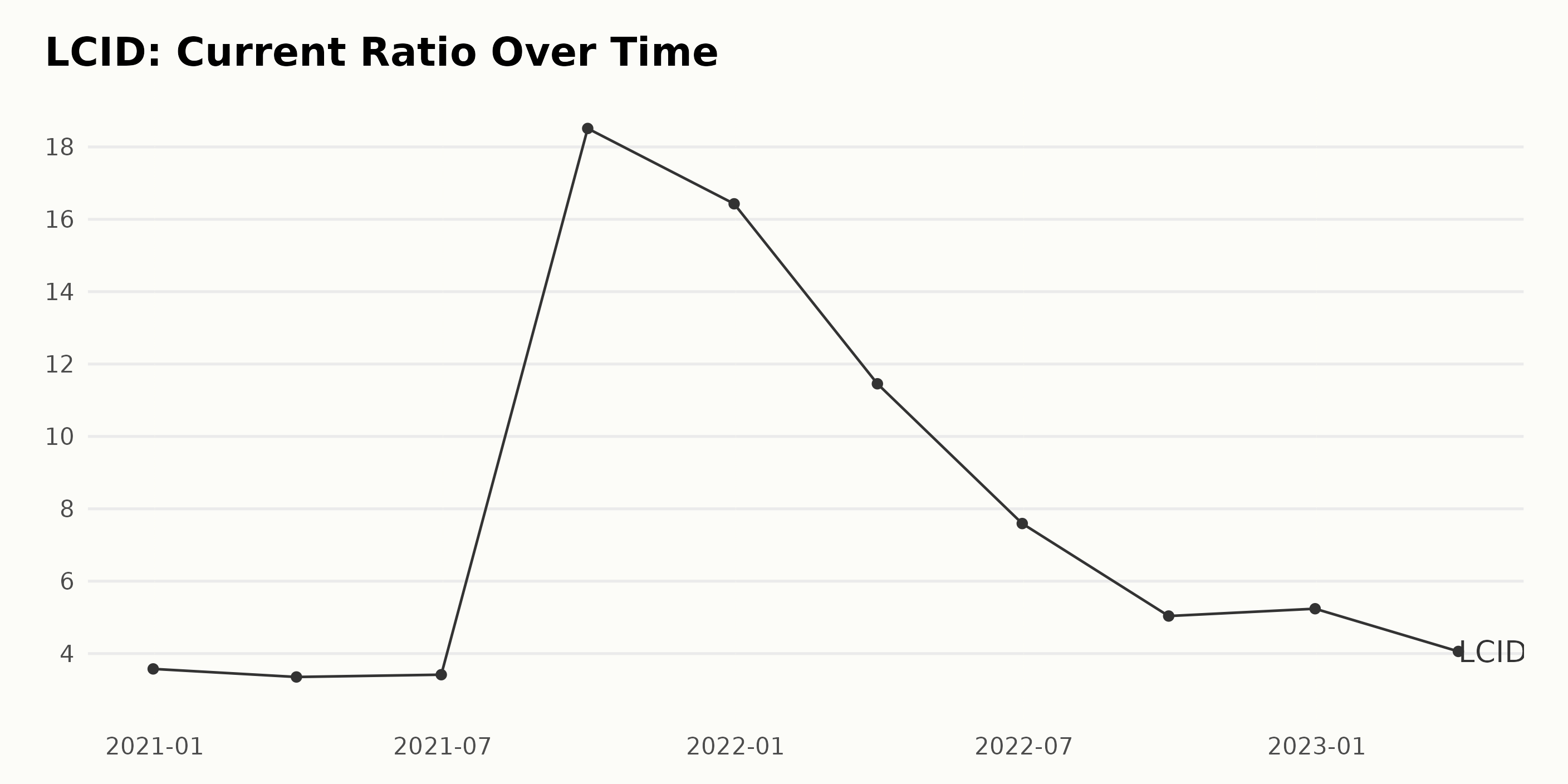

The current ratio of LCID has shown trends and fluctuations from December 2020 to March 2023. Here's a breakdown:

- In December 2020, the current ratio of LCID was 3.58.

- There was a slight decrease in the ratio in the first quarter of 2021 (March 2021), dipping to 3.35 before rebounding to 3.42 by June 2021.

- A striking increase was observed by September 2021, spiking to 18.51, followed by a slight decrease to 16.43 by the end of 2021 (December 2021).

- In 2022, however, the current ratio saw a somewhat steady decline—from 11.46 in March, dipping to 7.59 in June and dropping to 5.04 in September.

- As of December 2022, it moderately increased to 5.24, but later in the first quarter of 2023 (March 2023), it decreased to 4.06.

Comparing the last value from the first, the growth rate indicates a 13% increase in the current ratio over the observed period, even with the noted fluctuations. This percentage signifies growth, but the general trend in the latest period shows a drop in current ratios.

Though past performance is key, greater emphasis has been placed on more recent data showing a declining trend in the current ratio. Hence, given these figures, LCID’s ability to pay off its short-term liabilities with its short-term assets has somehow lessened in recent times. As the current ratio continues to evolve, closely monitoring this metric will be important for assessing LCID's financial health.

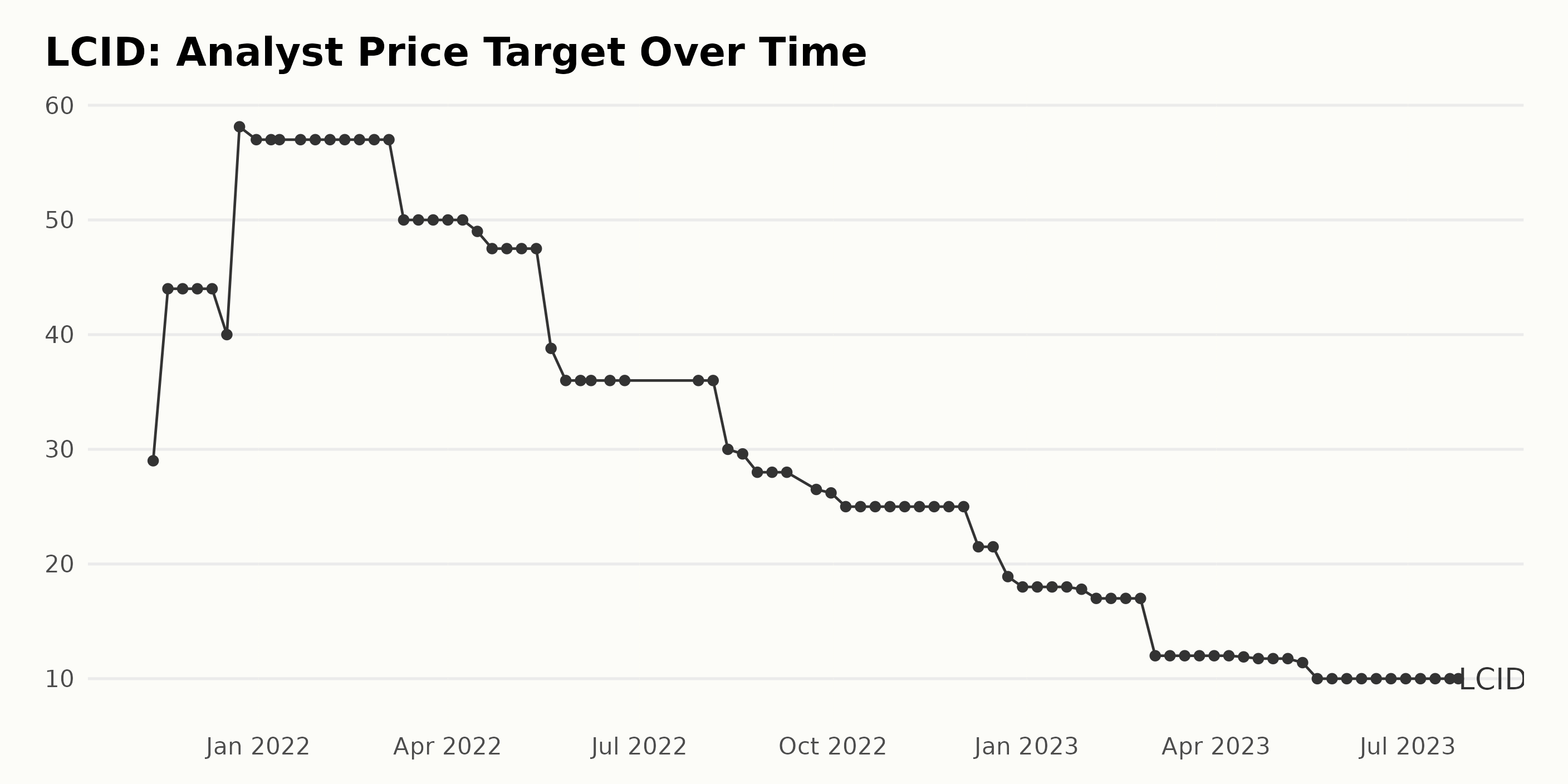

The Analyst Price Target (APT) trend for the publicly traded company LCID has shown significant fluctuations over the observed period. Key Observations:

- The APT value initially increased from $29 in November 2021 to its peak of $58.13 in December 2021.

- A general downward trend was observed from January 2022 to April 2023, with some plateauing at certain values before another downward adjustment. This includes the notable steady value of $57 from January to March 2022, followed by a drop to $50 and a relatively stable phase at $36 from June 2022 to August 2022.

- More recently, from May 2023, the APT value saw sharp dips reaching its lowest value at $10 from May to July 2023, where it remained stable.

Considering the entire period from November 2021 to July 2023, there was a decrease in the APT value of LCID from $29 to $10. Therefore, the overall growth rate for this period is negative, calculated at approximately -66%.

Emphasizing the more recent data, the APT of LCID has shown a steady hold at $10 for a couple of months leading up to July 2023. Without any signs of fluctuation during these months, it might indicate a more settled and conservative outlook from analysts on the company's future price.

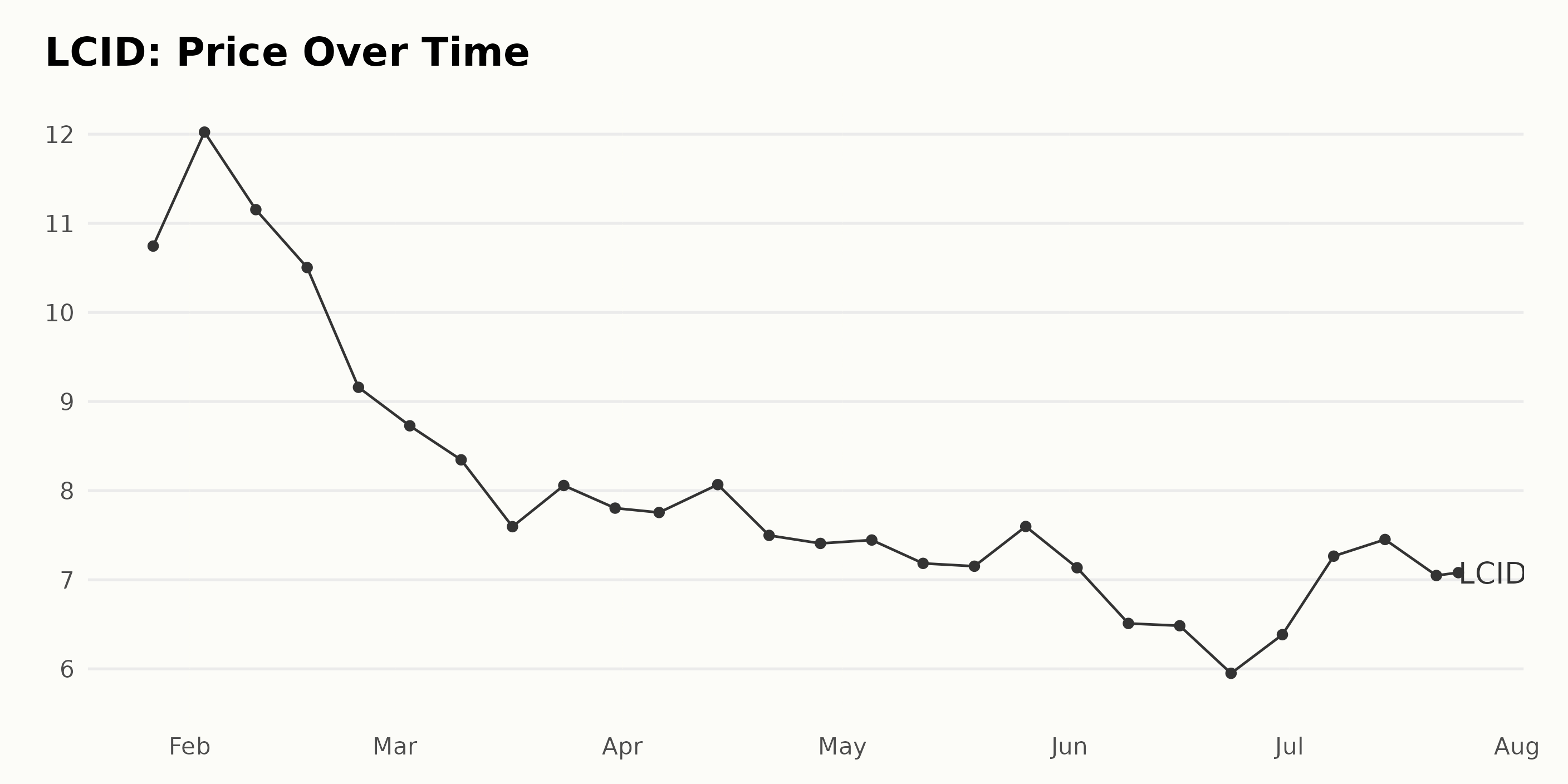

LCID's Share Price: An Analysis of Declining Trends in 2023

The LCID share price shows a generally declining trend from January to July 2023. The prices are rounded to two significant digits, and the descriptions are based on the monthly average price:

- In January 2023, the share price started at $10.75.

- During February 2023, the share price peaked at $12.02 and then started a steady decline to $9.16 by the end of the month.

- The decline continued through March 2023, starting at $8.73 on the 3rd and ending at $7.80 by the close of the month. A drop followed a small rise to $8.06 observed around March 24.

- In April 2023, while the price fluctuated somewhat, it remained mostly stable compared to the previous months, ending at $7.41.

- May 2023 saw some more fluctuations, with the price peaking at $7.60 near the end of the month, which was higher than the starting price of $7.45.

- In June 2023, the general trend was towards a dip, with the share price decreasing to $5.95. However, the month ended with a slight increase to $6.38.

- July 2023 showed a rising trend, with the share price reaching $7.45 midway through the month but eventually declining slightly to $7.17 by the last trading session.

The declining trend indicates a negative growth rate of LCID's share price, pointing towards an accelerating depreciative trend, particularly witnessed from February through July 2023. This is marked specifically by periods of consistent declines with intermittent minor rebounds. Here is a chart of LCID's price over the past 180 days.

Analyzing LCID's Performance: Insight Into Growth, Momentum, and Sentiment Trends

Based on the data provided, LCID, which falls within the Auto & Vehicle Manufacturers category comprising 55 stocks, has displayed a consecutive series of POWR Ratings grades of an F (Strong Sell) over a substantial period.

This evaluation stretches from the week ending January 28, 2023, to the week concluding July 22, 2023. Notably, its rank within this specified category fluctuated slightly over these months, generally indicating a less-than-favorable position. Specific rankings for LCID within the Auto & Vehicle Manufacturers category during this timeframe include:

- January 28, 2023: #55

- February 25, 2023: #55

- April 1, 2023: #55

- May 27, 2023: #35

- July 1, 2023: #55

- July 22, 2023: #55

As of the latest date in the dataset, as of July 25, 2023, LCID's POWR grade was F (Strong Sell), with a rank-in-category placing of #55.

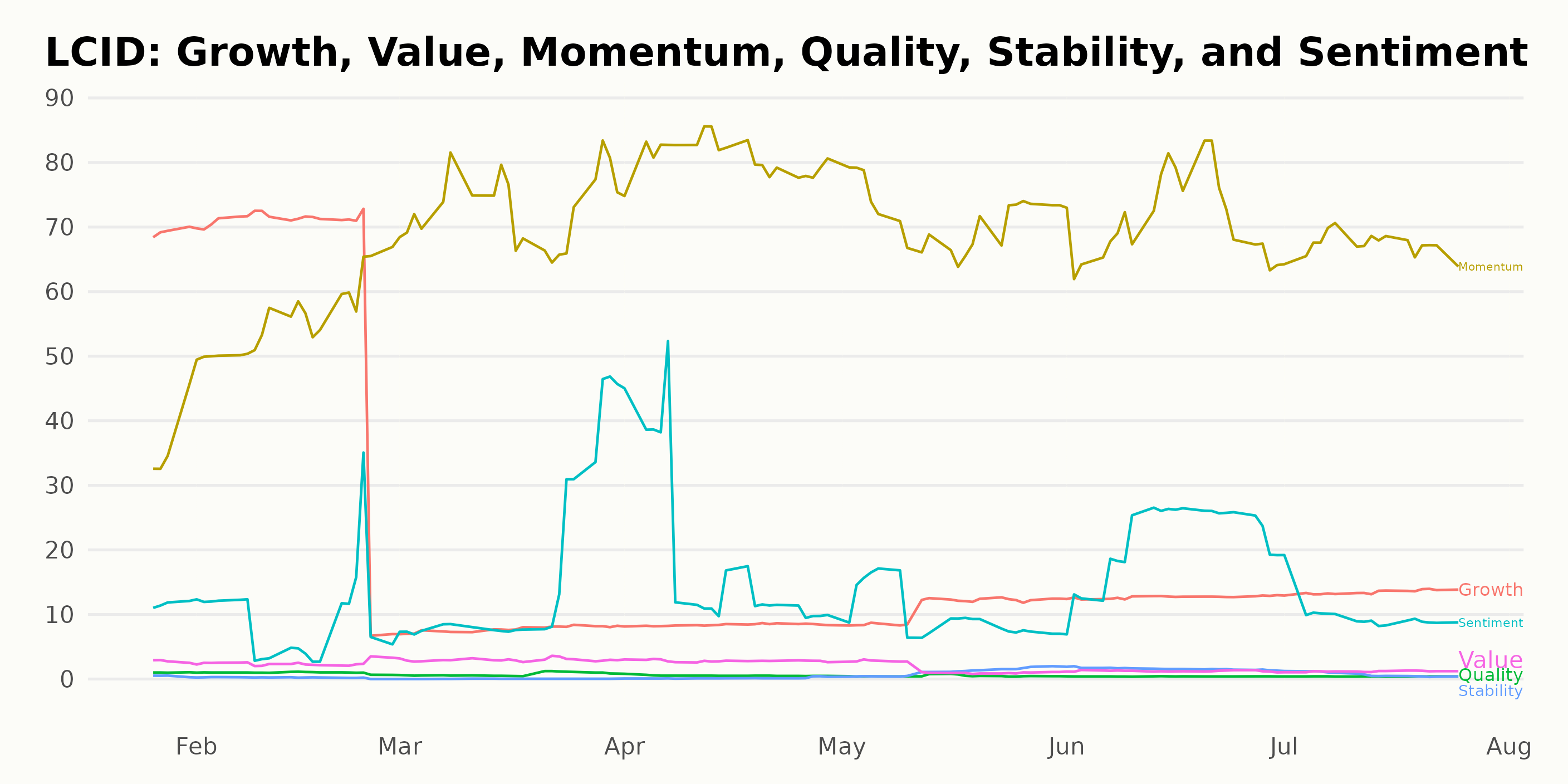

The three most noteworthy dimensions for LCID from the POWR Ratings are Growth, Momentum, and Sentiment.

Growth

- In January 2023, the growth dimension peaked, scoring 69.

- The value then saw a slight decline to 65 in February 2023.

- A significant drop occurred as it plummeted to 8 by March 2023, further maintaining the same score in April 2023.

- Post-April 2023, a slow increase can be observed with scores of 11 in May 2023, 13 in June 2023, and maintained at 13 in July 2023.

Momentum

- The momentum dimension started at 36 in January 2023.

- It witnessed a notable upward trend to 56 by February 2023 and continued to rise over the following months.

- The rating peaked at 81 in April 2023, and despite a slight reduction in the following months, it remained high with a score of 67 as of July 2023.

Sentiment

- In January 2023, the sentiment dimension rated a relatively low score of 12.

- There seemed to be minor fluctuations ranging between 9 and 19 through April 2023.

- An uptick started in June 2023, reaching 22 but decreased abruptly to 10 in July 2023.

In summary, while the Growth showed a sharp decrease followed by a gradual increase, the Momentum of LCID presented a clear upward trend throughout this period. As for Sentiment, a general fluctuation without a clear trend can be seen.

How does Lucid Group, Inc. (LCID) Stack Up Against its Peers?

Other stocks in the Auto & Vehicle Manufacturers sector that may be worth considering are Bayerische Motoren Werke Aktiengesellschaft (BMWYY), Mercedes-Benz Group AG (MBGAF), and Subaru Corporation (FUJHY) - they have better POWR Ratings.

43 Year Investment Pro Shares Top Picks

Steve Reitmeister is best known for his timely market outlooks & unique trading plans to stay on the right side of the market action. Click below to get his latest insights…

Steve Reitmeister’s Trading Plan & Top Picks >

LCID shares were trading at $7.00 per share on Tuesday afternoon, down $0.17 (-2.37%). Year-to-date, LCID has gained 2.49%, versus a 20.14% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post What Should Investors Do With Lucid Group (LCID) Shares This Week? appeared first on StockNews.com